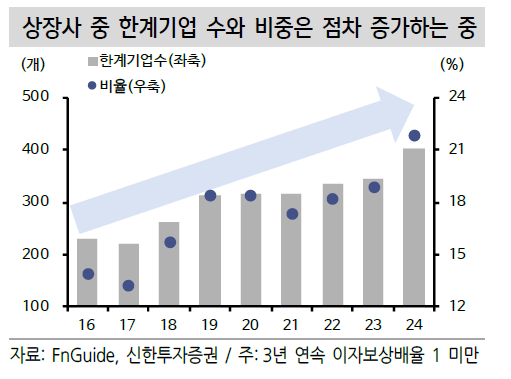

Proportion of Marginal Companies Among Listed Firms Rises to 21%

"Timely Exit Policy for Insolvent Companies Needed"

There are growing concerns that the persistent number of marginal firms in South Korea is distorting the country's gross domestic product (GDP) and leading to an inefficient allocation of scarce resources within industries. Analysts say that the stock market also needs an effective 'exit policy' to swiftly remove insolvent companies.

Marginal firms, also known as 'zombie companies,' are insolvent businesses that have reached the limits of survival, as they are unable to cover even their interest expenses with their operating profits. Typically, this term refers to companies whose interest coverage ratio (operating profit/interest expenses) remains below 1 for three consecutive years.

On December 12, Shinhan Investment Corp. provided this assessment in its report titled 'Status of Marginal Firms and Improvements to Delisting Systems.' The report analyzed the marginal firm issue as not only a cause of declining corporate competitiveness but also a structural problem resulting from a combination of accommodative monetary policy and various support measures.

In South Korea, the closure rate remained around 13% even during the global financial crisis. During the COVID-19 pandemic, the closure rate actually dropped to 10%.

As scarce resources within industries were allocated to marginal firms, both investment and GDP became distorted. The Bank of Korea estimated that between 2014 and 2019, only 2% of high-risk companies (which accounted for 3.8% of all firms) were actually eliminated, and if these had been replaced by healthy companies, domestic investment would have increased by 3.3% and GDP by 0.5%. Even after the pandemic, the proportion of high-risk companies remained similar, but the percentage of companies exiting the market fell further to 0.4% due to financial support and other factors.

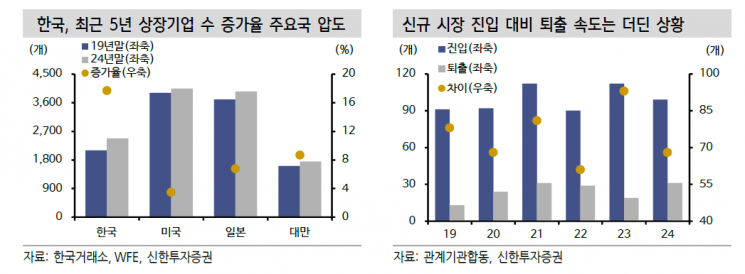

This trend has continued in the stock market. Over the past five years, the growth rate of newly listed companies in South Korea has been about three times higher than in major economies such as the United States and Japan, but the pace of delisting has lagged behind new listings. As a result, both the number and proportion of marginal firms among listed companies have steadily increased, reaching 401 companies, or 21.8%, last year.

At the beginning of this year, financial authorities announced improvements to the delisting system as part of the Value-Up Program, completing the foundational overhaul of the system. Starting early next year, requirements for market capitalization and sales for delisting will be gradually strengthened in both the KOSPI and KOSDAQ markets. After delisting, support for over-the-counter trading (through improvements to the K-OTC system) will also be implemented.

Kang Jin-hyuk, a researcher at Shinhan Investment Corp., stated, "Despite this year's bull market, more than half of listed companies still have a price-to-book ratio (PBR) below 1, indicating room for improvement in resource allocation. We expect additional timely exit policies for insolvent companies, alongside the acceleration of capital movement, so that investments can flow into healthy firms."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.