NH-Amundi Asset Management announced on December 17 that the HANARO Nuclear Power iSelect ETF will undergo rebalancing in line with changes to its index methodology.

The HANARO Nuclear Power iSelect ETF, launched in June 2022 as Korea’s first nuclear power-themed ETF, invests in companies across the nuclear value chain, including Doosan Enerbility, Korea Electric Power Corporation, HD Hyundai Electric, Hyundai Engineering & Construction, and Hyosung Heavy Industries. As of December 15, its net asset value stood at 538.4 billion won, making it the largest nuclear power-themed ETF in Korea.

The rebalancing will focus on restructuring the portfolio around companies with strong representation and high growth potential within the nuclear power industry value chain.

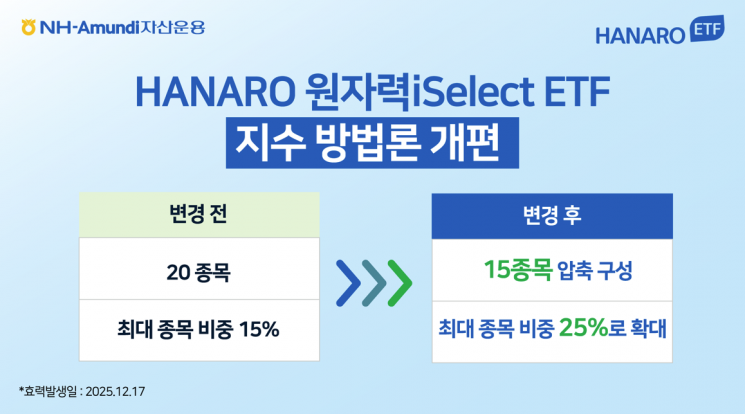

After the revision, the number of constituent stocks will be reduced from 20 to 15. The maximum weighting cap per stock will be increased from 15% to 25%. By increasing the investment allocation to leading companies with global competitiveness, the ETF aims to more efficiently capture the growth of the nuclear power industry.

Based on its strong performance, the HANARO Nuclear Power iSelect ETF has recorded the highest return among all domestic ETFs, excluding leveraged products, this year. According to the Korea Exchange, as of December 12, its year-to-date return was 198.78%.

Kim Seungcheol, Head of ETF Investment at NH-Amundi Asset Management, stated, "Through the revision of the index methodology, we expect to more effectively track the performance of Korea’s nuclear power industry as it evolves due to global expansion and small modular reactor (SMR) orders. We will continue to do our best to provide optimal portfolio strategies for domestic ETF investors."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)