Capital Flocks to Pluvicto’s Success

Global Market Projected to Reach $21 Billion by 2034

Both domestic and international bio companies are turning their attention to radiopharmaceuticals. As the commercial viability of these drugs as an "anticancer platform" has been confirmed, there is a surge in clinical trials and investments, drawing significant capital into the sector.

According to industry sources on December 24, Novartis’s radiopharmaceutical “Pluvicto” recorded sales of approximately $1.4 billion (about 2.0748 trillion won) from January to September this year, surpassing last year’s global sales of $1.39 billion (about 2.0599 trillion won). With the fourth quarter results included, expectations are high that annual sales will exceed the $2 billion (about 3 trillion won) target.

Radiopharmaceuticals work by injecting radioactive isotopes like a “drug” to precisely deliver radiation to tumors. Their structure is similar to antibody-drug conjugates (ADC), which attach a drug payload to an antibody to selectively destroy cancer cells. Unlike conventional radiation therapy, which delivers radiation externally, radiopharmaceuticals use a targeting molecule (such as a ligand, peptide, or antibody) to bind to specific proteins on the surface of cancer cells. Isotopes like Lutetium-177 (Lu-177) or Actinium-225 (Ac-225) are then delivered to the site, emitting radiation at a close range to damage and kill the cancer cell’s DNA.

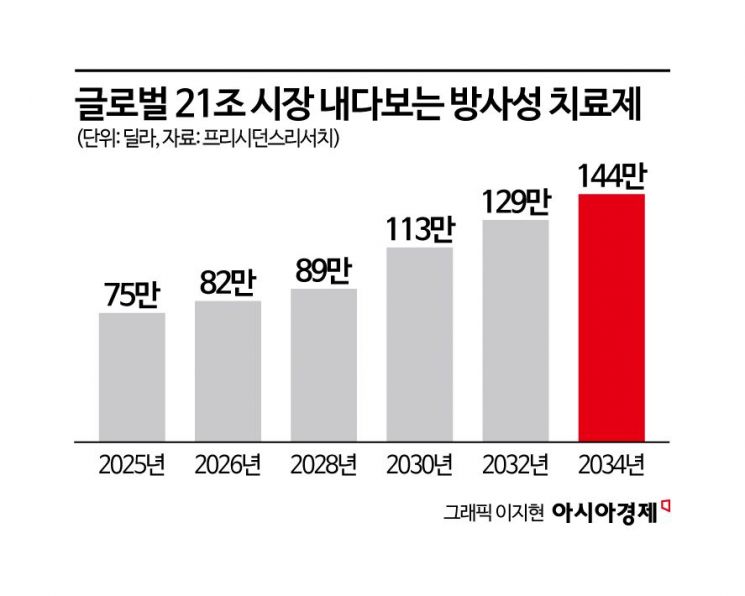

Competition in the radiopharmaceutical market intensified in 2022 when Novartis launched “Pluvicto” as a treatment for prostate cancer. Just as Daiichi Sankyo’s “Enhertu” expanded the ADC anticancer drug market by demonstrating its potential, the success of Pluvicto is fueling optimism for the radiopharmaceutical sector. According to market research firm Precedence Research, the global radiopharmaceuticals market is expected to grow from $7.51 billion (about 11.1298 trillion won) this year at a compound annual growth rate of 7.53%, reaching approximately $14.44 billion (about 21.4 trillion won) by 2034.

Major pharmaceutical companies have moved quickly to join the acquisition race. Bristol Myers Squibb (BMS) acquired radiopharmaceutical company RayzeBio for about $4.1 billion (about 6.0762 trillion won), securing an actinium-based platform. AstraZeneca acquired Fusion Pharmaceuticals for up to $2.4 billion (about 3.5568 trillion won), entering the next-generation radioconjugate competition in earnest. Eli Lilly also acquired Point Biopharma for about $1.4 billion (about 2.0748 trillion won), strengthening its pipeline of radioligand therapies. For domestic companies, this signals that “Big Pharma is confident in this field,” providing justification for further investment and development.

SK Biopharmaceuticals also accelerated its portfolio expansion last month by introducing the radiopharmaceutical candidate “WT-7695” from the University of Wisconsin’s technology transfer office for about 842.5 billion won. FutureChem and Cellbion are competing for the title of “Korea’s first radiopharmaceutical” by developing prostate cancer treatments targeting PSMA (prostate-specific membrane antigen). Both companies are preparing for Phase 3 clinical trials. D&D Pharmatech has also clarified its new business direction by launching its U.S.-based radiopharmaceutical development affiliate, G Alpha Therapeutics.

The emergence of new modalities (therapeutic approaches) is broadening the scope to manufacturing and supply chains. Moreover, radiopharmaceuticals require complex supply chains, including isotope procurement, GMP (Good Manufacturing Practice) labeling, transportation and storage, and hospital hot labs (dedicated radiopharmaceutical preparation rooms). As a result, “stable supply” itself becomes a competitive advantage, and the added value of CDMO (contract development and manufacturing organization) and manufacturing services is rising alongside drug development. This is why the government is pushing to build infrastructure, aiming for 100% self-sufficiency in key isotopes by 2030. In response, Cellbion is preparing its production and supply system by building a GMP labeling center and new plant, while DuChemBio is also pursuing pipeline and CDMO expansion simultaneously.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)