Complete Overhaul of 'AI Loan Consultant' Service

AI Consultations Expanded to All Non-Face-to-Face Loan Products

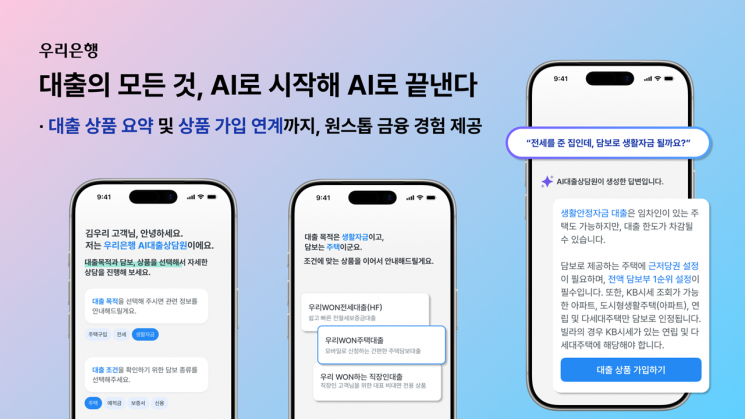

Woori Bank announced that it has completely revamped its 'AI Loan Consultant' service, enabling non-face-to-face loan consultations that replicate the in-branch experience by utilizing generative artificial intelligence (AI).

Previously, Woori Financial Group has been promoting a transition to an AI-based management system for productive finance and investment-focused financial support through its 'Future Co-Growth Project' announced in September 2025. Woori Bank has launched generative AI-based services such as the AI Savings Consultant, AI Loan Consultant, and AI Subscription Consultant. With the complete overhaul of the 'AI Loan Consultant' service, the bank has further advanced its loan consultation capabilities.

This revamp moves beyond product explanation-focused consultations, allowing AI to lead the consultation flow and systematically verify the purpose and conditions of the loan in stages. The service is newly designed so that even customers unfamiliar with loan structures and product selection can experience consultations similar to those at a bank branch, all in a non-face-to-face environment.

Previously, consultations were only available for mortgage loan products, but with this update, the scope has been expanded to cover all non-face-to-face loan products. Customers can now experience the entire process, from consultation to application, in a single seamless flow. The AI also provides continuous consultations based on previous consultation history when customers revisit. The latest loan policies and financial terminology have also been incorporated.

A Woori Bank representative stated, "This AI Loan Consultant revamp implements the branch loan consultation process in a non-face-to-face environment," adding, "We will continue to utilize generative AI to enhance customers' financial literacy and make it easier for them to use non-face-to-face financial services."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.