Cruise Tourist Arrivals Expected to Reach 1 Million This Year

Short Stays and Bottlenecked Infrastructure Limit Spending Impact

Future Success Hinges on Designing Structures That Drive Actual Consumption

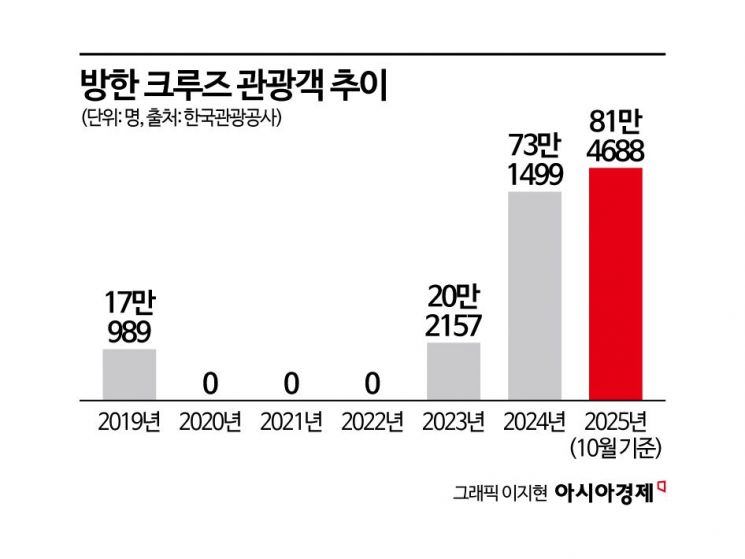

As the number of cruise tourists entering Korea this year is expected to approach 1 million, cruise tourism is once again emerging at the forefront of the national tourism strategy. The cruise market, which was the last to recover after the COVID-19 pandemic, is now entering a full-fledged rebound, drawing attention as a new growth opportunity not only for tourism but also for distribution, food service, and the broader local consumer market. However, experts point out that in order for cruise tourism to become an industry that translates increased visitor numbers into actual consumption, the planning capabilities of both the central and local governments must be strengthened.

The 135,500-ton cruise ship Adora Magic City that docked at Gangjeong Port in Seogwipo City, Jeju on the 2nd. Photo by Yonhap News

The 135,500-ton cruise ship Adora Magic City that docked at Gangjeong Port in Seogwipo City, Jeju on the 2nd. Photo by Yonhap News

Cruise Tourism as 'Regional Tourism Infrastructure'... Role Sharing Among Busan, Jeju, and Incheon

According to the Korea Tourism Organization on December 19, the number of foreign tourists who visited Korea by cruise ship this year reached 814,688 as of October. This figure already surpasses last year's total of 731,499 visitors, and whether the annual number of cruise visitors will exceed 1 million depends on the results of the final two months of the year.

The recent surge in cruise tourists is rooted in government policy. The Ministry of Oceans and Fisheries and the Ministry of Culture, Sports and Tourism have positioned cruise tourism not simply as maritime transportation, but as a means to revitalize regional tourism and domestic consumption, focusing on expanding ports of call and improving infrastructure. Cruises are highly valued as efficient tourism content because they can bring in thousands of foreign tourists at once, simultaneously stimulating spending on accommodation, transportation, shopping, and dining.

Especially since the pandemic, with Northeast Asia cruise routes resuming, the number of large cruise ships docking at Busan, Jeju, and Incheon has rapidly increased. The recovery of cruise demand from China is also playing a decisive role in boosting the number of cruise tourists visiting Korea. The government has recognized the limitations of a port-of-call-centric structure and is prioritizing the development of homeport and quasi-homeport cruises, which allow for longer stays, as a mid- to long-term goal.

In this process, local governments serve as the 'on-site executors' of cruise tourism. Busan City is enhancing the functionality of its international cruise terminal, streamlining CIQ (Customs, Immigration, Quarantine) procedures, and improving urban accessibility to increase its capacity to accommodate large cruise ships. Institutional measures, such as operating a landing permit system for Chinese group cruise tourists, are also being implemented in parallel.

Jeju Island is experimenting with quasi-homeport cruises centered on Gangjeong Port, adjusting its strategy to increase the domestic stay time of visitors. Incheon, meanwhile, is integrating cruise tourism with its urban tourism strategy rather than limiting it to port operations. The city plans to design routes connecting the cruise terminal, downtown commercial districts, duty-free shops, and traditional markets to create a structure where consumption occurs immediately upon disembarkation.

Since the 2nd, Jeju Island has installed automated immigration inspection gates at Jeju Port International Passenger Terminal and Gangjeong Cruise Terminal to reduce the immigration inspection time for cruise tourists and has officially started their operation.

Since the 2nd, Jeju Island has installed automated immigration inspection gates at Jeju Port International Passenger Terminal and Gangjeong Cruise Terminal to reduce the immigration inspection time for cruise tourists and has officially started their operation.

Distribution and Food Service Industries Move into 'Real-World Response' for Overseas Cruise Tourists

With the central and local governments establishing the foundation for increased cruise arrivals, the distribution and food service industries are also launching targeted responses for overseas cruise tourists. At the Incheon Port Cruise Terminal, Ottogi is operating a K-Food experience event using its flagship products, Jin Ramen and Cup Noodles, in a food truck format, aiming for both brand exposure and tasting opportunities. The product lineup is focused on instant foods that can be consumed even during short stays.

The convenience store sector is also taking action. GS25 and CU are strengthening displays of ready-to-eat meals, instant cooking products, and small-packaged snacks at stores near major tourist attractions, targeting foreign tourists and expanding bilingual signage in English and Chinese. They are also increasing the proportion of products that allow for quick payment and packaging, reflecting the characteristics of cruise tourists.

Among food service franchises, chicken brands such as BBQ and Kyochon Chicken are enhancing foreigner-only menus and takeout options at stores near tourist sites. This reflects the preference among cruise tourists for menu items that can be consumed and carried away quickly due to their limited time ashore.

In the duty-free and retail sectors, Lotte Duty Free and Shilla Duty Free are strengthening their offerings of small-package cosmetics, health supplements, and K-beauty curated sets aimed at cruise tourists. Their strategy is to directly attract cruise tourists through shuttle routes connecting ports and downtown duty-free shops, as well as group visit programs. In some regions, experimental tourism products that bundle uniquely Korean consumer goods such as seaweed, kimchi, and snacks with traditional markets are also being tested.

'From High Visitor Numbers to High-Spending Tourists'

The biggest challenge for cruise tourism remains the conversion rate to actual spending. Although the number of cruise tourists is rapidly increasing, there are repeated complaints that local businesses do not feel a corresponding boost in consumption. In reality, as long as port calls are short and sightseeing is organized around group travel, spending will inevitably be limited.

In fact, cruise tourism faces structural limitations even in quantitative expansion. When 3,000 to 5,000 people disembark simultaneously from a large cruise ship, CIQ processing capacity and transportation logistics become bottlenecks. The longer tourists wait to disembark, the less time they have for sightseeing and shopping, which in turn reduces the efficiency of Korean port calls from the cruise line's perspective.

Connectivity between ports and downtown areas is also considered insufficient. Simply increasing the number of shuttle buses or making temporary improvements to routes has its limits, leading cruise lines to maintain existing itineraries rather than adding new ports of call. The concentration of cruise ships at a few ports such as Busan, Jeju, and Incheon is also seen as a long-term constraint on scalability.

There are also clear qualitative limitations. The average time spent ashore is less than half a day, making it difficult to encourage high-value spending or in-depth experiences, and consumption is largely limited to low-priced items such as souvenirs, duty-free goods, and meals. The lack of multilingual guidance, payment systems, and experience in handling large numbers of tourists also hinders increased spending. In particular, traditional markets and local businesses often lack systems tailored to cruise tourists, resulting in missed opportunities for consumption.

The industry believes that the success of cruise tourism now depends not on competition to attract ships, but on the quality of planning. An industry official commented, "Whether cruises remain a fleeting tourism experience or evolve into a driver of local consumption and industry depends on how we design the experience from here on. We need to move beyond simply increasing visitor numbers and focus on concrete planning to extend stays and determine exactly where and how much tourists will spend."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)