GPs to Be Supervised Like Banks and Insurance Companies

Foreign Firms Remain in Regulatory Blind Spots... Reverse Discrimination Concerns Persist

Will This Mark a Step Toward Global Standards?

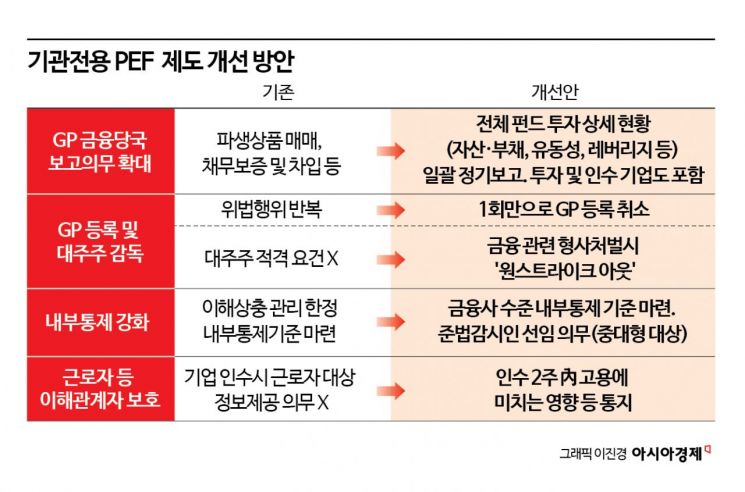

The Financial Services Commission has significantly tightened regulations on institution-only private equity funds (PEFs). The core measures include the immediate expulsion of asset management companies (GPs) found to have committed illegal acts and the imposition of reporting and internal control obligations at a level comparable to those for banks and insurance companies. However, concerns persist in the market that, contrary to the intended purpose of the system, regulatory blind spots remain for foreign asset managers, and that the regulatory burden may be disproportionately concentrated on domestic private equity funds, raising fears of "reverse discrimination."

Private Equity Funds to Be Supervised Like Banks and Insurance Companies

According to the reform plan announced by the Financial Services Commission on December 22, eligibility requirements for major shareholders will now be introduced for institution-only PEF GPs. If a serious legal violation occurs, registration can be revoked after just one infraction. Establishing an internal control system and appointing a compliance officer will also become mandatory.

In particular, reporting obligations will be greatly expanded. Previously, individual PEFs only reported limited items such as derivatives trading, debt guarantees, and borrowing status. Going forward, they will be required to regularly submit details such as: ▲ the operational status of all PEFs, including assets, liabilities, liquidity, leverage, and returns; ▲ the financial and liquidity status of acquired companies; ▲ the fees (including performance fees) received by each PEF and the calculation methods; and ▲ the status of third-party outsourcing. This effectively holds GPs to a level of accountability similar to that of financial institutions.

Furthermore, GPs will be required to notify the employee representatives of acquired companies within two weeks of acquisition regarding the purpose of acquiring management rights and the impact on employment. The aim is to bring the influence of private equity funds’ exercise of management rights on companies and the labor market under regulatory oversight.

Foreign Firms Remain in Blind Spots... Reverse Discrimination Concerns Persist

The question is whether these regulations will function as intended in the actual market. The Financial Services Commission emphasizes that these measures are designed to prevent side effects from the pursuit of short-term profits and to ensure that private equity funds fulfill their original roles of investing in innovative companies and facilitating industrial restructuring.

However, some point out that foreign asset managers still fall into regulatory blind spots. Foreign asset managers that establish a legal entity in Korea and register as a GP are subject to these regulations. However, if they register as a GP overseas and only set up a fund in Korea to invest, the domestic authorities have few means to sanction them. One domestic PEF manager noted, "Overseas limited partners may hesitate to invest due to concerns about information disclosure, and this regulation is likely to apply only to domestic PEFs. There is also a risk that confidential business information, such as fees and calculation methods, could be leaked during the reporting process."

Confusion is also anticipated in the detailed regulations. The provision requiring notification of management plans to the 'employee representative' of an acquired company does not fully reflect the reality that many companies do not have labor unions. A PEF industry insider commented, "While I understand the intent, there are many ambiguities in field application. In fact, general private equity funds have caused more problems, and institution-only PEFs have already been managed under strict oversight by limited partners, so there is a sense of unfairness."

Will This Be a Step Toward Global Standards?

However, financial authorities and some market participants argue that this regulatory overhaul should not be viewed merely as a tightening of regulations. The domestic PEF market has grown rapidly, but has faced criticism for lagging behind global standards in terms of internal controls and accountability. Given that major overseas private equity managers already operate under strict disclosure and supervisory systems in the United States and Europe, the domestic system can be seen as belatedly aligning itself with global standards.

The industry is watching whether this reform will lead to a structural reorganization between large/systematic GPs and small/project-based GPs. Large asset managers with internal control personnel and management systems are expected to adapt relatively quickly, while some smaller managers, who have relied on short-term profits and leverage, may need to fundamentally reconsider their management strategies.

Another PEF manager commented, "There are some regrets, but the reform reflects efforts to balance global practices with domestic realities. The key will be how precisely the detailed standards are established during the legislative and enforcement ordinance revision processes."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.