KB Financial Group Releases "2025 Korea Wealth Report"

Number of Wealthy Koreans Grows by About 10% Annually

Financial Investment Stance for Next Year: "Maintain the Status Quo"

More Favorable Opinions Toward Increasing Stock Investments

It is estimated that the number of wealthy individuals in South Korea with financial assets exceeding 1 billion won (approximately 1 million dollars) has surpassed 470,000. The total financial assets held by these individuals reached 3,066 trillion won, exceeding 3,000 trillion won for the first time this year.

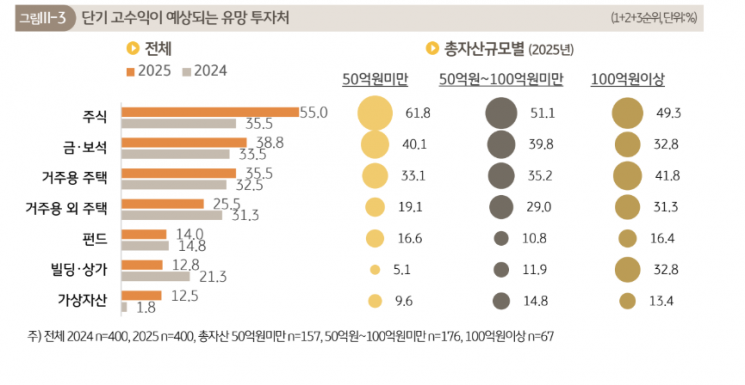

These wealthy individuals selected "stocks" as their top choice for promising investment destinations expected to yield high returns next year and over the next three to five years.

The Number of Wealthy Individuals in Korea Increases by About 10% Annually... Proportion of Real Estate Assets Decreases

According to the "2025 Korea Wealth Report" published by KB Financial Group Management Research Institute on December 14, the number of "wealthy individuals" with financial assets of at least 1 billion won increased from 130,000 in 2011 to 476,000 in 2025, growing by 9.7% annually.

The total financial assets held by these individuals also grew at an average annual rate of 7.2%, rising from 1,158 trillion won in 2011 to 3,066 trillion won this year. Thanks to the recovery of the financial market driven by a strong stock market, this figure increased by 8.5% compared to the previous year. Total real estate assets amounted to 2,971 trillion won, increasing by only 6% due to uncertainty in the real estate market, which is a smaller increase compared to previous years (7.7% in 2023 and 10.2% in 2024).

The overall asset portfolio of wealthy individuals in Korea has shifted, with the proportion of real estate assets decreasing and the proportion of other assets increasing. The share of real estate assets dropped from 58.1% in 2011 to 54.8%. Unlike financial assets, which saw little change in their share, other assets have increased their proportion in the portfolios of wealthy individuals, driven by greater investments in physical assets such as gold and jewelry, as well as alternative assets like virtual assets that have recently gained attention.

Over the past 15 years, the asset threshold considered to define a wealthy individual in Korea has consistently remained at 10 billion won. However, there have been some changes in the sources of wealth. While real estate investment and inheritance/gifts were once the main sources, there has been a shift toward business income, with an increasing number of individuals also growing their wealth through earned income and financial investment gains. Interests in asset management have also diversified from a focus on real estate investment to include financial investment, physical investment, rebalancing, and virtual assets.

Proportion of Liquid Financial Assets and Deposits Increases

The largest portion of total assets among wealthy individuals was "residential housing (31.0%)," followed by "liquid financial assets such as cash and demand deposits (12.0%)," "non-residential housing (10.4%)," "deposits and savings (9.7%)," "buildings and commercial properties (8.7%)," and "stocks (7.9%)."

Compared to the previous year, the proportion of liquid financial assets and deposits increased, and the share of stocks also rose slightly due to higher stock prices. On the other hand, as new investments in real estate continued to decline, the proportion of detailed real estate assets generally decreased.

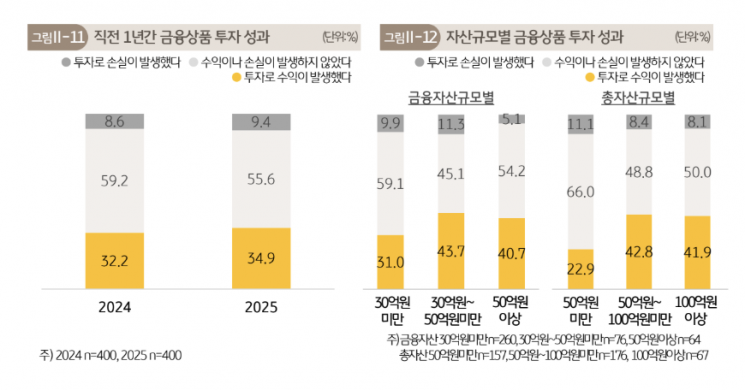

Over the past year, the number of wealthy individuals who experienced "gains" from financial investments (34.9%) was 3.7 times higher than those who experienced "losses" (9.4%). The research institute explained that this is related to the favorable atmosphere in the financial market in the first half of the year, as evidenced by the strong stock market and positive performance in the bond market.

Financial Investment Stance for Next Year: "Maintain the Status Quo"... Stocks Are the Top Choice

Wealthy individuals commonly selected "stocks" as the top promising investment destination expected to yield high returns next year and over the next three to five years.

Even as a wait-and-see attitude toward the financial market grows, stocks were the most popular choice for "increasing investment amounts" (17.0%), which was three times higher than the proportion planning to "reduce investment amounts" (5.8%). Compared to last year, the proportion of those planning to add funds to stocks increased by 1.7 percentage points, while those planning to withdraw funds decreased by as much as 16 percentage points, reflecting high expectations for stock investments.

Meanwhile, the "2025 Korea Wealth Report" was compiled based on a survey of 400 wealthy individuals in Korea conducted from July 21 to August 31, as well as in-depth personal interviews with a separate panel. The report can be found on the website of KB Financial Group Management Research Institute.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)