2024 Retirement Pension Statistics

Growing Preference for Retirement Pensions Among Stable Workplaces

Early Withdrawals from Retirement Pensions Up 4.3%

The accumulated funds in retirement pension plans have surpassed 400 trillion won for the first time since statistical records began. This appears to be the result of a growing preference for retirement pensions, particularly among stable workplaces, rather than a widespread expansion of the system itself. Last year, the number of people making early withdrawals from their retirement pensions increased by nearly 70,000 compared to the previous year.

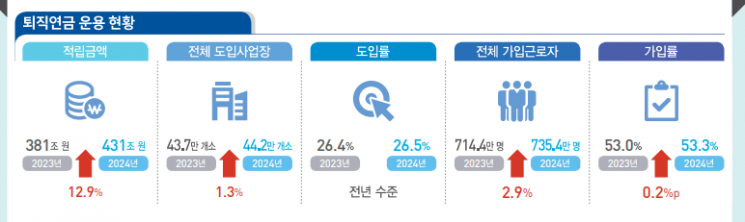

According to the "2024 Retirement Pension Statistics" released by the National Data Agency on December 15, the accumulated funds in retirement pension plans totaled 431 trillion won at the end of 2024, marking a 12.9% increase (49 trillion won) from the previous year. This is the first time the figure has exceeded 400 trillion won since statistics were first compiled in 2015. The National Data Agency analyzed that this increase is largely due to a growing number of employees at large corporations choosing retirement pensions over severance pay, rather than a significant rise in the number of workplaces adopting the system.

Under the current system, workplaces must choose between severance pay and retirement pension plans, with the decision made through labor-management agreements. Retirement pension plans require continuous deposits and management of funds with financial institutions, which can be burdensome for small businesses. As a result, the use of the system is expanding mainly among large corporations and stable workplaces with sufficient financial resources.

Although the total amount of retirement pension funds is increasing rapidly, the growth in the number of workplaces adopting the system and the number of participating employees remains limited. Last year, the total number of workplaces that had adopted the system was 442,000, an increase of only 1.3% from the previous year. The adoption rate among eligible workplaces (1,640,600) stood at 26.5%, similar to the previous year's 26.4%.

There have also been changes in the structure of fund management. By plan type, defined benefit (DB) plans accounted for the largest share at 49.7%, but this was a decrease of 4.0 percentage points from the previous year. In contrast, defined contribution (DC) plans made up 26.8% and individual retirement pension (IRP) plans accounted for 23.1%, increases of 0.9 percentage points and 3.1 percentage points, respectively, from the previous year.

Last year, the number of people making early withdrawals from their retirement pensions rose by 4.3% to 67,000, while the total amount withdrawn increased by 12.1% to 3 trillion won. Among the reasons for early withdrawal, home purchases accounted for the largest share at 56.5% based on the number of people, followed by rental housing (25.5%) and rehabilitation procedures (13.1%). For those aged 29 and under, rental housing was the most common reason for early withdrawal, while for all other age groups, home purchases were the most common reason.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)