Planned Annual Sale of 330 Billion Yen in ETFs

Sales May Be Suspended in Case of Market Turmoil

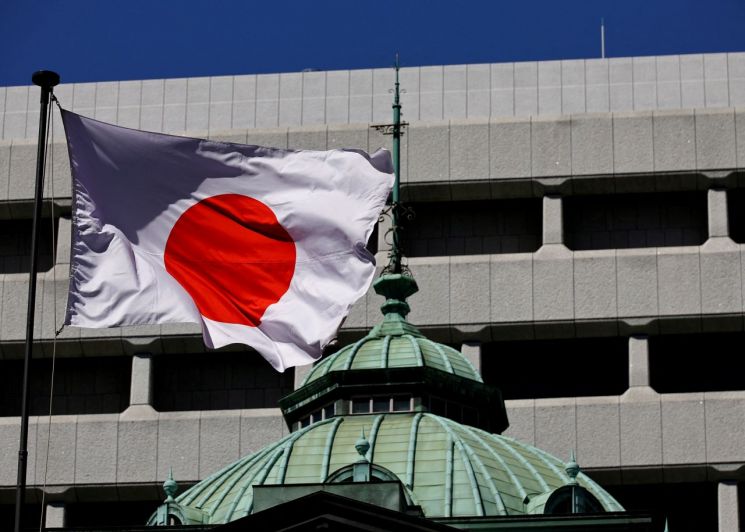

The Bank of Japan is set to begin selling its holdings of exchange-traded funds (ETFs) as early as January next year.

According to Bloomberg on December 14 (local time), officials from the Bank of Japan stated that they would gradually sell off their ETF assets in order to avoid market disruption.

This move follows the central bank’s announcement in September that it would dispose of its ETF and Japanese Real Estate Investment Trust (J-REIT) holdings at a pace of approximately 620 billion yen per year (based on market value), while keeping the benchmark interest rate at the current 0.5% during its monetary policy meeting.

As of the end of September, the market value of these assets stood at 83 trillion yen, with a book value of 37.1 trillion yen. The annual scale of ETF sales is about 330 billion yen based on book value. It is expected to take approximately 112 years to complete the sale of all ETF assets.

The reason for conducting the ETF asset sales over such a long period is to prevent turmoil in the financial markets. Previously, the Bank of Japan sold off shares of troubled banks in the 2000s. At that time, the sale of bank shares took about 10 years to complete.

In recent years, the sharp rise in the Japanese stock market has led to a significant increase in the market value of ETF assets. As with the sale of troubled bank shares, the central bank plans to maintain a steady pace in selling off ETFs. However, Bloomberg noted that if an event similar to the 2008 global financial crisis were to occur, the Bank of Japan may suspend ETF sales.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)