Christmas Cake Competition Intensifies Despite High Prices

Choices Split Between Premium and Practical Consumption

Consumers Feel the Strain from Price Hikes and Visual Rivalry

As Christmas and the end of the year approach, competition among food and bakery companies over cakes is intensifying. Despite the ongoing trend of high inflation, consumer sentiment to enjoy the holiday season remains strong, and cakes have become more than just a dessert-they have established themselves as iconic products symbolizing year-end parties and gatherings. The industry is aiming to capitalize on the holiday season by introducing limited-edition products, pre-order systems, and concept-driven cakes.

A significant trend in the current cake market is the polarization of consumption. While high-end cakes featuring premium ingredients and elaborate designs from hotel bakeries and premium dessert brands are gaining attention, demand for smaller cakes is also growing in line with the rise of single- and two-person households and a focus on practical consumption. Unlike the past, when large whole cakes dominated, the market now offers a wider range of options in terms of size and price, giving consumers more choices.

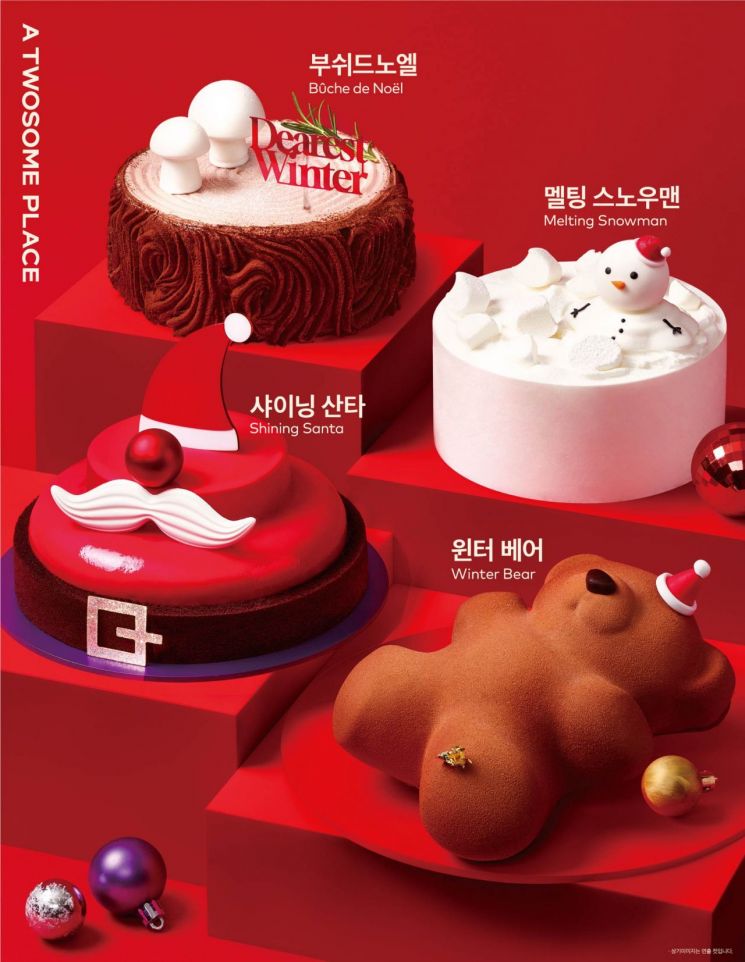

According to the industry on December 18, franchise bakeries are targeting traditional demand with limited-edition products for the holiday season. Paris Baguette is expanding its Christmas cake lineup centered on popular flavors such as strawberry, fresh cream, and chocolate, reinforcing its image as the "standard for year-end cakes." Twosome Place is presenting a holiday cake series featuring character elements like snowmen and Santa Claus, aiming at both younger consumers and social networking service (SNS) demand.

Caf? franchises and convenience stores have also joined the competition. Starbucks Korea and Hollys are increasing accessibility by offering year-end special products that include not only whole cakes but also small cakes and desserts. Convenience stores such as CU and GS25 are meeting the demand for "solo Christmas" with mini cakes and cake slices priced around 10,000 won. In contrast, hotel bakeries such as Josun Hotel, Lotte Hotel, and Shilla Hotel are targeting premium demand for holiday parties with high-priced cakes featuring champagne, premium chocolate, imported butter, and other luxury ingredients.

This year, a particularly notable change in the cake market is the intensification of competition centered on visual appeal. As designs and colors that are easy to share on SNS become a key factor in purchase decisions, cakes are increasingly consumed as "content to photograph and show off" rather than merely as food. In fact, character cakes from Twosome Place and objet-style cakes from hotel bakeries often attract attention for their design before their taste.

Pre-order and limited sales strategies have also become a core structure of the year-end cake market. Many bakeries and caf? franchises, including hotel bakeries and Paris Baguette, now operate primarily on a reservation basis, and some premium products even sell out early during the pre-order stage. While this is rational from the perspective of demand forecasting and production efficiency, some consumers complain that it limits their choices.

As the competition over Christmas cakes intensifies each year, concerns about price burdens and structural limitations are also growing. It has become common for whole cakes from major franchises and hotel bakeries to exceed the 50,000 to 100,000 won range, and recently, Shilla Hotel even introduced a 500,000 won truffle cake called "The Finest Luxury." The industry cites rising raw material prices, increased labor costs, and higher design and marketing expenses as reasons, but some consumers say it feels like they are paying for the holiday atmosphere rather than the cake itself.

The fundamental cause of these issues is the demand structure that is excessively concentrated during the holiday season. As cake sales are heavily focused on Christmas, companies have come to rely on high-priced products and limited-edition strategies to achieve high sales in a short period. This naturally leads to price increases and a focus on visual appeal, ultimately increasing the burden on consumers.

The marketing environment centered on SNS also plays a significant role. As cakes are perceived as "products to be shown off" rather than "delicious desserts," there is a strong tendency for design and buzz to take precedence over actual taste and quality. This is also why consumers frequently report that excessive decorations make cakes difficult to store or cut, and that the taste does not meet expectations given the price.

Environmental concerns are also emerging as an issue. The increased use of large packaging boxes, disposable decorative items, and plastic figures is raising concerns that Christmas cake consumption is adding to the environmental burden. While some brands are attempting to use eco-friendly packaging or minimize decorations, there are still limitations to widespread adoption across the market.

Both inside and outside the industry, there are calls for a strategic shift to ensure the sustainability of the Christmas cake market. A representative from the food service industry commented, "The key is how to increase satisfaction and the persuasiveness of the experience relative to the price, rather than relying on short-term buzz and high prices. The long-term success of the cake market will depend not on who can launch the most extravagant product, but on how clearly companies can present reasons for consumers to willingly accept the price and make that choice."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)