Slowing Growth in School Uniforms and Intensifying Competition in Sports Merchandise

Seeking Global Opportunities with 'Teen Beauty'

Strategic Partnership with Cosmax... Eco-Friendly Concept Targeting Generation Z

With declining birth rates and a stagnant market dampening the growth potential of the school uniform business, Hyungji Elite has identified the K-beauty market as a new breakthrough. The company determined that it would be difficult to maintain a stable growth trajectory relying solely on its three existing business pillars: school uniforms, workwear, and sports merchandising. Leveraging its unique strength in teenage customer data, Hyungji Elite aims to target the global beauty market.

According to industry sources on December 17, Hyungji Elite recently signed a strategic memorandum of understanding (MOU) with Cosmax, a global cosmetics original design manufacturer (ODM), to enter the Generation Z beauty market. The strategy is to combine the company’s data on teenage students and their parents with Cosmax’s research and manufacturing capabilities to create synergy in the global market. Based on this partnership, the goal is to expand into overseas beauty markets including China, Japan, and the United States.

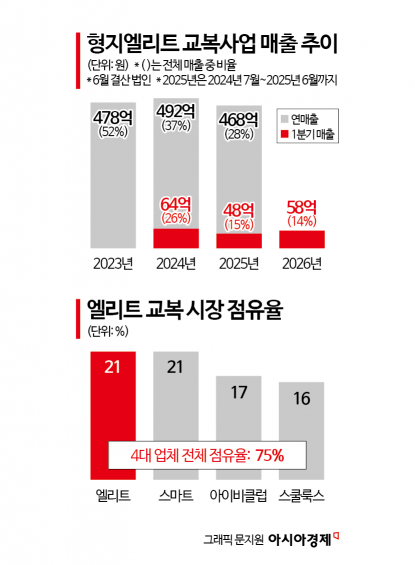

The decision to pursue a K-beauty business targeting teenagers was driven by internal assessments that growth in Hyungji Elite’s core businesses had slowed. According to the Financial Supervisory Service’s electronic disclosure system, Hyungji Elite’s school uniform sales for the first quarter of this fiscal year (July to September 2025, as the company closes its books in June) amounted to 584.1 billion won, accounting for only about 14% of total sales. This is less than half of the period when this segment’s sales share soared above 40%.

Although the school uniform business has expanded overseas to markets such as China and Southeast Asia, sales growth has been limited. Among the four major school uniform companies, Elite holds the largest market share. However, the domestic student uniform market is structurally difficult to expand, as the number of new students entering each year is fixed. Even when costs rise, it is difficult to sharply increase prices due to the high political and social sensitivity of the product. In China, the company is developing a premium school uniform business focused on international schools, but this has not been enough to accelerate sales growth.

The business segment currently driving Hyungji Elite’s performance is the newly added sports uniforms and merchandise division. From July to September this year (the first quarter), sales in the sports business reached 24.7 billion won, about three times higher than the same period last year (9 billion won). As a result, the company’s first-quarter sales totaled 33.3 billion won, a 30% increase year-on-year, with operating profit doubling to 1.5 billion won.

This growth is attributed to the expanding fan bases of major baseball teams such as the Lotte Giants, SSG Landers, and Hanwha Eagles, which has led to a significant increase in consumers purchasing uniforms and merchandise. In football, the company produces uniforms and merchandise for FC Seoul, FC Barcelona, and Suwon Samsung Bluewings, and has recently signed a contract with Real Madrid. In the workwear segment, the company has been expanding sales to individual consumers in addition to B2B transactions for the past two years.

However, the company believes that these markets cannot be relied upon in the long term. The sports merchandise market is rapidly evolving as new entrants intensify competition, and rivalry among competitors is also heating up in the workwear sector. The company has concluded that it will be difficult to secure medium- to long-term growth drivers with its existing business portfolio alone.

A Hyungji Elite representative explained, "Since the sports merchandise business, which we started two to three years ago, has significantly contributed to sales, we believe now is the right time to launch a new business." It is reported that Vice Chairman Choi Junho of Hyungji Elite has played a strong role in driving this new initiative.

Accordingly, the company plans to work with Cosmax to build an integrated process covering everything from brand planning to product development, production, and distribution, aiming to secure product competitiveness in the beauty market. The core focus is an eco-friendly concept targeting Generation Z. User-based data accumulated through the school uniform business-such as students’ skin concerns, color preferences, consumption patterns, and social networking service (SNS) responses-is expected to serve as a key differentiator in the challenging teen K-beauty market. The company is considering a phased approach, starting with basic products in Korea and China and expanding from there.

Industry observers note that Hyungji Elite’s move reflects a broader trend in the distribution and fashion sectors to position K-beauty as a new growth engine, beyond the strategy of a single company. In fact, Hyundai Home Shopping, a TV home shopping company, launched the offline beauty platform ‘COASIS’ this month, targeting women in their 30s to 60s. The platform plans to introduce brands not commonly found in existing channels, ranging from the hair loss shampoo ‘Bynic’ to high-performance derma cosmetics ‘Jasderma’.

Meanwhile, Hyungji Elite is planning a paid-in capital increase of 21.3 billion won in January next year. The capital raise will be conducted through a rights offering followed by a public offering of any unsubscribed shares. The funds raised will be used for operating capital (15.8 billion won) and debt repayment (5.5 billion won). The operating capital will be used to pay for school uniforms and sports uniform purchases on credit in the first quarter of next year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.