64.5% of Household Assets Are Non-Financial Assets

Tax System Reform and Long-Term Investment Encouragement Needed

"Corporate Investment and Household Asset Growth Must Create a Virtuous Cycle"

It has been found that, compared to other major countries, South Korea's household assets are excessively concentrated in non-financial assets such as real estate. As a result, there are calls for measures to invigorate financial investment in order to enhance household liquidity and investment activity.

The Korea Economic Research Institute (KERI) announced these findings on December 8, citing a research report titled "Comparison of Household Asset Composition and Policy Tasks in Major Countries," which was commissioned from Professor Song Heonjae of the University of Seoul.

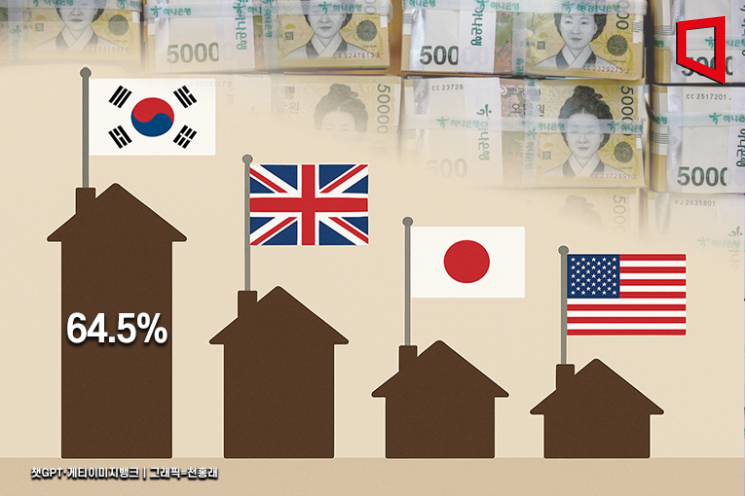

An analysis of household asset structures over the past five years (2020-2024) showed that, as of last year, the proportion of non-financial assets (such as real estate) in South Korea stood at 64.5%, the highest among the major countries examined (South Korea, the United States, Japan, and the United Kingdom). Within financial assets, there was a notable concentration in cash-equivalent holdings. The proportion of cash and deposits within Korean households' financial assets increased from 43.4% in 2020 to 46.3% in 2024, while the share of investment-related assets such as securities, bonds, and derivative financial products decreased from 25.1% in 2020 to 24.0% in 2024.

In the United States, over the past five years, the share of financial assets in household portfolios was the highest among the major countries, and the proportion of financial investment products within those assets also increased, indicating a continued investment-oriented asset structure.

The proportion of financial assets within household assets in the United States slightly declined from 70.7% in 2020 to 68.0% in 2024, partly due to rising real estate prices, but it remained at a high level. Within financial assets, the share of financial investment products rose from 51.4% to 56.1% during the same period. This is analyzed as a result of the recent boom in asset markets, which has further stimulated household financial investment.

In Japan, the financial asset structure has remained centered on cash and deposits over the past five years, but the proportion of financial investment products within financial assets has shown a gradual increase. The share of cash and deposits within Japan's financial assets fell slightly from 54.6% in 2020 to 50.9% in 2024, although it remained the highest among the major countries. Due to the effects of the weak yen and government-led stock exchange reforms, the share of financial investment products rose from 15.2% to 20.9% over the same period.

The United Kingdom has maintained a financial asset structure centered on private pensions over the past five years, with the proportion of insurance and pension products within financial assets being the highest among the major countries. Notably, due to increased economic uncertainty and high interest rates following Brexit, the share of cash and deposits rose from 25.3% in 2020 to 33.9% in 2024.

The report proposed several measures to ease the concentration on non-financial assets and to promote financial investment: restructuring the taxation system on financial income, encouraging long-term investment, and strengthening financial education.

The report pointed out that the current dividend income tax and capital gains tax systems are complex and operate with multiple tax rates, and suggested simplifying the tax rates as a way to restructure the taxation system. In the long term, it argued that a single, separate tax rate should be introduced for "financial income," which would encompass interest, dividend income, and capital gains from stocks, in order to vitalize financial markets.

Additionally, to foster a culture of long-term investment, the report recommended reintroducing the "tax-deductible long-term fund," which has been restricted since 2015. Citing the example of the United States, where losses of up to $3,000 per year are allowed as tax deductions, the report suggested considering a system that would allow tax deductions for losses incurred when selling financial investment products held for more than 10 years.

Furthermore, regarding the planned introduction of financial education as an elective subject in high schools in 2026, the report argued that the target audience should be expanded to include elementary school students. It especially emphasized the need for systematic education encompassing financial fraud prevention, response methods for victims, and basic financial investment strategies, noting that those unfamiliar with financial investment are at greater risk of exposure to financial scams.

Lee Sangho, Head of the Economic and Industrial Division at KERI, stated, "The excessive concentration of household assets in real estate is restricting the flow of funds into productive areas such as corporate investment," and emphasized, "We must establish and spread a culture of financial investment to build a virtuous cycle in which corporate growth and household asset accumulation reinforce each other."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)