Riding the AI Boom, Stock Prices Soar 100-Fold from Their Lows

Hyosung Heavy Industries, HD Hyundai Electric, and Other Power Stocks Take the Lead

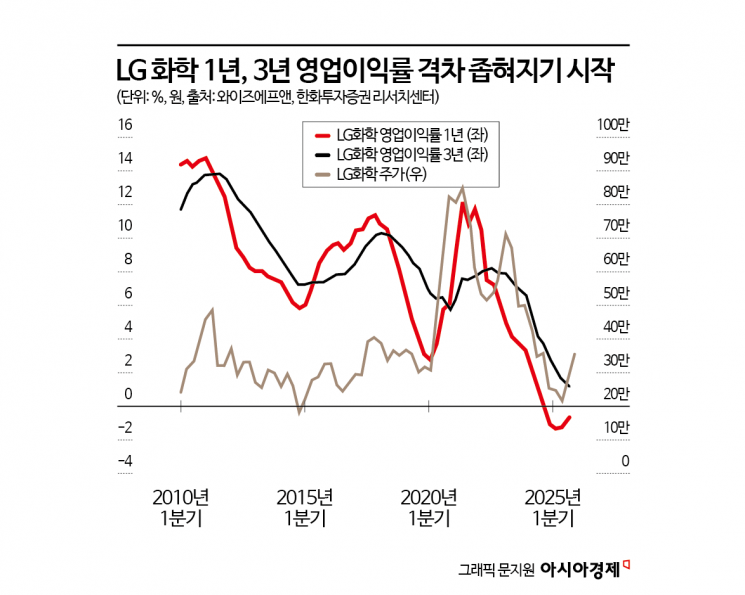

Spotlight on LG Chem and Others Narrowing the Gap Between 1-Year and 3-Year Operating Margins

This year, the domestic stock market has shown relatively strong performance compared to major global stock markets, and stocks known as “hundred-baggers” (stocks whose prices have risen 100-fold) are emerging one after another. In Yeouido, the securities industry is hopeful that the next hundred-bagger could be born among companies whose operating margins are rebounding alongside improving business conditions.

According to the Korea Exchange on December 19, the share price of Hyosung Heavy Industries has risen by about 360% so far this year. Although it has entered a correction phase after reaching an all-time high of 2,483,000 won on November 4, its share price is now 100 times higher than it was in June 2020. Hyosung Heavy Industries currently holds the title of the most expensive stock among domestic listed companies.

During the same period, the share price of HD Hyundai Electric also soared more than 100 times from the 7,000-won range. Last month, it surged to 976,000 won during intraday trading, making it a candidate for the next “emperor stock.” LS ELECTRIC, which hit a low of 3,440 won per share in May 2003, surpassed 344,000 won in October this year.

Kim Suyeon, a researcher at Hanwha Investment & Securities, explained, “What drove the stock market this year was the global artificial intelligence (AI) investment cycle. Riding this wave, stocks like HD Hyundai Electric, LS ELECTRIC, and Hyosung Heavy Industries in the power equipment sector have risen 100-fold from their lows.” She added, “Since the 1990s, the average time it took for a stock to rise 100-fold was 15 years. The fact that HD Hyundai Electric and Hyosung Heavy Industries achieved this in only one-third of that time shows just how powerful a turnaround stock can be.”

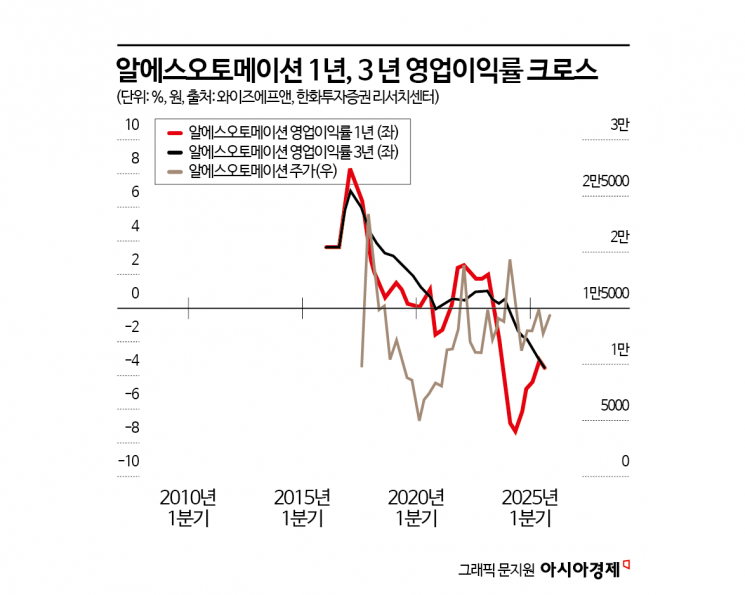

One of the criteria for identifying stocks that could rise 100-fold is the “golden cross” between the one-year operating margin and the three-year operating margin. When a company’s one-year operating margin, which reflects short-term business conditions and direction, crosses above its three-year operating margin, which shows long-term profitability, it can be seen as a sign of a turnaround. For example, HD Hyundai Electric, which saw its operating margin bottom out in the second quarter of 2019 due to losses, implemented restructuring and shifted to a high value-added business model. As a result, in the second quarter of 2020, its one-year operating margin crossed above its three-year operating margin.

Kim also emphasized, “Among companies where margins have started to improve, LG Chem notably returned to profitability in the third quarter, and its one-year operating margin is beginning to recover from the bottom.” She further introduced, “Similar patterns are emerging in the chemical and battery sectors with companies like SK Innovation, Lotte Chemical, and Korea Petrochemical Ind. Others, such as Celltrion and RS Automation, have also been named as turnaround candidates.”

Kang Dongjin, a researcher at Hyundai Motor Securities, commented on LG Chem, “The company has secured orders for about 110,000 tons of cathode materials for Panasonic in the United States, and shipments of cathode materials for Toyota and Honda, mainly in North America, are continuously expanding. This will lay the foundation for a turnaround next year.” He raised the target share price from 400,000 won to 512,000 won.

Jung Isu, a researcher at IBK Investment & Securities, said of Celltrion, “The company is expected to continue improving its profit margin as the share of high-margin new products increases, production of improved products with higher yields boosts profitability of existing products, and the amortization of development costs comes to an end.” He estimated, “Accordingly, the operating margin in the fourth quarter of this year will reach 33.0%, an improvement of 3.7 percentage points compared to the third quarter.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)