Shinhan Investment & Securities Survey of 200 PBs on Market Outlook

"Semiconductors and AI to Lead the Market Again Next Year"

Six to seven out of ten private bankers (PBs) at Shinhan Investment & Securities predict that the return on the Korean stock market next year will be similar to or higher than that of the U.S. stock market. Despite the continued strong dollar trend, both the Korean and U.S. markets are expected to remain centered on artificial intelligence (AI) and semiconductors, as was the case this year.

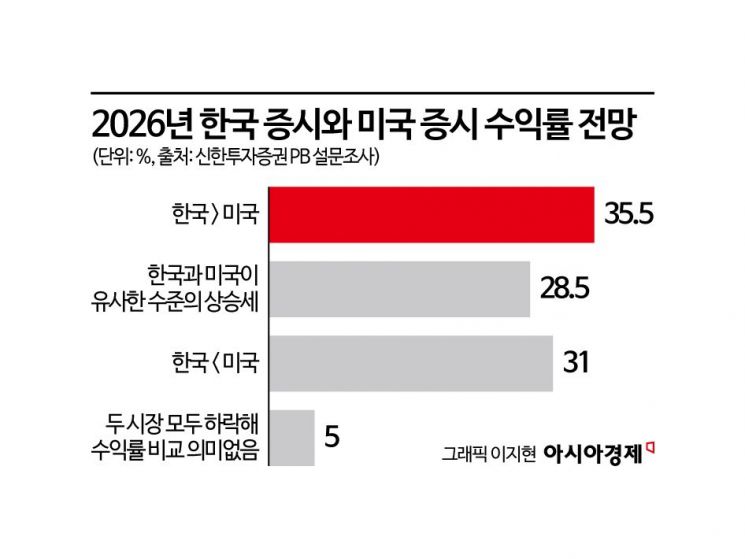

On December 16, Shinhan Investment & Securities released the results of its 2026 market outlook survey, which was conducted with 200 PBs. The highest proportion of respondents, 35.5%, answered that the annual return on the Korean stock market would surpass that of the U.S. market. Another 28.5% said that Korea and the U.S. would show similar returns. In contrast, only 5.0% of respondents predicted that both markets would decline. Meanwhile, 31.0% said the U.S. stock market would outperform Korea.

In this survey, a significant portion of PBs (58.0%) expected that major domestic companies would deliver solid results, led by exporters, next year. Additionally, 33.5% anticipated a strong earnings-driven market overall.

With the Korean government preparing measures to revitalize the KOSDAQ, 10 percentage points more respondents believed that the KOSPI (main board) has greater upside potential than the KOSDAQ next year. Only 4.0% predicted that both the KOSPI and KOSDAQ would decline.

Within the Korean stock market, AI and semiconductors (62.5%) were cited as the leading sectors. This was followed by bio (24.0%), others (10.0%), and automobiles (3.5%). Globally, AI and semiconductor sectors also received overwhelming support. When asked which sector would be the most promising in 2026, 80.5% of PBs-eight out of ten-chose AI and semiconductors for both Korea and the U.S.

Regarding the recent topic of exchange rates, the majority of respondents said that the Korean won would fluctuate around its current level amid continued dollar strength. Only about 10% expected the won to strengthen. When asked about the impact of geopolitical risks such as cross-strait tensions and Korea-Japan relations, more than half (53.0%) anticipated increased volatility in both the Korean and global stock markets.

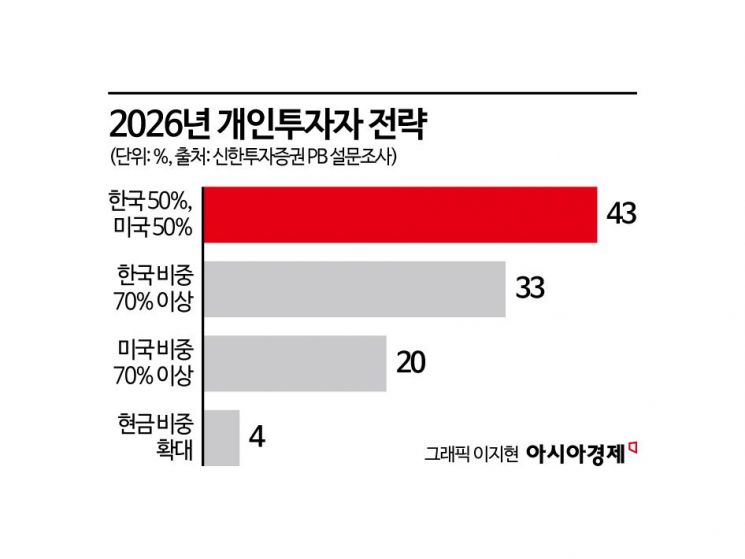

As for individual investors' strategies for 2026, 43.0% recommended allocating investments equally between Korea and the U.S. (50:50). This was followed by allocating more than 70% to Korea (33.0%) and more than 70% to the U.S. (20.0%).

A representative from Shinhan Investment & Securities stated, "Our PBs forecast that in 2026, Korea will continue to see a market driven by the performance of export-oriented companies focused on semiconductors and AI. We hope this survey will serve as a valuable guide for successful investing."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)