Second Quarter Revenue at $16.06 Billion

Slight Increase Year-on-Year,

But Misses Market Expectations

Share Price Plunges 10% in After-Hours Trading

Market Sees Oracle at the Center of "Bubble" Debate

Broadcom Earnings Likely a Ke

The quarterly earnings of Oracle, which has been regarded as a leading player in the artificial intelligence (AI) cloud sector, have fallen short of expectations. Oracle is considered the biggest beneficiary of AI infrastructure expansion, thanks to its strong cloud business. However, as the company posted disappointing results, concerns have emerged that this could reignite the debate over an "AI bubble." Oracle's share price plunged more than 10% in after-hours trading.

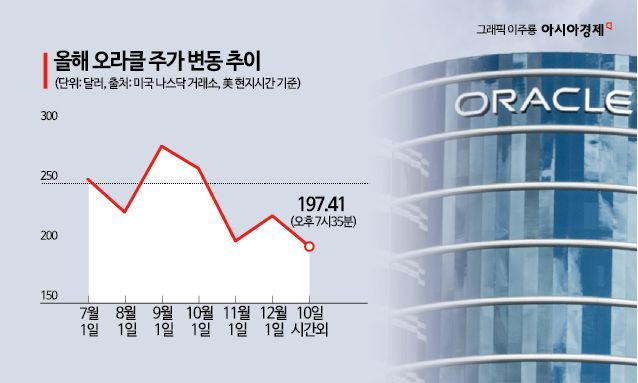

On December 10 (local time), Oracle announced after the market closed that its revenue for the second quarter of fiscal year 2026 (September to November 2025) reached $16.06 billion. While this was an increase from the same period last year, it fell short of market expectations of $16.21 billion. During the same period, earnings per share (EPS) came in at $2.26, beating estimates, but the market reacted more sensitively to the revenue miss than to the profit beat. Oracle's share price tumbled more than 10% in after-hours trading, dropping below the $200 mark.

Oracle's earnings drew attention because they are seen as a leading indicator of AI investment. This year, Oracle has been in the spotlight as a "core cloud provider in the AI era," driven by its expansion of AI infrastructure and acquisition of large enterprise clients. In particular, news of major cloud computing contracts with big tech companies such as OpenAI and Meta sent its share price soaring to as high as $346 at one point. On Wall Street, Oracle has been classified alongside Nvidia and Microsoft as a symbolic stock of the AI boom.

As Oracle's share price plummeted in after-hours trading, some in the market have diagnosed that "Oracle is once again at the center of the AI bubble debate." The reasons include an excessive gap between future revenue expectations and reality, aggressive debt-fueled investment, dependence on specific clients, and the inherently low margins of the AI infrastructure business.

Oracle has recently accelerated large-scale data center investments to meet growing AI cloud demand. However, the AI infrastructure business requires significant upfront investment and takes time to become profitable. The fact that margins are lower than in traditional software businesses is also a burden.

Oracle's high dependence on OpenAI is also seen as a weakness. Oracle's rapid growth has largely been driven by increased AI workloads from certain major clients. If demand from these clients decreases or contract structures change, Oracle's growth could be directly impacted. This is why investors are concerned that "the AI boom is relying on too narrow a base of demand."

With Oracle's earnings now released, the AI bubble debate is expected to resurface. Previously, when concerns over an AI bubble arose, Nvidia managed to quell them by posting better-than-expected third-quarter results. In particular, the earnings announcement from Broadcom scheduled for December 11 is expected to serve as an important indicator of where the AI bubble debate is headed.

The shock from Oracle quickly spread to other major AI-related stocks. Nvidia fell more than 1% in after-hours trading, while other AI-related stocks such as AMD also weakened. Some in the market have cautioned that "Oracle's disappointing revenue may be an early sign of slowing AI demand across the technology sector," urging a more cautious outlook.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)