Pop-up Store Opens in Harajuku, Tokyo on the 12th

Full-scale Entry into Japan Begins

"Japanese Sales to Expand to 40% of Overseas Revenue"

Korean Designer Brands Show High Growth Potential

Online Fashion Market in Japan Continues to Ri

"We plan to expand our global business, which has so far focused on North America, to Japan."

Eunyoung Lee, who oversees global business at the fashion platform W Concept, made this statement during a media conference at the W Concept popup store held in Harajuku, Tokyo, Japan, on December 12. She explained, "We determined that the Korean fashion market has already reached its growth limit, so we have been strengthening our overseas business for several years." W Concept aims to raise the proportion of Japanese sales in its overseas revenue to 40%.

On the afternoon of the 12th, Eunyoung Lee, Global Business Manager of W Concept, explained the reason for opening the popup store at the 'W Concept Popup Store' near Harajuku Station in Tokyo, Japan. Photo by Jaehyun Park

On the afternoon of the 12th, Eunyoung Lee, Global Business Manager of W Concept, explained the reason for opening the popup store at the 'W Concept Popup Store' near Harajuku Station in Tokyo, Japan. Photo by Jaehyun Park

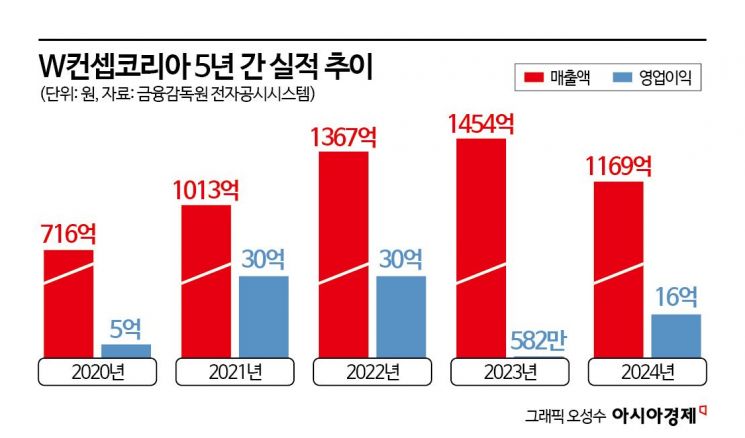

W Concept turned its attention to overseas markets because it judged that growth in the domestic market was slowing. W Concept's revenue grew rapidly from 71.6 billion won in 2020 to 101.3 billion won in 2021 and 136.7 billion won in 2022. However, in 2023, revenue increased to 145.4 billion won, with the growth rate slowing, and last year, revenue decreased to 116.9 billion won. Profitability also fluctuated significantly. Operating profit was only 500 million won in 2020, then reached 3 billion won in both 2021 and 2022, but dropped to 58.2 million won in 2023. Last year, operating profit recovered to 1.6 billion won. Both inside and outside the company, there is a consensus that the growth model centered on the domestic market has reached its limit.

Based on this assessment, W Concept has chosen the Japanese market as a key hub for its overseas business. W Concept is operating its first offline popup store in Japan until the 22nd. This popup marks the company's official entry into the Japanese market and is a strategic attempt to directly showcase the competitiveness of Korean designer brands to Japanese consumers.

Lee emphasized, "This popup store is a kind of preview of the brand experience W Concept will offer in Japan," adding, "We will pursue more aggressive business expansion in the Japanese market going forward."

This popup store features 15 Korean designer brands currently sold on W Concept. Among them, nine brands-including U Sentic, Mohan, Frontrow, and Lazyge-are being introduced at Japanese offline stores for the first time. Kim Dajeong, Vice President of Lazyge, who attended the event, said, "It's costly and burdensome in terms of regulations for a brand to enter overseas markets alone," adding, "Entering through a platform is a practical alternative."

Harajuku in Tokyo, where the popup store is located, is Japan's most iconic fashion street. Korean brands such as Blue Elephant, Saeter, and Ader Error also have stores in this area. On this day, Japanese influencers, brand representatives, and media personnel visited the W Concept popup store, and on weekends, local consumers came to shop. Moeka, a 26-year-old Japanese visitor, said, "I learned about W Concept for the first time, but the floral decorations caught my eye and naturally drew me in," adding, "Korean brands are cute and trendy, yet also have a mature vibe, which is impressive."

Products from Korean designer brands displayed inside the W Concept Tokyo pop-up store. Photo by Jae-Hyun Park

Products from Korean designer brands displayed inside the W Concept Tokyo pop-up store. Photo by Jae-Hyun Park

W Concept chose Japan as a key overseas hub because the local fashion platform market is relatively underdeveloped. Lee explained, "Currently, Zozotown is virtually the only notable fashion platform in Japan," and "since there are not many channels where multiple brands can be compared and purchased in one place, the competitive environment is limited." She added, "We saw this market structure as a significant opportunity."

The recent surge of the Korean Wave in Japan is another major reason for entering the market. With interest in K-fashion and K-beauty rising rapidly, and the domestic fashion market reaching saturation, the company aims to use the culturally similar Japanese market as a new growth breakthrough. There are also plans to use Japan as a bridgehead for targeting the broader Asian market.

Industry experts believe that the Korean designer brands carried by W Concept have strong growth potential in Japan. Since there are almost no platforms in Japan specializing in Korean women's contemporary designer fashion, W Concept is expected to play a pioneering role in the market.

W Concept has been preparing for its entry into the Japanese market since last year. In September last year, it revamped its global mall to introduce an automatic Japanese translation service, expanded local payment options, and strengthened localization by operating a customer service center dedicated to Japanese customers.

The Japanese fashion market is worth about 8.25 trillion yen (approximately 73 trillion won), about 1.6 times the size of the Korean market. While the market has traditionally been dominated by offline sales, online consumption has grown rapidly since COVID-19. According to Japan's Ministry of Economy, Trade and Industry, the B2C (business-to-consumer) e-commerce conversion rate for apparel in Japan was 23.38% last year, higher than food, beverages, and liquor (4.52%) or cosmetics and pharmaceuticals (8.82%).

A W Concept representative stated, "The Japanese online fashion market is centered on brand-owned malls and open markets, so there are virtually no Korean-style online fashion select shops," adding, "We will focus on introducing the new model of a designer brand select shop to the Japanese market." He also said, "This popup store is designed to allow people to experience firsthand the design competitiveness and global potential of Korean designer brands."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)