"4% Benchmark Return and 1 Million Won Minimum Subscription" Aligned

Mirae Asset Focuses More on Unlisted Companies and Venture Capital, with Longer Maturity

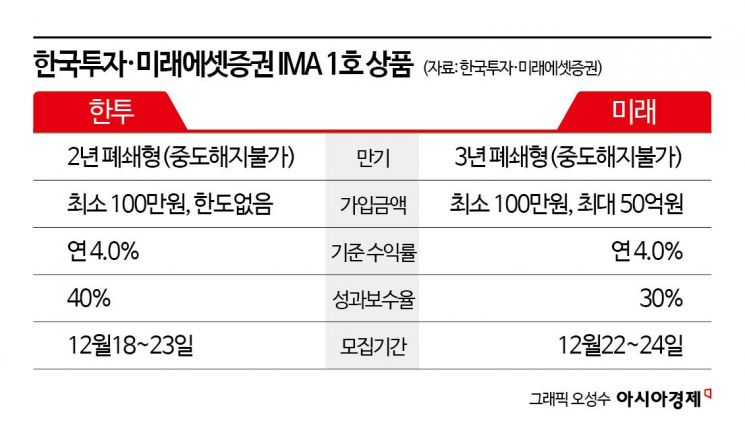

Following Korea Investment & Securities, Mirae Asset Securities also launched its first Integrated Managed Account (IMA) product on December 22, signaling the beginning of an intense competition among major securities firms vying to become the "Korean Goldman Sachs" by attracting large-scale funds. Both companies’ first IMA products share the same standard annual return rate of 4% and do not allow early redemption. However, their management strategies differ. While Korea Investment & Securities aims to secure both stability and profitability by diversifying assets both domestically and internationally, Mirae Asset Securities has reduced the overall scale and placed greater emphasis on venture capital.

According to the financial investment industry on December 22, Mirae Asset Securities is offering its "Mirae Asset IMA No. 1" product, a closed-end product with a three-year maturity, from this day until December 24. The total fundraising target is 100 billion won. Previously, Korea Investment & Securities’ IMA No. 1 product, "Korea Investment IMA S1," exceeded 200 billion won in subscriptions on its launch day, December 18, confirming strong initial demand. Park, an office worker in his 40s who subscribed on the first day, said, "I had been waiting since I heard IMA products would be released. I thought it was much better than putting money in bank deposits or savings, so I invested at least the minimum amount."

This enthusiasm is attributed to the symbolic significance of being the first IMA product introduced eight years after the system was implemented, as well as the standard return rate, which surpasses that of bank deposits and savings, attracting investors’ attention. An IMA is a principal-guaranteed performance-based product in which a securities company pools client deposits to invest in corporate finance assets such as venture capital, returning profits based on investment performance. Although the law does not guarantee principal protection, the securities company is contractually obligated to do so.

Currently, both companies’ first products feature the same standard annual return rate (4%) and minimum subscription amount (1 million won). Both have a closed-end structure, prohibiting early redemption before maturity. As the inaugural products, they appear to prioritize principal protection and stability. However, their detailed management approaches diverge. Korea Investment & Securities takes a 40% performance fee on returns exceeding the standard rate, with the remaining 60% going to clients. The product’s maturity is set at two years, with no cap on individual subscription amounts. In contrast, Mirae Asset Securities has lowered its performance fee to 30% but extended the maturity to three years and capped individual subscriptions at 5 billion won. The total fundraising target is set at 100 billion won, just 10% of Korea Investment & Securities’ offering.

The differences in strategy are also reflected in their investment targets. Korea Investment & Securities includes domestic acquisition finance, corporate loans, and venture capital investments, as well as overseas infrastructure funds and business development companies (BDCs), to potentially boost returns. Through diversified investments at home and abroad, the company aims to achieve both profitability and stability. On the other hand, Mirae Asset Securities focuses more on domestic unlisted company investments, venture capital, and corporate finance, emphasizing venture capital investments. The decision to set the maturity one year longer than Korea Investment & Securities’ product is interpreted as reflecting the need to consider the mid- to long-term growth potential of venture capital investments. An industry insider, speaking on condition of anonymity, said, "From the perspective of both investors and the companies, Korea Investment & Securities appears to be more proactive in securing stable profitability."

Some analysts argue that the launch of the first IMA products should be viewed not as a competition among major securities firms, but as a battle for funds with the banking sector. Recently, banks have been introducing deposit products with annual interest rates in the 3% range, but the standard return rate offered by the IMA No. 1 products from Korea Investment & Securities and Mirae Asset Securities is a higher 4%. Moreover, if returns exceed the standard rate, the portion allocated to clients increases further. Korea Investment & Securities CEO Kim Seonghwan emphasized his confidence in an interview on launch day, saying, "It’s difficult to specify a target return, but although we may become the public enemy of banks, we are setting a much higher investment base than bank interest rates."

Lee Hyukjun, Head of Financial SF Evaluation at NICE Investors Service, also stated, "IMA represents a significant change that could expand the movement of funds within the financial sector," adding, "By increasing the deposit and loan limits previously allowed for securities firms, competition between banks and securities companies will intensify." However, some experts note that, compared to bank deposits, the disadvantages of IMA products are clear, making large-scale fund movement less likely in the long term. The closed-end structure of IMA products does not allow early redemption, and if redemption is unavoidable, principal loss may occur. Additionally, while the withholding tax rate at maturity is the same as for bank deposit interest income (15.4%), if annual interest and dividend income exceeds 20 million won, it becomes subject to comprehensive financial income taxation.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)