Estimated 6,900 Transactions in November

Share of Mid- to Low-Priced Districts Nears 30%

Transaction Volume Rises in Guro and Eunpyeong

Sharp Decline in Transaction Share for Gangdong and Seongdong

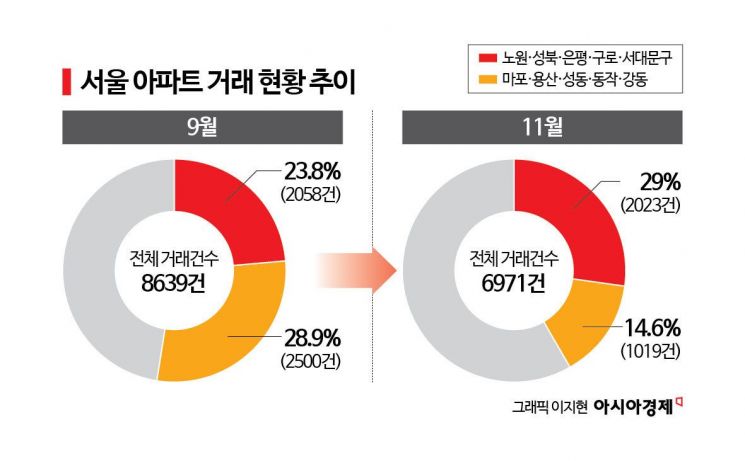

Following the October 15 measures that designated all of Seoul as a land transaction permit zone, it was found that about 30% of apartment purchases in Seoul have concentrated in five districts, including Nowon District, where mid- to low-priced apartments are clustered. With stricter lending regulations and restrictions on gap investments significantly reducing transactions in higher-priced areas, it is analyzed that young buyers, who can take advantage of first-time homebuyer benefits, have rushed to purchase mid- to low-priced apartments.

According to the Seoul Real Estate Information Plaza on December 9, the total number of apartment transactions in Seoul last month was 2,350. When combined with the number of land transaction permit applications (4,621), it is estimated that a total of 6,971 apartment sales took place in Seoul last month. Since the entire city was designated as a land transaction permit zone following the measures, it is necessary to add the number of permit applications to estimate the transaction volume more accurately, due to the time lag caused by the permit process. Data compiled from the online civil complaint system, Saeol Electronic Civil Service Window, shows that 4,621 land transaction permit applications were submitted across Seoul’s 25 districts last month.

After the announcement of the measures, the combined transaction volume in districts with a concentration of apartments priced below 1 billion won increased. As of last month, the five districts-Nowon (475 transactions), Seongbuk (452), Eunpyeong (361), Guro (358), and Seodaemun (377)-accounted for 29% (2,023 transactions) of all apartment transactions in Seoul, approaching the 30% mark. In September, these districts accounted for only 23.8% (2,058 transactions) of the total transaction volume (8,639 transactions).

Among the top 10 districts by transaction volume, those with a concentration of mid- to low-priced apartments performed well. Guro and Eunpyeong, which were outside the top 10 in September, rose to 7th and 8th place, respectively, last month. Seongbuk, which ranked 6th in September, climbed to 3rd place last month.

Districts with a concentration of apartments priced between 1 billion and 2 billion won underperformed. Last month, the five districts of Mapo (169 transactions), Gangdong (268), Seongdong (129), Dongjak (212), and Yongsan (241) accounted for only 14.6% (1,019 transactions) of the total, a significant decrease from 28.9% in September. Gangdong and Seongdong, which ranked 1st and 4th in transaction volume in September, fell out of the top 10 last month.

Kwon Youngsun, Team Leader at Shinhan Bank Investment Advisory Center, said, "After the October 15 measures, the market has shifted to focus on real demand, leading to a decline in transaction volume in Mapo and Seongdong, which had previously attracted a large influx of investment demand." He explained, "Those who had tried to purchase higher-priced apartments in Mapo with funds available for gap investment have now turned their attention to Seodaemun and Eunpyeong."

Yoon Sumin, Real Estate Specialist at NH Nonghyup Bank, said, "The five districts with a high concentration of mid- to low-priced apartments are mainly where newlyweds and young professionals are buying their first homes, taking advantage of benefits such as a 70% loan-to-value (LTV) ratio for first-time homebuyers." He added, "With restrictions on gap investments leading to fewer rental listings and fewer price options, buyers have chosen to enter areas that are easier to access."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)