Malaysia Accounts for 13% of Global Back-End Processing

Korean Semiconductor Exports to Malaysia Up 99% This Year

Supply Chain Shifts as Companies Bypass U.S. Sanctions on China

Since the United States strengthened its semiconductor sanctions against China, the flow of South Korean semiconductor exports has shifted clearly from China to ASEAN countries. In particular, Malaysia has emerged as the country with the highest growth rate in South Korean semiconductor exports this year, establishing itself as a new hub for back-end production processes. Meanwhile, exports to Hong Kong, which had previously handled much of the back-end processing, have dropped by more than 14%. As demand for artificial intelligence grows, investments in foundries and the adoption of advanced packaging in the ASEAN region are expanding, accelerating the global supply chain restructuring movement.

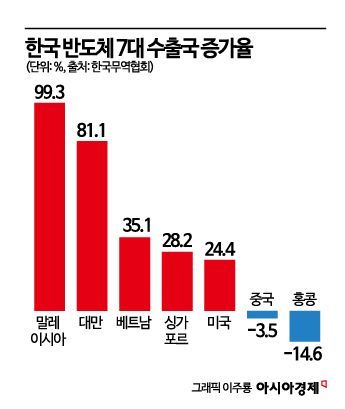

According to the Korea International Trade Association's report, "2025 Export-Import Assessment and 2026 Outlook," released on December 8, Malaysia recorded the highest growth rate in South Korean semiconductor exports from January to October this year, with an increase of 99.3% compared to the same period last year. This was followed by Taiwan (81.1%), Vietnam (35.1%), and Singapore (28.2%), highlighting a marked increase in exports to major Asian countries. South Korea’s semiconductor exports to Malaysia have seen a rapid surge recently, jumping from 1.7% in 2023 to 22.1% in 2024, and reaching an explosive 99.3% increase this year.

Malaysia ranks as the fifth-largest semiconductor exporter in the world. About 13% of the global back-end processes, such as assembly, testing, and packaging (ATP), take place in Malaysia. The back-end process is the final stage where wafer chips are packaged, connected, and verified to become finished products. In Malaysia, companies specializing in assembly, testing, packaging, and electronics manufacturing services (EMS) are concentrated. Especially in the Penang region, a semiconductor cluster has formed, attracting active investment. The Malaysian government also announced an investment plan worth approximately 100 billion dollars based on its "National Semiconductor Strategy" released in May last year.

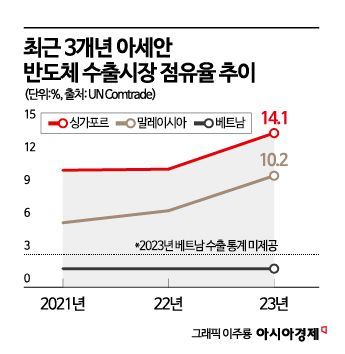

ASEAN countries such as Malaysia, Singapore, and Vietnam are geographically close to major semiconductor-producing countries like South Korea and Taiwan, and offer relatively low labor costs, providing a competitive edge in reducing production expenses. This has made them attractive as bases for semiconductor back-end processing. With the recent growth of Malaysia’s advanced packaging market, the added value of the ASEAN semiconductor industry is also expected to rise. Heo Seulbi, a researcher at the Korea International Trade Association’s Trend Analysis Office, said, "Malaysia is a leading country in global semiconductor exports, with an industry structure focused on packaging processes," adding, "There are quite a few semiconductor companies worldwide looking to increase their investments locally."

In particular, as the United States has tightened its semiconductor export restrictions to China, there is a noticeable trend of some back-end processes (packaging and testing) previously conducted in China shifting to Malaysia. It has been reported that more Chinese companies are entering the ASEAN region to circumvent US sanctions. Global semiconductor companies such as Micron, Infineon, and Intel are also increasing their investments in the ASEAN region. Intel plans to establish its first 3D packaging plant outside the United States in the Penang region, adding around 208 million dollars to its existing 7 billion dollar investment.

The surge in memory demand due to the AI development boom is also seen as a key driver behind the sharp increase in exports to Malaysia. Researcher Heo noted, "The semiconductors packaged in Malaysia are generally based on standard technologies rather than high-end ones," but added, "With the recent surge in AI demand, high-performance semiconductors alone are not enough, so packaging demand for standard semiconductors has also increased significantly."

If US sanctions on Chinese semiconductors continue, it is expected that domestic companies may also pursue supply chain diversification to third countries such as Malaysia. Samsung Electronics operates a packaging plant in Cheonan, South Chungcheong Province, and has a test and packaging production base in Suzhou, China. SK hynix runs back-end facilities in Icheon and Cheongju, as well as packaging plants in Chongqing and Wuxi, China. The company is also investing more than 5 trillion won in Indiana, United States, to establish a packaging production base for AI memory.

Park Jaekeun, President of the Korean Society of Semiconductor & Display Technology (professor at Hanyang University), said, "Semiconductor companies such as Samsung and SK hynix have conducted a lot of packaging in China," but added, "Due to US sanctions on Chinese semiconductors, if certain products are packaged in China, they become subject to sanctions, so there is a move to shift production to other countries." He continued, "For example, products subject to regulation, such as DRAM below 17nm or NAND above 200 layers, cannot be packaged in China, so the volume must be shifted to Malaysia. If US sanctions persist and memory supply shortages continue, the volume of packaging heading to Malaysia will only increase."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)