Up 3.07% Yesterday, Over 11% Gain This Month

New Shareholder Return Policy Planned for Next Year

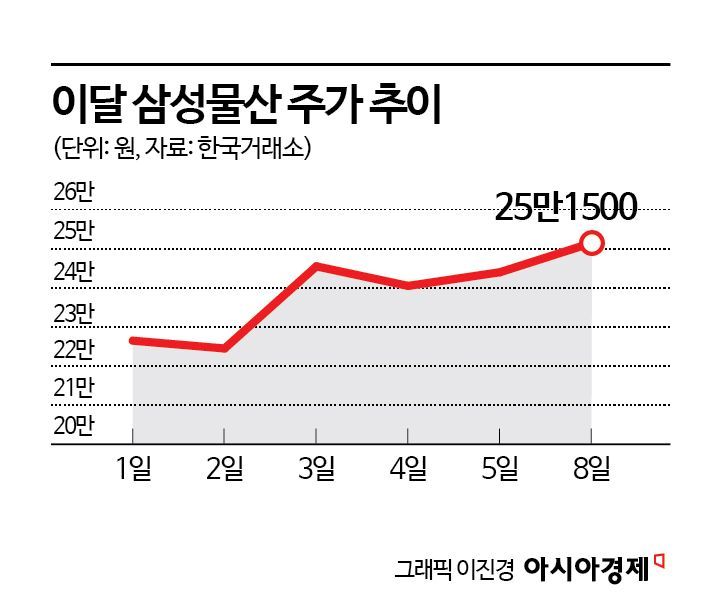

Samsung C&T continues its strong stock performance, driven by the rising value of its subsidiaries and growing expectations for shareholder returns. The share price has climbed more than 11% this month, settling above the 250,000 won mark.

According to the Korea Exchange on December 9, Samsung C&T closed at 251,500 won the previous day, up 3.07%. During the session, the stock reached 258,000 won, setting a new all-time high. It has risen 11.78% so far this month.

Steady buying by institutional and foreign investors has supported the stock's upward momentum. Institutions have net purchased 45.8 billion won worth of Samsung C&T shares this month, while foreign investors have net purchased 15.8 billion won. Notably, institutions have maintained net buying of Samsung C&T for 11 consecutive trading days.

The rise in the value of subsidiary holdings and expectations for shareholder returns are cited as key drivers of the stock's rally. Park Sera, a researcher at Shin Young Securities, commented, "Samsung C&T is essentially an operating holding company at the apex of the Samsung Group's governance structure, with its subsidiary equity value and shareholder return policy serving as key catalysts. The market is currently anticipating a revaluation of Samsung C&T's equity holdings, and with a new shareholder return policy set to be announced in 2026, both factors are in play. The company's corporate value is expected to become even stronger next year."

Kim Han-i, a researcher at Hyundai Motor Securities, said, "Since October, the market capitalization has tracked the strong performance of Samsung Electronics and Samsung Biologics. Although there was some volatility in the combined market cap last month due to the spin-off and relisting of Samsung Biologics, the positive trend in the value of Samsung Electronics' equity is encouraging. The recent optimism surrounding artificial intelligence (AI) and the semiconductor industry is also expected to provide further upside for the stock."

Expectations are also growing for the shareholder return policy to be announced next year. The market anticipates that Samsung C&T will unveil a three-year shareholder return policy for 2026-2028 early next year. Park Sera noted, "Samsung C&T plans to announce a new shareholder return policy in 2026. Having completed its share cancellation, the focus is likely to shift toward dividend policy, and proactive measures regarding payout ratios are anticipated."

The strengthening of Chairman Lee Jae-yong's leadership is also seen as positive. On December 3, Samsung C&T surged more than 9% following news that Hong Ra-hee, Honorary Director of the Samsung Museum of Art Leeum, would gift her shares to Chairman Lee. Hong plans to transfer her entire holding of Samsung C&T shares (1,808,577 shares, representing a 1.06% stake) to her eldest son, Chairman Lee, on January 2 next year. As a result, Chairman Lee's stake will increase from 19.76% to 20.82%. Samsung C&T sits at the top of the Samsung Group's governance structure, with Chairman Lee as its largest shareholder. While the additional 1% stake may not significantly affect management rights, the market interprets this transfer as further consolidating Chairman Lee's control.

Lee Sangheon, a researcher at iM Securities, predicted, "Chairman Lee Jae-yong's return as a registered director will likely become apparent at Samsung Electronics' annual general meeting in March next year. Not only Samsung Electronics but the entire Samsung Group is laying the foundation for growth through governance reforms, which could lead to a re-rating of Samsung C&T's valuation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)