Food Industry on High Alert

Raw Material Sourcing Emerges as Key Issue Beyond Labeling

As the implementation of the mandatory full labeling system for genetically modified organisms (GMO) approaches, domestic food companies are re-examining their entire raw material procurement strategies. This is because they believe that changes in labeling standards could affect not only labeling itself, but also the structure of raw material sourcing and production stability. Given the industry's reliance on imports for key grains such as soybeans and corn, supply chain risks have emerged as a critical variable.

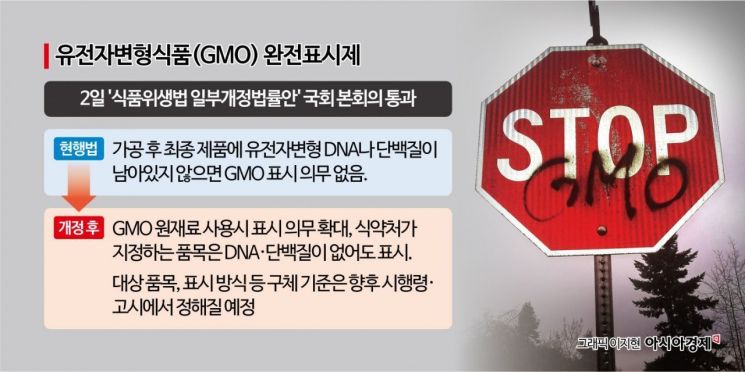

According to the food industry on December 16, the "Partial Amendment to the Food Sanitation Act," which passed the National Assembly's plenary session, requires GMO labeling even for certain items that do not contain genetically modified substances or proteins after the manufacturing or processing stage. The specific items subject to labeling will be determined by the head of the Ministry of Food and Drug Safety after review and resolution by the Food Sanitation Deliberation Committee under the Ministry.

The industry sees the full GMO labeling system as likely to function as a regulation that effectively influences raw material selection, going beyond the existing labeling regime. Until now, the labeling requirement only applied if genetically modified DNA or protein was detected after manufacturing or processing. Going forward, however, products will have to be labeled as GMO if the raw materials are genetically modified, regardless of whether they are processed or not.

As the labeling standard shifts from the end product to the raw materials, food manufacturers are now at a crossroads. They must either continue using GMO ingredients and accept the burden of labeling their products as containing GMOs or switch to non-GMO ingredients to avoid this labeling. However, most in the industry believe that continuing with GMO ingredients is not a viable option. This is due to concerns that GMO labeling will be perceived negatively by consumers, which could directly damage brand image and lead to decreased sales.

The challenge lies in sourcing non-GMO ingredients. Non-GMO soybeans and corn account for only a limited share of the global grain market. Moreover, strict segregation from GMO ingredients is required throughout production and distribution, resulting in supply chains being concentrated in specific countries or regions. This structure makes the supply of non-GMO ingredients more vulnerable to disruptions caused by weather anomalies or geopolitical factors.

Supply chain management costs are also a significant burden. To use non-GMO ingredients, companies must establish traceability and management systems covering the entire process from production to distribution, storage, and processing. The industry views this not as a simple ingredient swap but as a structural change requiring a reorganization of supply sources and a complete overhaul of management systems. This transition is expected to be especially costly and burdensome for small and medium-sized food companies.

Rising cost pressures are also a practical concern. Non-GMO soybeans and corn are often traded at prices more than 20% higher than GMO ingredients on the international market. Given the domestic food industry's heavy reliance on imports for major raw materials such as soybeans, corn, and canola, switching to non-GMO ingredients will inevitably lead to increased production costs.

Industry forecasts suggest that if the transition to non-GMO becomes widespread, prices of primary processed foods could rise by 5-15% or more. Furthermore, if these increased costs are passed down to secondary and tertiary processed foods such as snacks, beverages, and instant foods, consumers could feel an even greater impact on overall food prices.

An industry official commented, "If the full GMO labeling system functions as a de facto regulation on raw materials rather than just a labeling system, we must carefully assess its impact on prices and overall industrial competitiveness. Unless the enforcement decree is designed with a well-structured grace period, phased implementation, and clear exceptions, policy side effects will be unavoidable."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)