Financial Services Commission Holds "Real Estate PF Status Review Meeting"

Real Estate PF Exposure at 177.9 Trillion Won, Down 8.7 Trillion Won from Previous Quarter

Non-Performing Loans of Concern Fall to 18.2 Trillion Won for Second Consecutive Quarter

PF Loan Delinquency Rate in Financial Sector Drops by 0.15 Percentage Points to 4.24%

The scale of non-performing real estate project financing (PF) in South Korea is shrinking, and delinquency rates are declining, indicating an overall improvement in the situation. The government has decided to gradually implement the "PF System Improvement Plan," which includes raising the equity ratio for PF projects, starting in 2027.

Non-Performing Loans of Concern Fall to 18.2 Trillion Won for Second Consecutive Quarter

On the afternoon of December 22, the Financial Services Commission, the Financial Supervisory Service, the Ministry of Economy and Finance, and the Ministry of Land, Infrastructure and Transport held a "Real Estate PF Status Review Meeting" at the Korea Federation of Banks in Jung-gu, Seoul, to discuss the current status of non-performing real estate PF and improvement measures.

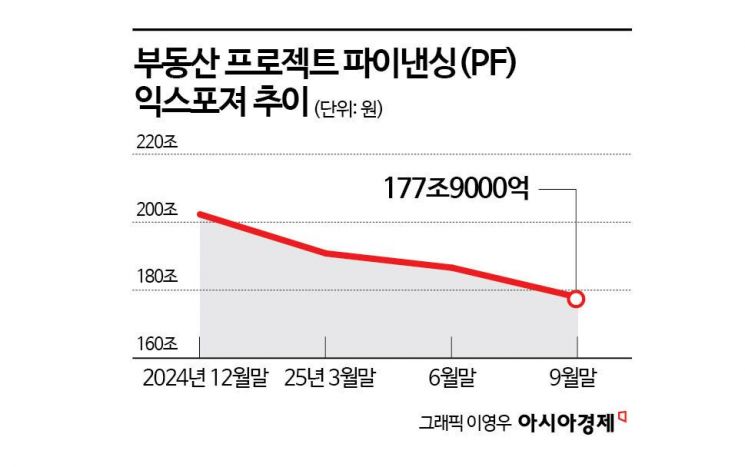

According to the Financial Services Commission and the Financial Supervisory Service, as of the end of September, the total domestic real estate PF exposure (amount at risk) stood at 177.9 trillion won, a decrease of 8.7 trillion won from the previous quarter. Compared to the end of last year, when the figure was 202.3 trillion won, the exposure has dropped significantly.

The domestic real estate PF exposure figure includes not only real estate PF loans but also land-secured loans, debt guarantees, and all other PF-related products. An official from the Financial Services Commission explained, "The reduction in exposure due to project completions, settlements, and restructurings has outpaced new PF exposure, leading to an overall decrease in total real estate PF exposure."

As of the end of September, loans classified as "watch" or "non-performing" following business feasibility assessments of real estate PF projects amounted to 18.2 trillion won, representing 10.2% of total PF exposure. The amount of loans of concern and non-performing loans declined for the second consecutive quarter, dropping from 21.9 trillion won at the end of March to 20.8 trillion won at the end of June, and further down to the 18 trillion won range by September.

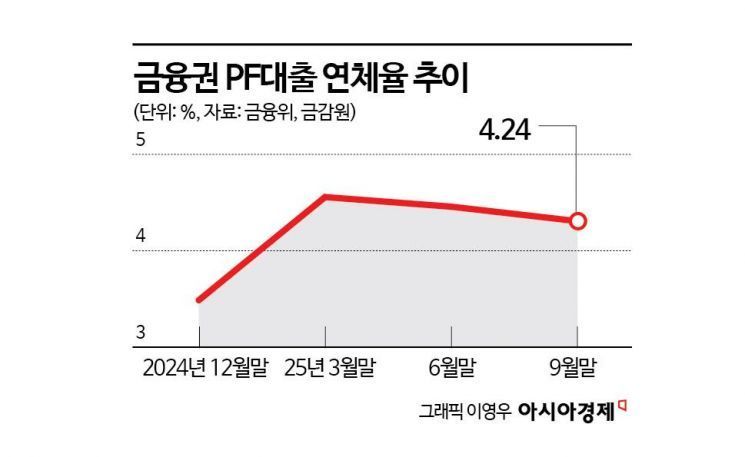

As of the end of September, the delinquency rate for PF loans in the financial sector was 4.24%. Despite a decrease in the outstanding balance of PF loans, the delinquency rate dropped by 0.15 percentage points from the previous quarter, due to the financial sector's efforts to resolve non-performing loans.

The delinquency rate for land-secured loans at small and medium-sized financial institutions (savings banks, credit-specialized financial companies, and mutual finance institutions) remained high at 32.43%. However, the financial authorities judged that this was not a dangerous situation, as it was due to a significant decrease in the loan balance (the denominator) while the amount of delinquent loans (the numerator) increased.

New PF lending has increased, particularly for projects with strong business fundamentals. In the third quarter, new PF lending amounted to 20.6 trillion won, up 4.2 trillion won from the same period last year. An official from the Financial Services Commission stated, "New funds continue to be supplied to the PF market, especially for high-quality projects with sound business prospects."

16.5 Trillion Won Worth of Non-Performing Projects Resolved

According to the Financial Services Commission, from the second half of last year through September of this year, a total of 16.5 trillion won in projects classified as "watch" or "non-performing" were resolved or restructured. Of this, 11.8 trillion won was resolved through auctions, private contracts, and write-offs, while 4.7 trillion won was restructured through new funding and financial restructuring.

As non-performing projects were resolved, the ratio of substandard and below loans in PF dropped by 8.0 percentage points, and the PF delinquency rate also fell by 5.8 percentage points, indicating improvements in key soundness indicators.

To continue supporting the resolution and restructuring of ongoing real estate PF projects and the supply of new funds, the Financial Services Commission decided to extend nine out of ten temporary financial regulatory relief measures related to real estate PF, which are still deemed necessary, until June next year. The specific timing for normalization will be determined in the first half of next year, taking into account real estate PF market conditions.

At the meeting, improvements to the real estate PF soundness system were also discussed. To prevent excessive contraction of the PF market, it was decided to allow exceptions to loan restriction regulations (equity ratio requirements) for cases where the actual risk is low. In addition, risk weights and loan loss provisions will be differentiated based on the equity ratio relative to PF project costs, and lending restrictions will be implemented after a one-year preparation period, starting in 2027. To minimize market disruption, the new rules will apply only to new PF loans, and the equity ratio requirement will be gradually raised from 5% to 10%, then to 15% and 20% over four years.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)