Kazuo Ueda, BOJ Governor

"Rate Hike to Be Considered at Next Meeting"

10-Year Government Bond Yield Hits 18-Year High

ECB Monetary Policy Meeting on December 17?18

Inflation-Focused... Fourth Consecutive Rate Hold Likely

As investors focus on the direction of the US Federal Reserve's interest rate decision in December, major central banks in countries such as Japan and those in Europe are also showing busy activity as the year-end approaches. In Japan, the 10-year government bond yield has surged to its highest level in 18 years, causing significant ripples, while in Europe, there are growing voices demanding a more proactive monetary policy.

Governor Ueda Sends Preemptive Signal for Rate Hike

According to US financial media outlet CNBC, the Bank of Japan (BOJ) is scheduled to hold its monetary policy meeting on December 18-19. The European Central Bank (ECB) will also convene its meeting on December 17-18.

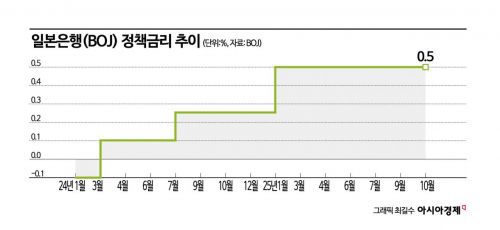

Kazuo Ueda, Governor of the BOJ, sent a signal for a policy rate hike at a press conference last week, stating, "We will consider a rate increase at the next meeting." Previously, when the BOJ raised rates in January, he had also indicated in advance that a decision on a rate hike would be made at the next meeting, which helped minimize market shock. This is being interpreted as a similar move. Currently, Japan's policy rate stands at around 0.5%.

There are growing expectations that the Japanese government will not block a BOJ rate hike. Satsuki Katayama, Minister of Finance, recently stated that the BOJ would appropriately manage policy to achieve its 2% inflation target and that the specific means would be left to the BOJ's discretion. Minoru Kiuchi, Minister for Economic Revitalization, also requested close communication with the government but did not express opposition to the possibility of a rate hike.

If the BOJ proceeds with a rate hike, it would be the first increase since the inauguration of the Sanae Takaichi administration and the first in 11 months since January this year. The Sanae Cabinet was expected to pursue "Sanaenomics," a fiscal policy focused on expansion, following the expansionary fiscal policies of former Prime Minister Shinzo Abe's "Abenomics."

If Japan raises rates, bond market volatility is expected to increase. The 10-year Japanese government bond yield has already reached its highest level since 2007. On December 6, the yield on 10-year Japanese government bonds recorded 1.948% per annum, the highest since July 2007-a span of 18 years. There are also projections that the yield will soon surpass 2% per annum.

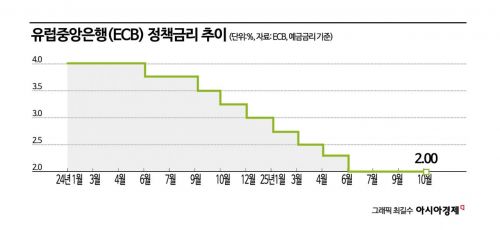

ECB Likely to Hold Rates Steady

In contrast, the ECB is seen as having secured room to maneuver by maintaining a stable inflation rate of around 2%. Previously, the ECB kept rates unchanged in October, marking the third consecutive hold; if it holds again this time, it will be the fourth. The European policy rate, based on the deposit facility rate which serves as the benchmark, remains at 2%.

In October, it was assessed that there was no need to rush rate adjustments, as inflation in the eurozone (the 20 countries using the euro) remained stable and the economy continued to grow.

According to data released by Eurostat on December 3, the eurozone inflation rate in November was 2.2%, up 0.1 percentage points from 2.1% in October, and was assessed as stable. This marks the third consecutive month that inflation has exceeded the ECB's medium-term target of 2.0%.

The market has also tilted toward the possibility of a rate hold. Diego Iscaro, economist at S&P Global Market Intelligence, said immediately after the announcement, "It will not be enough to convince the ECB of the need for further rate cuts." Christine Lagarde, President of the ECB, also stated on November 28, "I believe the rate agreed upon at the last meeting is appropriately set."

However, French President Emmanuel Macron, in an interview with French business daily Les Echos on December 7, emphasized that the ECB should not focus solely on inflation as its only objective, but should also consider growth and employment. He pointed out, "To reaffirm the value of the European internal market, growth and employment must also be included as objectives, not just inflation." Unlike the US Federal Reserve, which has a "dual mandate" of price stability and maximum employment, the ECB focuses primarily on achieving price stability at around 2%. President Macron has previously argued for the expansion of the ECB's objectives.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)