Pharmaceutical Exports to the U.S. Up 24% Year-on-Year

Turning Risk into Opportunity in the World's Largest Market

Korean bio companies have responded to global trade variables in the bio industry with a strategy of "localization." As more companies establish production and commercialization bases in the United States, the world's largest pharmaceutical market, trade risks are increasingly seen as "manageable variables," and efforts to penetrate the market are expected to accelerate.

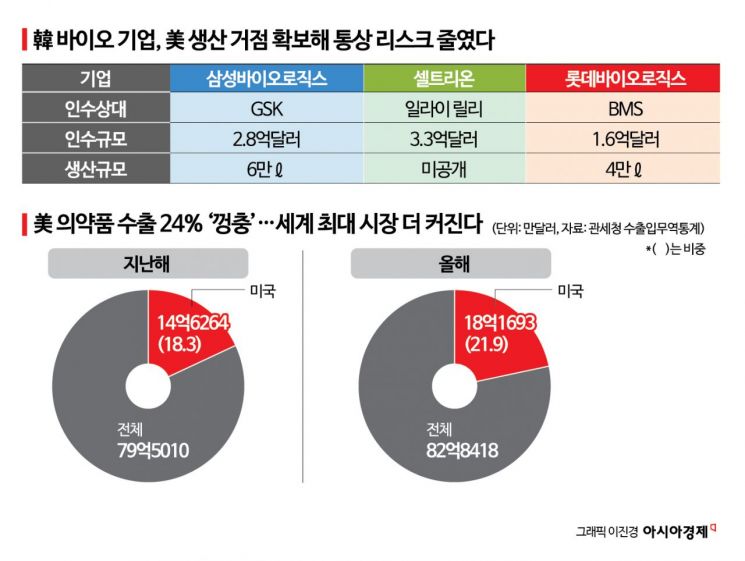

According to export and import trade statistics from the Korea Customs Service on December 23, cumulative pharmaceutical exports to the United States through December 20 amounted to $1.81693 billion (approximately 2.6905 trillion won) this year. This represents a 24% increase compared to $1.46264 billion (approximately 2.1658 trillion won) last year. The growth of biosimilars and active pharmaceutical ingredients has driven this increase, raising the U.S. share of Korea's total pharmaceutical exports from 18.3% last year to 21.9% this year. Despite the United States restructuring its pharmaceutical supply chain under the framework of "national security," Korean companies are seen as seizing new opportunities. Since the launch of the Donald Trump administration, the United States has imposed tariffs on pharmaceuticals, and this month, the Biological Security Act came into effect, which aims to exclude Chinese CDMO (Contract Development and Manufacturing Organization) companies from the supply chain.

The core of the localization strategy chosen by Korean companies to mitigate trade risk is the acquisition of existing production facilities. Samsung Biologics acquired the HGS manufacturing facility (DS 60,000 liters) in Rockville, Maryland, from GlaxoSmithKline (GSK) for $280 million (approximately 414.6 billion won), while Celltrion acquired a manufacturing facility from Eli Lilly for $330 million (approximately 488.6 billion won), adding a "U.S. local production option." Lotte Biologics acquired the Syracuse campus from Bristol Myers Squibb (BMS) in 2023 and is developing it into a North American CDMO hub. The company is differentiating itself by operating a cGMP (current Good Manufacturing Practice) ADC facility, which cost about $100 million (approximately 148 billion won), focusing on high-value modalities.

Acquiring local production facilities can simultaneously reduce both time and uncertainty costs. Building a new biopharmaceutical production base in the U.S. from scratch-a "greenfield" project-requires meeting various conditions such as regulatory approvals, design, validation, and staffing, and takes at least four to six years to stabilize production. During this period, policy changes and demand fluctuations can disrupt a company's plans. In contrast, acquiring an existing plant allows a company to secure proven equipment and operational know-how as a package, enabling them to immediately meet delivery, supply stability, and regulatory requirements demanded by the U.S. market. Bio production sites are facilities where not only physical conditions but also accumulated "operational experience" in processes, quality, and documentation systems are critical. This is why acquiring a local production facility is considered the fastest way to establish a reference in the U.S. and enhance the ability to respond to customer audits.

SK Biopharmaceuticals has internalized its commercialization capabilities by outsourcing production to U.S.-based CMO (Contract Manufacturing Organization) companies while establishing a "direct sales" base in the United States. Through its U.S. subsidiary, SK Life Science, SK Biopharmaceuticals directly sells its epilepsy treatment "XCOPRI" in the U.S. and is working to expand both its market presence and pipeline. The direct sales model allows the company to respond more swiftly to changes in the U.S. distribution, insurance, and prescription environment, thereby strengthening the "durability of sales."

Lee Seungkyu, Vice Chairman of the Korea Biotechnology Industry Organization, stated, "The strategy of our companies is to absorb client risk through local production and commercialization, thereby increasing opportunities for orders and prescriptions. With agile responses, trade variables are more likely to become negotiation leverage rather than risks. Going forward, the key will be timely capacity expansion and the development of high-value modalities."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.