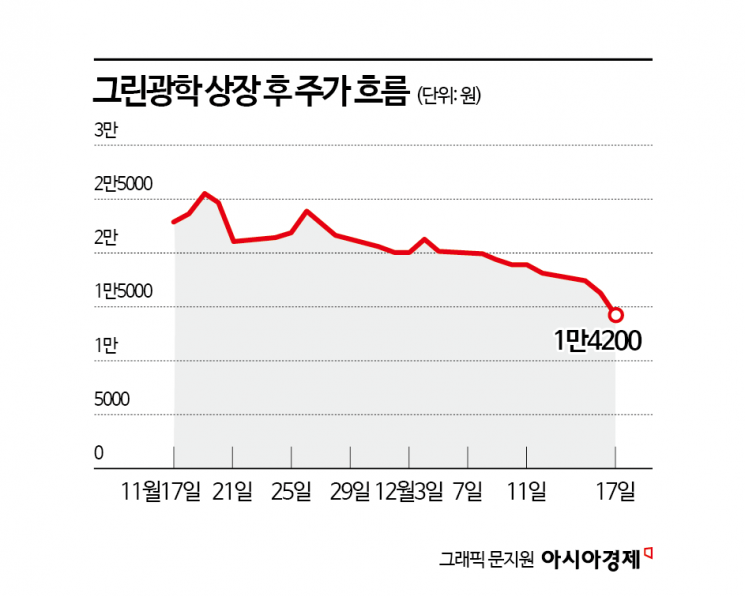

Listed on KOSDAQ on November 17 with an offering price of 16,000 won

Stock surged to 55,000 won on debut, then entered a downward trend

Individuals net purchased 71.1 billion won since listing... Facing a 45% loss on average

The stock price of Green Optics, a newly listed company that entered the KOSDAQ market last month, has fallen below its IPO price. Individual investors, who expected the company to grow in the defense and aerospace sectors based on its advanced optical technology, began net buying from the first day of listing but are now facing significant losses.

According to the financial investment industry on December 18, individual investors recorded a cumulative net purchase of 71.1 billion won from November 17, the day Green Optics was listed, through the previous day. The average purchase price per share was 25,850 won, which, compared to the current price of 14,200 won, translates to a loss of about 45%.

Green Optics was listed on the KOSDAQ market on November 17 with an IPO price of 16,000 won. On the first day of listing, the price rose to as high as 55,000 won but closed at 22,850 won. Since then, the stock price has failed to rebound and at one point during the previous day's session fell to 13,960 won.

Concerns over an overhang (large potential selling volume) are cited as one of the reasons for Green Optics' poor stock performance since its listing. Park Jongseon, a researcher at Eugene Investment & Securities, analyzed, "The immediately tradable volume after listing was 36.5% of the total shares, which is somewhat burdensome," adding, "The proportion of tradable shares one month after listing will be 47.5%."

According to the KOSDAQ Market Listing Regulations, shares acquired by venture capital or professional investors through means other than public offering or sale, and held for less than two years, are subject to a mandatory one-month holding period at the Korea Securities Depository from the listing date. Looking at institutional trading trends, it appears that institutions have been realizing profits on shares whose lock-up period has ended. On the first day of listing, institutions recorded a net sale of about 456,000 shares and have continued to maintain a selling stance since then.

There are projections that the company’s performance will improve starting next year, suggesting there is room for a rebound once the supply-demand imbalance is resolved. Kang Kyungkeun, a researcher at NH Investment & Securities, explained, "The order backlog increased from 25.1 billion won in 2023 to 62.3 billion won in the first half of this year," and added, "Green Optics is currently working on 17 EO/IR projects with companies such as LIG Nex1 and Hanwha Systems, with contracts totaling more than 26.6 billion won."

Yoon Cheolhwan, a researcher at Korea Investment & Securities, also analyzed, "Next year’s outlook is for sales of 67.7 billion won and operating profit of 6.4 billion won," adding, "Operating profit is expected to increase by 192% compared to this year’s estimate." He continued, "In the defense sector, stable sales from laser anti-aircraft weapons and gyroscope applications are expected to continue next year, and the guided weapons segment is expected to stand out starting next year."

Founded in 1999, Green Optics supplies core optical components to advanced industries such as defense and aerospace, semiconductors, and displays. The company handles every stage from design to processing, polishing, coating, assembly, and evaluation.

Green Optics has also secured production technology for zinc sulfide (ZnS) material, which only about 10 companies worldwide can produce. ZnS is a material with excellent transmittance in the infrared range and is mainly used in the defense sector. The ZnS produced by Green Optics is used as a material for seeker domes in guided weapons and is exported to countries such as Israel, the United States, and Japan.

The company has also developed electro-optical/infrared (EO/IR) observation systems capable of identifying targets even in adverse weather or fog. These systems are used in a variety of advanced weapon systems, including naval close-in weapon systems, attack helicopters, and cameras mounted on unmanned aerial vehicles. As of the third quarter of this year, Green Optics recorded cumulative sales of 28.2 billion won and operating profit of 700 million won. Sales increased by 38.5% compared to the same period last year, and operating profit turned positive.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)