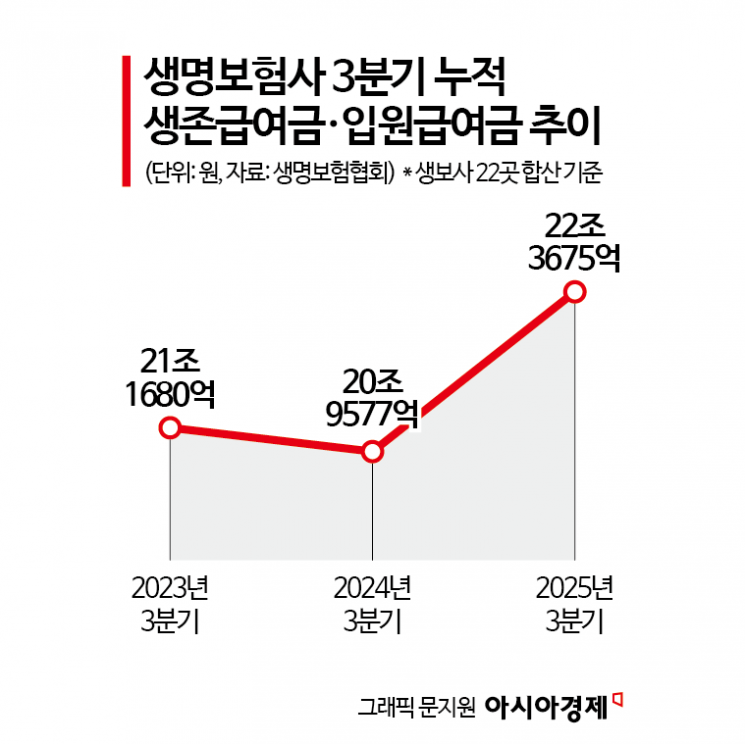

Survival and Hospitalization Benefits Paid by Life Insurers Reach 22.37 Trillion Won, Up 6.72% Year-on-Year

High-Interest Pension Payouts and Death Benefit Securitization Add to the Burden

Fierce Price War Over Hospitalization Benefits in Health Ins

Payouts for survival and hospitalization benefits by domestic life insurance companies have reached an all-time high. As Korea enters a super-aged society, the life expectancy of policyholders is increasing, leading to higher associated costs.

According to the Korea Life Insurance Association on December 19, the combined total of survival and hospitalization benefits paid by 22 domestic life insurers for the cumulative period up to the third quarter of this year amounted to 22.3675 trillion won, a 6.72% increase from 20.9577 trillion won during the same period last year. This is the highest cumulative third-quarter figure since related statistics began to be compiled in 2017.

Survival benefits are insurance payouts with a pension-like nature, provided to customers who survive during the policy period. In the third quarter of this year, life insurers paid out 12.1368 trillion won in survival benefits. This amount is 2.5 times greater than their net profit for the same period, which was 4.8301 trillion won. By company, Samsung Life Insurance paid the most at 3.3881 trillion won, followed by Hanwha Life Insurance at 2.3379 trillion won, and Kyobo Life Insurance at 1.3318 trillion won.

The increase in survival benefits is primarily due to the fact that many individual pension policies, which saw a surge in subscriptions in the 1990s as a means of preparing for retirement, are now reaching their payout phase. At that time, many products offered guaranteed interest rates exceeding 10%, but recently, rates have dropped to the 2-3% range, resulting in negative spreads. As of the first half of this year, the total reserves for pension savings insurance stood at 70.7001 trillion won (37.9778 trillion won for life insurers and 32.7222 trillion won for non-life insurers).

Rising life expectancy is another major factor driving up survival benefits. According to the revised experience life table released last year, the life expectancy of domestic life insurance policyholders is now 88.5 years (86.3 years for men and 90.7 years for women), an increase of 17.7 years compared to 70.8 years in 1989. An industry official stated, "Although the number of policyholders is gradually decreasing due to low birth rates and an aging population, survival benefits are increasing as life expectancy rises. With the recent implementation of death benefit securitization, survival benefits are expected to increase even further."

The increase in life expectancy is also driving up hospitalization benefits. Hospitalization benefits are insurance payouts provided when a policyholder is hospitalized due to illness or accident. In the third quarter of this year, life insurers paid out 10.2307 trillion won in hospitalization benefits, surpassing the 10 trillion won mark for the first time ever. The largest payouts were made by major companies such as Samsung Life Insurance (2.6464 trillion won), Hanwha Life Insurance (1.7566 trillion won), and Kyobo Life Insurance (1.1792 trillion won).

Intense competition among life insurers to secure market share in the health insurance sector has also significantly contributed to the increase in hospitalization benefits. Since the adoption of International Financial Reporting Standards (IFRS17), life insurers have been competitively launching products that offer high daily hospitalization and caregiver allowances in order to secure the Contractual Service Margin (CSM), a key profitability metric. Some insurers have even introduced products that provide over 500,000 won per day for single-room hospitalization and around 200,000 won per day for caregiver allowances. An industry official commented, "During the period of the medical strike, it was difficult to reserve single rooms, so loss ratios were not high. However, after the strike ended, the number of hospitalizations increased, leading to higher loss ratios. For life insurers that aggressively participated in this cutthroat competition and accumulated large CSMs, this may soon come back to haunt them."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)