Possibility of Increased Foreign Currency Loans Due to Government's "High Exchange Rate Defense" Measures

Rising Exchange Rate Increases Won-Converted Amount, Negatively Affecting Soundness Indicators

Year-End Financial Statements Reflect Exchan

As the high exchange rate continues to exceed 1,470 won at the end of the year, banks are feeling increasing pressure. This is because the volume of foreign currency loans has grown in the fourth quarter, and there is a high possibility of further expansion due to the government's "high exchange rate defense" measures. Nevertheless, the persistent won-dollar exchange rate remains a burden for year-end financial closing.

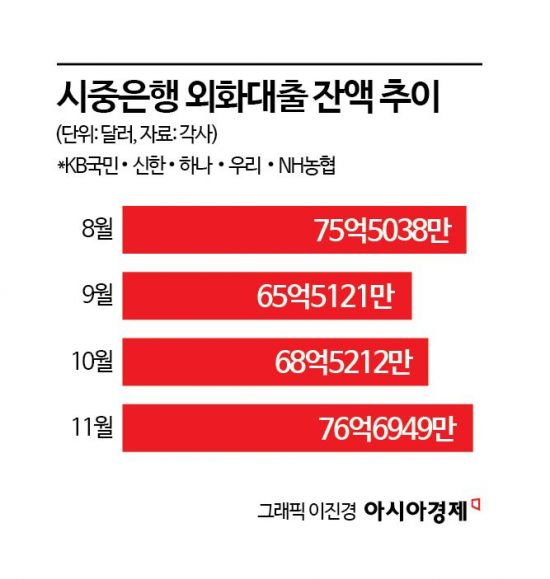

According to the financial sector on December 23, the outstanding balance of foreign currency loans at the five major domestic banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup) stood at $7,669.49 million as of the end of last month.

The balance of foreign currency loans has been increasing again in the fourth quarter. After dropping to $6,551.21 million in September, the last month of the third quarter, it rose to $6,852.12 million in October and expanded further in November. The balance in November increased by $1,118.28 million compared to the end of September. When converted at the previous day's weekly closing won-dollar exchange rate (1,480.1 won), this represents an increase of approximately 1.6552 trillion won. While there has been a slight decrease in December, the balance still remains in the $7 billion range.

In the midst of this, the government has expanded the scope of foreign currency loans as part of its high exchange rate measures, increasing the likelihood that foreign currency loans will grow further. On December 18, the government extended the use of foreign currency loans, which were previously allowed only for domestic facility funds of export companies, to include domestic working capital and other business management purposes. The rationale is that allowing export companies to borrow in dollars and exchange them for won would induce dollar inflows into the domestic foreign exchange market, thereby reducing upward pressure on the exchange rate.

The problem is that an increase in foreign currency loans during a period of high exchange rates can negatively impact banks' risk management. All loans are assigned risk weights based on factors such as the borrower's creditworthiness to calculate risk-weighted assets (RWA). Since foreign currency loans are calculated based on the amount converted to won, a rise in the exchange rate increases the won-denominated value and inevitably the RWA as well. This can lead to a deterioration in key bank soundness indicators such as the capital adequacy ratio (BIS) and the common equity tier 1 (CET1) ratio, both of which are calculated based on RWA. A banking sector official commented, "Unlike facility funds, it is structurally more difficult to specify the use of working capital, which also carries a higher risk weight."

From a risk management perspective, expanding the scope of foreign currency loans for won-denominated purposes to include working capital is also seen as a burden. One banking sector official said, "Working capital is used for business operations, so its use is very broad and wide-ranging. While all loans are subject to post-management to verify that the funds were actually used for business purposes, in reality, it is relatively difficult to provide evidence for working capital." He added, "As a result, the burden of risk management may increase, such as additional responsibilities for post-audit or the need to set aside more provisions."

Although the government is making every effort to reverse the trend by announcing a series of high exchange rate measures, the elevated exchange rate level is not coming down easily. The high exchange rate is also a burden for banks with a large proportion of foreign currency assets when closing their books at year-end. The year-end closing applies the first posted exchange rate (base rate) on the last trading day of December, which can affect not only banks' financial statements and soundness indicators, but also next year's business plans. A financial sector official said, "When considering the burden of provisions that overseas branches must accumulate and hedging costs, it can also impact earnings."

The government is expected to mobilize all available means to keep the exchange rate as low as possible during the remaining six trading days. However, the market believes that despite the government's efforts, the year-end closing rate will likely be formed around 1,475 won. This is even higher than the 1,472.5 won recorded on December 30 last year, the highest level in 27 years. Baek Seokhyun, a researcher at Shinhan Bank S&T Center, said, "While the foreign exchange authorities' strong presence is defending the upper end of the exchange rate, it is questionable whether this will be as effective as the exchange rate level itself. Domestic supply and demand still favor dollar buying, and external factors such as the decline in French and Japanese government bond prices are also contributing to the upward trend of the dollar."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.