Kim Hyunjung's Amendment Reviewed by Political Affairs Committee

"Management Activities Could Decline, Costs May Rise Due to Excessive Litigation"

Shareholders of Financial Parent Companies Could Sue Subsidiary Management

Shareholding Requirement for Lawsuits to Be Lowered from 0.5% to 0.05%

Financial Services Commission: "Needs Careful Review"

The Korea Federation of Banks has explicitly expressed its opposition to a bill that would lower the threshold for holding the management of a financial subsidiary accountable through lawsuits filed by shareholders of the parent company. The federation cited concerns such as the potential discouragement of management activities and increased costs due to excessive litigation.

On December 19, the Korea Federation of Banks stated its position in a review report on the amendment to the "Act on Corporate Governance of Financial Companies," which was proposed by Assemblywoman Kim Hyunjung of the Democratic Party of Korea, a member of the National Assembly’s Political Affairs Committee, in August.

The main content of the amendment is to ease the requirements for filing multiple derivative lawsuits against financial companies. The multiple derivative action system allows shareholders of a parent company to file lawsuits demanding accountability from directors of a subsidiary. This system was introduced to prevent controlling shareholders of a parent company from causing losses to the parent company by establishing subsidiaries and misappropriating the subsidiary’s assets or business opportunities.

Currently, minority shareholders of financial companies can file lawsuits under the Commercial Act. In the case of listed companies, shareholders who have held at least 0.5% of the total issued shares for at least six months can file a lawsuit. Assemblywoman Kim argued that this requirement is excessively strict and does not sufficiently protect minority shareholders’ rights, and therefore proposed an amendment to lower the shareholding threshold to 0.05%. For example, a shareholder holding 0.05% of a financial holding company’s shares would be able to file a lawsuit against a bank under that holding company.

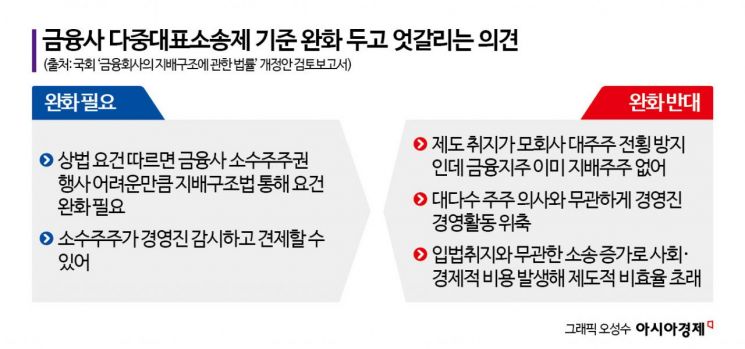

Those in favor of the amendment argue that relaxing the requirements is necessary to make minority shareholder rights more substantive. The current Commercial Act defines minority shareholder rights such as the right to propose agenda items, the right to demand dismissal, and the right to file derivative lawsuits, in order to keep the majority shareholders or management in check and protect minority shareholders. In particular, for listed companies with dispersed shareholding structures, the requirements for exercising minority shareholder rights have already been relaxed to ensure their practical effectiveness.

Proponents claim that since financial companies also have dispersed shareholding structures, and since the "Act on Corporate Governance of Financial Companies" has already eased some requirements for exercising minority shareholder rights under the Commercial Act to make these rights more substantive, it is also necessary to relax the requirements for multiple derivative lawsuits, which are a form of minority shareholder right. They explain that this would strengthen mechanisms for minority shareholders to monitor and check management, thereby promoting transparent management of financial companies.

In response, the Korea Federation of Banks expressed concerns that management activities could be discouraged regardless of the intentions of the majority of shareholders. The federation stated in the report, "A minority shareholder holding 0.05% of the parent company’s shares could intervene in the management of a subsidiary through a multiple derivative lawsuit, which raises concerns that the active and discretionary management activities of executives could be discouraged regardless of the will of the majority of shareholders."

The federation also argued that, considering the purpose of multiple derivative lawsuits is to prevent abuses of power by controlling shareholders of the parent company, there is little need to relax the requirements for financial holding companies, which already have dispersed shareholding structures and no controlling shareholders due to limits on share ownership by any single entity. The federation emphasized, "Unlike general corporate groups, financial holding companies do not have controlling shareholders, so the likelihood of private interests being pursued is significantly lower. If the requirements are relaxed and applied without considering the unique characteristics of financial holding companies, it could raise issues of fairness compared to general corporate groups."

The federation further pointed out that an increase in lawsuits unrelated to the legislative intent could lead to social and economic costs and institutional inefficiency. However, Jeong Myungho, Chief Expert of the National Assembly’s Political Affairs Committee, stated in the review report, "Even for shareholder derivative lawsuits, which have less stringent requirements than multiple derivative lawsuits, the average number of cases filed per year is low, so concerns about excessive litigation are not significant."

Meanwhile, the Financial Services Commission, the relevant ministry, took a neutral stance on the amendment, stating, "It is necessary to carefully review whether there is a need to ease the requirements for multiple derivative lawsuits for financial companies compared to the Commercial Act."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)