The Most Pressing Risks: Cyberattacks, Inflation, and Geopolitical Instability

"Strengthening Supply Chain Resilience and Cost Management Is Crucial"

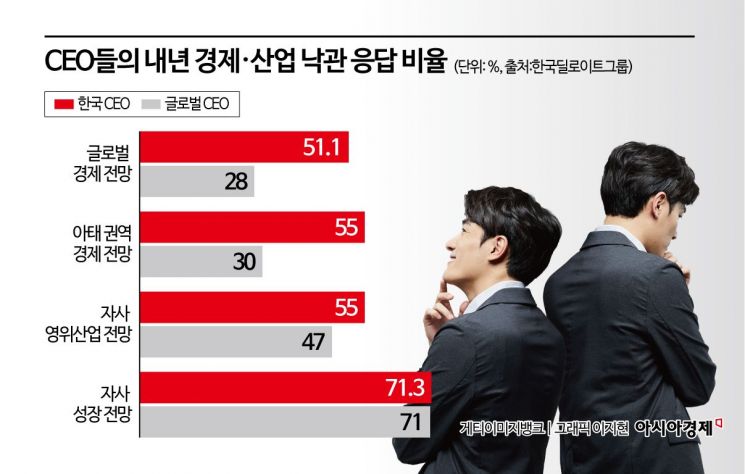

A recent survey found that only 28% of chief executive officers (CEOs) at major global companies are optimistic about the economy next year. In contrast, more than half of domestic CEOs expressed optimism.

On December 10, Deloitte Korea Group released its '2026 Deloitte Global Economic and Industry Outlook' report, based on surveys and in-depth interviews with 149 CEOs from domestic and international companies (including 80 from Korea).

According to the report, 28% of CEOs said they were optimistic about the global economy and industry next year. This figure has doubled compared to 14% in the first half of this year. The proportion of pessimistic responses fell from 58% to 32%.

Korean CEOs were even more optimistic than the global average, with 51.5% stating that they view next year's economy positively. In all areas surveyed-including the global economic outlook, Asia-Pacific regional economic outlook, and projections for their own industry and company growth-Korean CEOs were significantly more optimistic than their global counterparts.

The report explained the reasons for this, stating, "They perceive global economic uncertainty as an opportunity, and Korea sees strong potential for growth based on exports and supply chains. In addition, there are high expectations for growth strategies centered on the Asia-Pacific Economic Cooperation (APEC), as well as technological innovation and productivity improvements."

Global CEOs assessed that major risks burdening corporate management have not yet been resolved. The most urgent short-term risks identified were: cyberattacks, inflation, and geopolitical instability. On the other hand, stricter sustainability regulations, global supply chain disruptions, and financial or market instability were considered risks requiring longer-term responses.

Domestic CEOs also identified cyberattacks as the most significant core risk, both in the short and long term. Many also responded that persistent inflation and expanding supply chain risks would burden corporate competitiveness going forward.

For global CEOs, strengthening supply chain resilience and cost management were cited as top management priorities. Thirty-eight percent of all CEOs said they plan to redesign supply chains through expansion, diversification, and localization of operations. In addition, 41% said they would prioritize internal cost reduction over raising product or service prices.

Domestic CEOs also stated that, in the short term, they would focus on operational efficiency and optimizing customer management, while in the mid- to long-term, they would seek to improve cost structures through technology adoption and streamlining distribution networks.

There were mixed views on the economic outlook by region. For the first time, the survey included a question on the U.S. economic outlook, with 41% of CEOs evaluating the U.S. economy negatively. This reflects concerns that increased tariffs will put cost pressures on U.S. growth. In contrast, Europe is expected to see a gradual recovery, while Asia is projected to maintain solid growth.

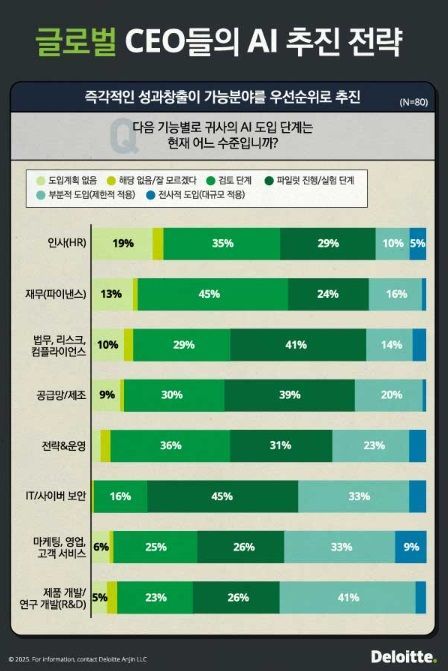

Meanwhile, artificial intelligence (AI) has firmly established itself as a core investment area not only in the short term but also in mid- to long-term management strategies. Both domestic and international CEOs believe AI will have a significant impact on major work processes as well as overall corporate strategy. However, they assessed that AI's influence would be relatively limited in highly strategic decision-making areas such as mergers and acquisitions (M&A) or partnership building.

Alongside AI adoption, the establishment of 'responsible AI' principles is rapidly spreading. Sixty-nine percent of all CEOs responded that they are establishing clear AI policies and usage guidelines. Fifty-six percent said they are implementing measures to foster an ethical AI culture.

The full report is available on the Deloitte website. Hong Jongsung, CEO of Deloitte Korea Group, stated, "Companies need to develop response strategies based on tangible changes, such as supply chain restructuring, advancing AI strategies, and strengthening talent capabilities. By detecting changes in the management environment in a timely manner and executing strategic actions accordingly, companies can secure resilience."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)