Expert Opinions from the Financial Investment Sector

Large-Scale Government-Led Strategic Project Support Welcomed

Concerns Over Governance, Fundraising, and Polarization of Neglected Sectors

"This will be a major growth driver for innovative and venture companies that are thirsty for investment."

"The key is to separate the wheat from the chaff. It's like digging irrigation channels to grow crops, but ending up supplying water to a swimming pool operator instead of a farmer."

With the official launch of the "National Growth Fund," which will inject as much as 150 trillion won into advanced industries such as artificial intelligence (AI) and semiconductors, the financial investment sector is watching with both anticipation and concern. While there is broad consensus that Korea urgently needs large-scale, government-led strategic project support amid intensifying global technological hegemony competition, a wave of concerns has emerged regarding challenges such as fundraising, the difficulty of distinguishing quality investments, and the potential side effects of valuation bubbles impacting the market.

National Growth Fund Launch Raises Expectations as a "Catalyst for the Venture Ecosystem"

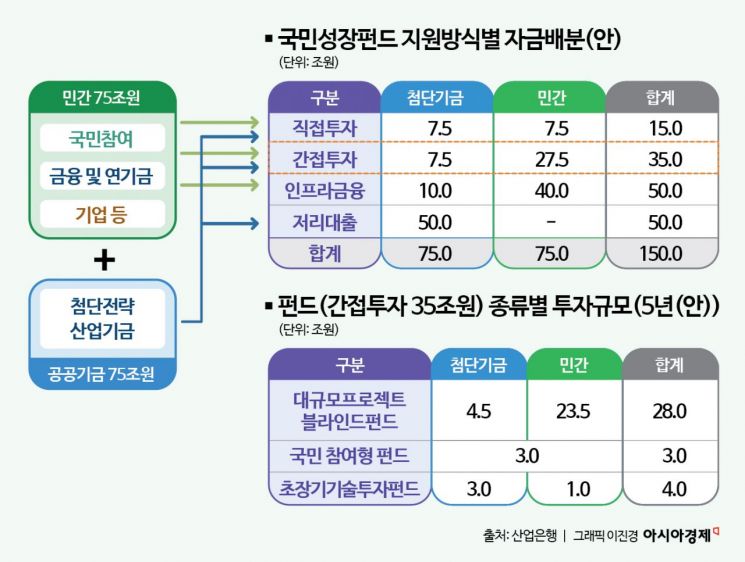

According to the Financial Services Commission and other sources on December 12, the specific investment methods for the National Growth Fund, which were released the previous afternoon, are divided into four categories: direct investment (15 trillion won), indirect investment (35 trillion won), infrastructure investment and lending (50 trillion won), and ultra-low interest loans (50 trillion won). The government plans to finalize its 2026 management plan within this month and begin making full-scale investment decisions from the beginning of next year.

Lee Hyoseop, Senior Research Fellow at the Korea Capital Market Institute, commented, "This will give breathing room to the innovation and venture ecosystem," adding, "In the United States, Europe, and Japan, large-scale investments are being made at the national level in AI, quantum industries, and biotechnology, but our country is currently falling behind. The launch of the National Growth Fund itself is very important and meaningful." There are also expectations that the recently frozen corporate bond market will be revitalized, with corporate fundraising and bond issuance centered on strategic industries.

From a stock market perspective, it is also expected to have a positive impact on short-term investor sentiment. Kim Jaeseung, a researcher at Hyundai Motor Securities, said, "Stock prices in sectors and companies with policy momentum tend to rise because market interest increases and liquidity is concentrated," adding, "The launch of the National Growth Fund is positive for short-term investor sentiment." A look at the initial performance of previous policy funds, such as the Green Fund and the Unification Fund, also confirms this trend. Kang Jinhyeok, a researcher at Shinhan Investment Corp., predicted in a report, "In the early stages, the main beneficiaries will be industry-leading companies and their partners, rather than small and mid-cap stocks."

In particular, the venture capital (VC) industry is cited as one of the biggest beneficiaries of the National Growth Fund. Some even analyze that this could be the second boom period after the growth of the parent fund. As the government and the private sector share risks together, there is strong anticipation that areas previously avoided by VCs could now be activated. However, there are growing concerns that if funds are concentrated in companies with excessively high initial valuations, side effects such as market distortion, excess liquidity, and volatility could intensify. Lee also noted, "These concerns were raised during the New Deal Fund as well," adding, "It is important to strike the right balance during the screening process." Regarding concerns about moral hazard for VCs, he added, "Since it is not the VCs themselves but the policy fund making the investments, the risk will be relatively lower."

The Key Issue is "Distinguishing Quality Investments"... Questions Remain About Fundraising

The key issues are efficient design, operation, and supervision, considering the massive scale of 150 trillion won and the complex structure involving the government, private sector, and financial institutions. Seo Joonsik, professor of economics at Soongsil University, said, "Expanding the size of capital through the National Growth Fund is extremely important for economic growth," but also stressed, "It must be done efficiently. The system must be set up properly to ensure accurate evaluation and to prevent funds from being misallocated." He likened it to creating irrigation channels and supplying water to grow crops, but if the focus is only on supplying water quickly, it could end up being provided to a swimming pool operator instead of a farmer.

Cheon Junbeom, Vice President of the Korea Corporate Governance Forum and an attorney, pointed out, "The much bigger issue is how to make investment decisions and conduct post-investment management in an objective and thorough manner," adding, "With the government, financial sector, and industry all involved, if no one is supervising, there is a risk of moral hazard." Lee also emphasized, "Governance is important. Selection of investment targets is crucial."

There are also many questions about how the 150 trillion won will be raised over the next five years. The fund is to be composed of 75 trillion won in government-guaranteed bonds and 75 trillion won in private capital, but the fiscal allocation included in next year's budget as a catalyst for attracting private capital is currently only about 1 trillion won.

Ahn Donghyun, professor of economics at Seoul National University, began by asking, "How exactly will the funds be raised?" He added, "If the plan is to issue Korea Development Bank bonds, that will inevitably push up interest rates and have an impact on the bond market. There are more than just one or two issues that need to be resolved," highlighting the broad external ripple effects on the market. The securities industry has already released reports warning that an increase in the issuance of top-rated bonds centered on Korea Development Bank bonds could create supply and demand noise in the credit market.

The issue of measures for neglected sectors was also raised. Professor Ahn warned, "Companies that are not in strategic sectors will find it even more difficult to issue corporate bonds and raise funds," suggesting that polarization could intensify. As a result, there is growing support for the need to improve fund allocation efficiency through restructuring of marginal companies.

A senior official at a securities firm, speaking on condition of anonymity, emphasized, "For the National Growth Fund to succeed, it must be backed by realistic fundraising measures." He added, "During the fund formation process, the government will likely increase pressure on the financial sector, and the four major banks have already discussed investing 10 trillion won plus alpha each. Ultimately, this means that the lending capacity of the banking sector will be reduced by that amount."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)