Average Won-Dollar Exchange Rate at 1,450 in the Fourth Quarter

The won-dollar exchange rate has remained stubbornly high in the 1,470-won range, further widening the performance gap between "export-oriented companies" and "domestic-oriented companies" even within the pharmaceutical and biotech sectors. Most pharmaceutical companies face increased cost burdens because they pay for active pharmaceutical ingredients, clinical trial expenses, and global licensing fees in dollars. However, contract development and manufacturing (CDMO) companies that generate revenue in dollars, as well as biotech firms with global direct sales structures, are expected to see a marked improvement in fourth-quarter results.

According to the industry on December 11, the average won-dollar exchange rate for the fourth quarter of this year (October 1 to December 10) was 1,450.5 won, which is 6.1% higher than last year’s overall average of 1,366.58 won. With this high exchange rate trend continuing, the fourth-quarter performance of export-driven domestic pharmaceutical and biotech companies is also expected to remain on an upward trajectory.

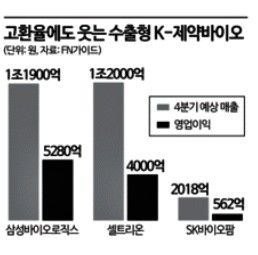

Samsung Biologics is classified as a prime beneficiary of the strong dollar, as it holds numerous dollar-based contract orders. As of the third quarter, its order backlog based on minimum purchase quantities exceeded $10.2 billion (about 14.9593 trillion won). Analysts estimate that every 10% increase in the won-dollar exchange rate could boost operating profit by more than 100 billion won. In the fourth quarter, the ramp-up of Plant 5 (increased utilization) and the stabilization of utilization rates at existing Plants 1 through 4 are expected to be further enhanced by the exchange rate effect. According to market consensus for the fourth quarter, sales are projected at 1.19 trillion won and operating profit at 528 billion won. After the spin-off from Samsung Episholdings, Samsung Biologics is expected to achieve an annual operating profit of 2 trillion won for the first time in its history. Kiwoom Securities noted, "The full operation of Plant 4 and the exchange rate effect allowed third-quarter results to exceed market expectations," adding, "The exchange rate effect could be an additional driver for performance improvement in the fourth quarter as well."

Celltrion Group is also regarded as the company that absorbs the exchange rate effect most stably, as the proportion of global direct sales continues to grow. Celltrion achieved its highest-ever quarterly operating profit of 301.4 billion won in the third quarter. In the fourth quarter, strong sales of high-margin products such as Remsima SC, Yuflyma, and Begzelma, combined with a strong dollar, are expected to result in sales of 1.2 trillion won and operating profit of 400 billion won. Prior to the merger, Celltrion Healthcare recorded hundreds of billions to trillions of won in foreign exchange gains during periods of strong dollar, so it is expected that gains from the revaluation of inventory and accounts receivable will likely contribute to improved non-operating income in the fourth quarter as well.

SK Biopharmaceuticals is also benefiting from the strong dollar, as its epilepsy treatment Xcopri (cenobamate), which is sold directly in the United States, generates stable dollar-denominated revenue. Analysts forecast SK Biopharmaceuticals’ fourth-quarter sales at 201.8 billion won and operating profit at 56.2 billion won. ST Pharm, which focuses on CDMO for bio active pharmaceutical ingredients, is considered the company that will benefit most from the high exchange rate in the fourth quarter. Thanks to its export-oriented business structure centered on oligonucleotide (RNA) CDMO, a significant portion of its sales is generated in dollars. In fact, third-quarter CDMO sales grew 92.9% year-on-year to 68.6 billion won.

On the other hand, domestic-oriented pharmaceutical companies with a high proportion of imported active pharmaceutical ingredients are expected to be hit hard, as the strong dollar directly leads to higher cost ratios. This is because, with Korea’s self-sufficiency rate for active pharmaceutical ingredients stuck in the 30% range, the prices of ingredients imported from China and India fully reflect the strong dollar. Companies focused on generics, in particular, are warned that the burden of cost ratios in the fourth quarter will increase compared to last year, due to a combination of rising labor, logistics, and clinical trial expenses. An industry insider stated, "The performance gap between export-oriented companies that can leverage the high exchange rate in the fourth quarter and domestic-oriented companies will become even more pronounced."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)