Productive Finance and Higher Mortgage Risk Weights

Some Commercial Banks Face Penalties for Exceeding Mortgage Targets

Further Decline in Mortgage Lending Capacity Expected Next Year

As the year-end "loan cliff" becomes a reality, there are projections that the credit crunch felt by genuine borrowers will persist into next year. This outlook is due to financial authorities maintaining their policy of keeping household loan growth within the nominal GDP growth rate in 2025, while also encouraging a shift toward "productive finance"-directing capital away from real estate and into high-growth companies and industries. As a result, banks are expected to set even more conservative household loan growth targets when submitting their plans to financial regulators.

According to the financial sector on December 16, the Financial Supervisory Service recently requested major commercial banks to submit their annual household loan growth targets and is currently collecting them. The Financial Supervisory Service plans to coordinate detailed target ratios with the Financial Services Commission at a later stage.

Financial authorities intend to manage household loan growth within the nominal GDP growth rate next year, just as they did this year. With the Bank of Korea, the Organisation for Economic Co-operation and Development (OECD), and other major institutions forecasting real GDP growth in the high 1% to low 2% range and consumer price inflation around 2% for next year, it is expected that the household loan growth target will be set at no more than the high 3% range.

Major commercial banks are expected to submit conservative targets in line with these regulatory guidelines. An official at Bank A said, "We submitted a target of around 2% at the beginning of this year, but realistically, we expect to submit an even lower figure for next year." An official at Bank B commented, "Although banks are told to set their own targets, we have no choice but to align with the authorities, so we will be as conservative as possible. In particular, since commercial banks are set to inject significant capital into 'productive finance' over the next five years, household loan growth will likely be kept to a minimum and provided only to genuine borrowers."

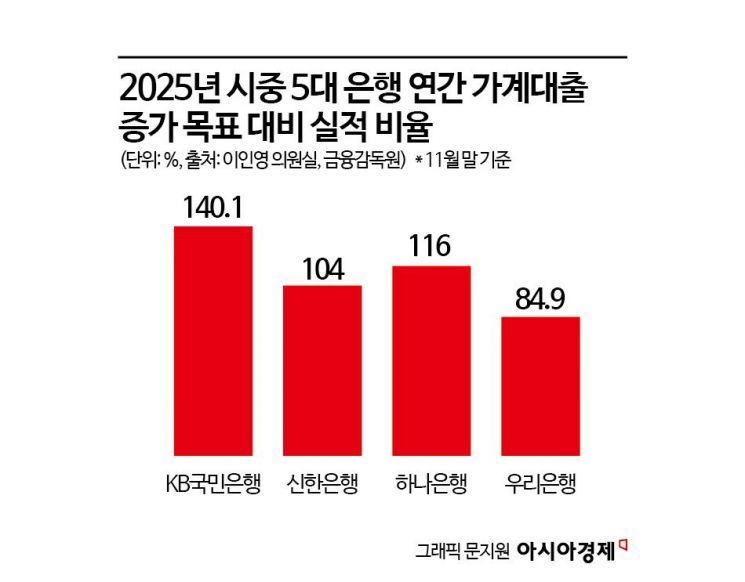

Some major commercial banks have already exceeded their targets, and if penalized by the authorities, their lending capacity next year could shrink further. KB Kookmin Bank recorded the highest ratio among the top five banks, with its actual annual loan growth reaching 140.1% of its target. While Kookmin Bank set a household loan growth target of 2.0061 trillion won for this year, the figure had already reached 2.8099 trillion won as of the end of November. The bank is making last-ditch efforts to stay within the cap, such as suspending mortgage loans for living stabilization funds and waiving early repayment fees on household loans until the end of the year, but it is highly likely to exceed its target.

In addition, Hana Bank recorded 1.0548 trillion won in household loan growth as of the end of last month, 116% of its original target of 910.2 billion won. Shinhan Bank also saw its household loans increase by 1.7025 trillion won by last month, reaching 104% of its target of 1.6375 trillion won. Due to the June 27 measures, which cut the second half loan cap by 50% compared to the original plan, the annual targets were quickly exhausted. Currently, Woori Bank is the only one among the four major commercial banks with sufficient room left, at 84.9% of its cap.

Starting in January next year, banks' capacity to issue mortgage loans will be further reduced due to an increase in the risk weight floor for mortgage loans to 20%. As a result, the capacity to issue new mortgage loans is expected to decrease by 27 trillion won.

Both within and outside the financial sector, there are concerns that if this policy stance continues, the year-end loan cliff will be repeated next year. A banking sector official said, "Since we are already resuming mortgage loan operations for next year's allocations, lending will loosen somewhat at the start of the year, but with the current total volume control policy, lending capacity will inevitably decline as the year-end approaches."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)