MainBiz Association Announces Results of 2025 Business Performance and 2026 Economic Outlook Survey

According to a survey, 39.9% of small and medium-sized enterprises (SMEs) expect the economic conditions in 2026 to be similar to this year. While there is limited optimism for a recovery, no clear signs of a rebound have been observed.

The MainBiz Association announced the results of its "2025 Business Performance and 2026 Economic Outlook Survey" of 351 MainBiz-certified companies on December 22. According to the survey, 71.8% of respondents cited sluggish domestic demand as a major challenge this year, while 61.5% pointed to rising costs. Throughout the year, both shrinking demand and cost pressures have affected businesses simultaneously.

In this business environment, more than half of the companies experienced either declining or stagnant sales, and it was found that companies focused on short-term, conservative response strategies centered on survival, such as cost reduction and defending existing markets.

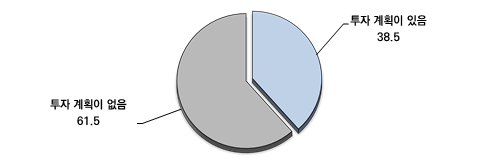

For the 2026 economic outlook, technology-based sectors and medium-to-large companies were relatively optimistic, while domestic service industries and small-scale businesses were more pessimistic. Reflecting these perceptions, companies are expected to maintain a generally conservative management stance. More than half of the respondents, 58.7%, indicated that their management strategy for 2026 would be to "maintain the status quo," and 61.5% stated they "have no investment plans," showing that investment sentiment remains subdued amid uncertainty.

The reasons for companies' reluctance to invest were found to be a combination of economic uncertainty, internal funding constraints, lack of information related to digital and facility investments, and difficulties in securing skilled personnel. Although awareness of the importance of digital transformation and the adoption of artificial intelligence (AI) is high, actual implementation remains at an early stage, with cost burdens and lack of capabilities identified as the main limiting factors.

Policy demands were raised simultaneously across almost all areas, including funding, personnel, and technology. In particular, "financial support" (59.0%), "personnel training and employment retention" (41.9%), and "technology development and R&D" (32.5%) accounted for high proportions, indicating that policy needs are greatest in these three areas.

A representative of the MainBiz Association stated, "These survey results show that the difficulties faced by SMEs go beyond a simple economic slowdown and are appearing as structural and complex pressures that require simultaneous changes in cost, technology, and personnel structures." The representative added, "Government support should move away from single-policy approaches and shift toward integrated package-type designs tailored to the growth stages of companies." The representative further emphasized, "Digital transformation and the adoption of new technologies must be promoted not just by raising awareness, but through support based on implementation and dual-track, customized strategies that consider capability gaps between companies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)