Bancassurance Sales Cap for Life Insurers to Be Raised from 33% to 50% Next Year

Savings-Type Insurance Remains Key Channel, Favoring Large Life Insurers

"Cutthroat Competition Likely to Intensify for Small and Medium-Sized Insurers"

The financial authorities’ move to ease regulations on bancassurance-the insurance sales channel within banks-has caused a stir in the life insurance industry. While large insurers with a high proportion of bancassurance sales see this as an opportunity to boost their performance, concerns are being raised that small and mid-sized insurers will see little benefit, potentially deepening polarization within the industry.

According to the financial sector on December 5, the Financial Services Commission is pushing to ease the sales ratio restrictions on bancassurance sometime next year. The proposed plan would raise the cap for life insurance products from 33% to 50%, and for non-life insurance products from 50% to 75%. This regulation, which prohibits banks from selling products from a single insurer above a certain ratio, was already relaxed once in April, easing the so-called “25% rule” that had been in place for 20 years. The financial authorities are considering further deregulation, noting that the rate of misselling in bancassurance is relatively low.

Bancassurance is the main sales channel for life insurance companies. This is because it is easier to sell savings-type insurance products-which are similar to bank deposits and savings accounts-than to sell non-life insurance products, which require more complex explanations. In the third quarter of this year, the cumulative first-year premiums collected through bancassurance face-to-face channels by 22 life insurers reached 14.4251 trillion won, an 11.8% increase from 12.9065 trillion won in the same period last year. In contrast, non-life insurers have been withdrawing from bancassurance, with Samsung Fire & Marine Insurance, the industry leader, halting new bancassurance business in January for the first time in 21 years.

Industry insiders unanimously agree that if bancassurance regulations are eased, only banks and large life insurers will benefit. Banks receive commissions for selling insurance products on behalf of insurers through bancassurance. If sales ratio restrictions are loosened, banks will have more opportunities to sell popular products. In the third quarter of this year, the cumulative bancassurance commission income of the five major banks reached 438.5 billion won, already surpassing the annual total for last year (413 billion won).

Large life insurers mainly sell savings-type insurance through bancassurance to secure stable cash flows. In fact, savings-type insurance is not favored under the International Financial Reporting Standards (IFRS17) framework, as protection-type insurance is more advantageous for securing the Insurance Contract Service Margin (CSM), a key profitability indicator for insurers. However, with financial authorities recently emphasizing comprehensive asset-liability management (ALM), including tighter duration gap management, savings-type insurance has become more important. There is a growing preference for securing liquidity with short-term savings-type insurance and managing assets with a focus on short-term investments. The financial authorities’ move at the end of last year to lower the recognized liquidity ratio for risk-free bonds with maturities over three months from 100% to 30% has also contributed to increased demand for savings-type insurance.

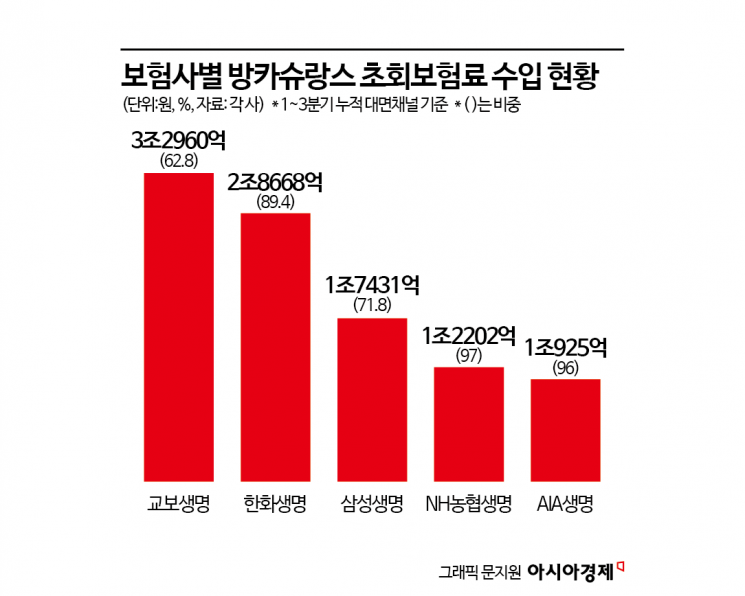

Looking at the cumulative first-year premiums collected through bancassurance face-to-face channels by life insurer as of the third quarter this year, Kyobo Life Insurance led the pack with 3.296 trillion won, followed by Hanwha Life Insurance (2.8668 trillion won), Samsung Life Insurance (1.7431 trillion won), and NH NongHyup Life Insurance (1.2202 trillion won). If bancassurance regulations are relaxed, large life insurers that are not part of financial holding companies are expected to benefit the most, as the “25% rule” will still apply to insurers affiliated with financial holding groups. An industry official commented, “Bancassurance has always been a favorable channel for large life insurers with solid sales networks. Small and mid-sized insurers, whose sales networks are relatively weak, will inevitably face cutthroat competition to secure competitiveness.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)