Lee Chanjin, Governor of the Financial Supervisory Service, who previously invested his apartment sale deposit in the KOSPI, has now subscribed to the first 'Integrated Investment Account (IMA)' product launched eight years after the system was introduced, in an effort to revitalize the supply of venture capital. This move is intended to clearly demonstrate the Lee Jaemyung administration's commitment to consistently pursue a shift toward productive finance through the capital market.

Lee Chanjin, Governor of the Financial Supervisory Service, is subscribing to the IMA No.1 product during his visit to Korea Investment & Securities in Yeouido on the 23rd. Financial Supervisory Service

Lee Chanjin, Governor of the Financial Supervisory Service, is subscribing to the IMA No.1 product during his visit to Korea Investment & Securities in Yeouido on the 23rd. Financial Supervisory Service

According to the Financial Supervisory Service, on the afternoon of the 23rd, Governor Lee visited Korea Investment & Securities in Yeouido, where he subscribed to the first IMA product, 'Korea Investment IMA S1,' and met with company executives. The IMA is a performance-based product in which securities firms pool customer deposits to invest in corporate financial assets such as venture capital, and return the results to customers, with a principal payment obligation.

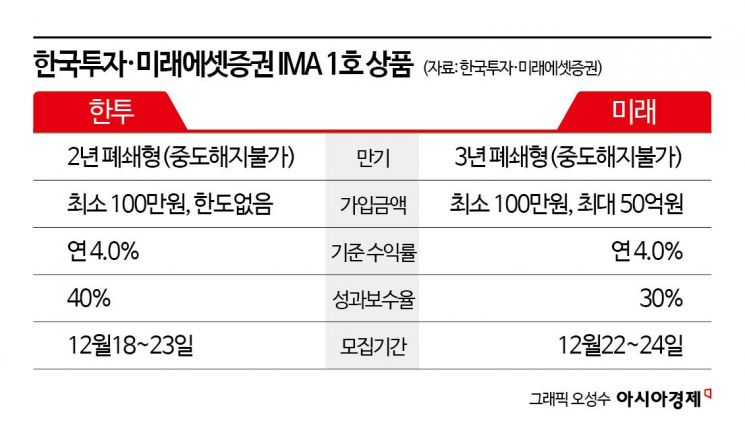

On the same day, Governor Lee also subscribed to Mirae Asset Securities' first IMA product, 'Mirae Asset IMA No.1,' which was launched this week. Both companies' first products are closed-end products (early redemption not allowed) with a benchmark yield of '4% per annum,' and the minimum subscription amount is 1 million won. The Korea Investment product has a two-year maturity, while the Mirae Asset product has a three-year maturity.

This decision to subscribe to the IMA, as with his previous subscription to a KOSPI-tracking Exchange Traded Fund (ETF), was made to directly examine the IMA system from an investor's perspective on site, and is also interpreted as a move to put into practice the government's policy of directing funds concentrated in real estate into the capital market.

Governor Lee Chanjin emphasized, "Since the IMA is a product that requires the simultaneous functioning of three pillars-venture capital supply, soundness management, and investor protection-I will continue to monitor whether the system is being properly implemented in the field."

On this day, in a meeting with Kim Sunghwan, President of Korea Investment & Securities, and other executives from the company and its holding group, Governor Lee also called on Korea Investment & Securities to play a leading role in the transition to productive finance through the capital market.

He noted that while quantitative expansion of venture capital is important, it is even more crucial to distinguish and select companies whose innovation and growth potential have been verified. He stated that in order for investment funds to be used for corporate growth and innovation in line with the purpose of productive finance, the company should set an example in its own management and supervision systems.

In addition, from the perspective of investor protection, he urged the company to take responsibility for recent investor losses related to overseas real estate funds and to work to restore investor trust. He further emphasized that financial holding companies are responsible for detecting and managing risks across the entire group in an integrated manner, highlighting the importance of internal controls and risk management.

A Financial Supervisory Service official stated, "We plan to continuously monitor the actual supply of venture capital and the implementation of investor protection in the securities industry to ensure that the IMA is operated in line with its original purpose of revitalizing the supply of venture capital. We will also continue to identify and communicate with the industry about necessary system improvements to ensure the effective supply of venture capital."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)