Giving Up Stable Management Fees for the Sake of Competition

Desperate to Secure KIC Track Record to Attract Overseas LPs

Some private equity fund (PEF) managers engaged in a fierce "race to the bottom" by drastically lowering management fees in the first-ever domestic PEF manager selection competition conducted by the Korea Investment Corporation (KIC), the sovereign wealth fund. This reflects how much managers coveted the opportunity to add KIC’s first delegated PEF investment to their track record, given KIC’s rising global stature.

According to the investment banking (IB) industry on December 22, KIC recently completed its internal process for selecting delegated managers (GPs) and notified IMM Investment and Dominus Investment of their selection. The delegated management contracts are scheduled to be signed in February next year. The size of each mandate is about $200 million (approximately 295 billion won), though the exact timing of execution has not yet been determined.

This was the first time KIC selected domestic PEF managers, leading to intense competition. Over 10 managers submitted applications, and some reportedly offered to forgo nearly all management fees. Typically, PEF managers charge an annual management fee of 1.0-2.0% from the capital committed by investors, with performance fees being separate. Considering KIC’s commitment of $200 million per company, this means they gave up a stable annual income of up to 3 billion won. An industry insider commented, “For some managers, the title of ‘KIC’s first delegated PEF’ was crucial. It was seen as a prime opportunity to strengthen their track record, so they made aggressive offers.”

KIC’s investment record is also seen as a strong advantage in attracting overseas limited partners (LPs). This particular investment is limited to supporting domestic companies (strategic investors, SI) in their overseas expansion, and solo investments are not permitted. Nevertheless, it is expected to make it easier for domestic PEF managers and companies to enter overseas markets and attract the attention of international LPs. In addition to expanding assets under management, the symbolic value of being KIC’s first delegated investment and the enhanced competitiveness in attracting additional capital are seen as major benefits.

An IB industry source said, “KIC’s status is now even higher abroad than domestically. While investment performance is of course the most important factor, being selected by KIC can be leveraged as a strong portfolio asset when attracting overseas LPs.”

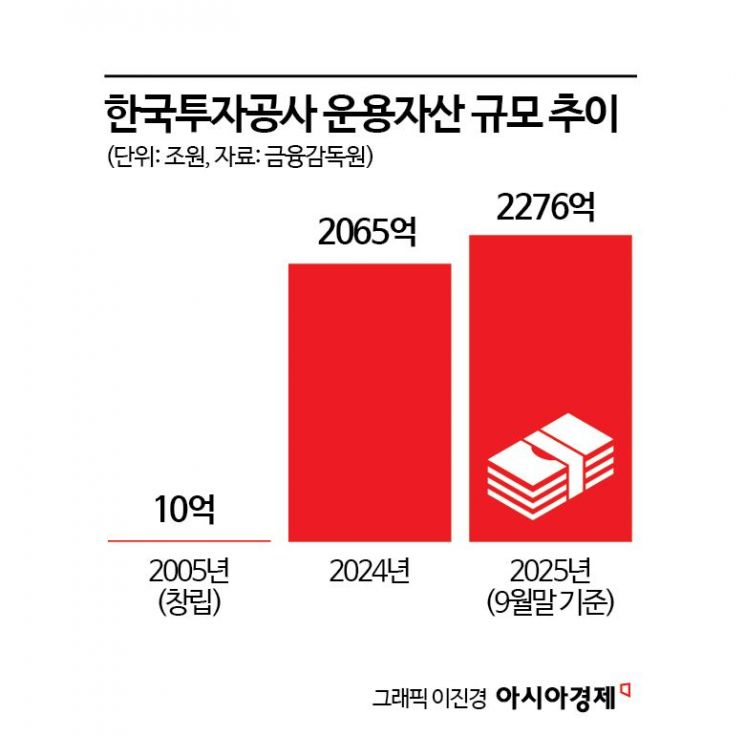

KIC, which marks its 20th anniversary this year, has grown dramatically in stature and size since its founding. As of the end of last year, its assets under management reached $206.5 billion, ranking 14th among major global sovereign wealth funds. This is more than 200 times the $1 billion it managed at its inception. At this year’s 20th anniversary event, leading global asset managers participated and offered congratulations. Michael Gitlin, CEO of Capital Group, visited Korea to deliver a keynote speech, while Larry Fink, Chairman of BlackRock, and Steve Schwarzman, Chairman of Blackstone, sent congratulatory messages via video.

The industry expects KIC’s domestic investment to serve as a turning point for the market. Considering that the National Pension Service typically commits 100 billion to 150 billion won per manager, KIC is poised to instantly become a major player in the domestic PE industry. KIC also plans to continue additional capital commitments to domestic GPs next year. A PEF industry insider predicted, “With existing LPs becoming more stringent in their commitments, competition for KIC’s capital is likely to remain fierce going forward.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.