KOSDAQ’s Highest Average Monthly Returns in January and February

Capital Injections Expected from National Growth Fund and IMA Venture Capital

Hint for Identifying Rally Leaders: Focus on Free Cash Flow

There are growing projections that KOSDAQ, which has lagged behind KOSPI in terms of gains, could become the main driver of the year-end "Santa Rally." In addition to KOSDAQ’s historical seasonality of strong performance at the end and beginning of the year, expectations are rising for policy momentum such as fund inflows and the tightening of delisting requirements.

According to the Korea Exchange on December 4, the KOSDAQ closed at 932.01 the previous day, up 0.39%. This marked six consecutive trading days of gains since November 26. During this period, KOSDAQ surged by about 6%, ranking first among major global indices in terms of returns. Since the beginning of this year, it has soared by more than 37%.

With KOSPI rebounding and stabilizing above the 4,000 mark and KOSDAQ also maintaining a solid upward trend, the securities industry is increasingly betting on a year-end Santa Rally. There is growing anticipation for policy momentum aimed at revitalizing the KOSDAQ market, as well as the potential for improved index returns due to tighter delisting requirements.

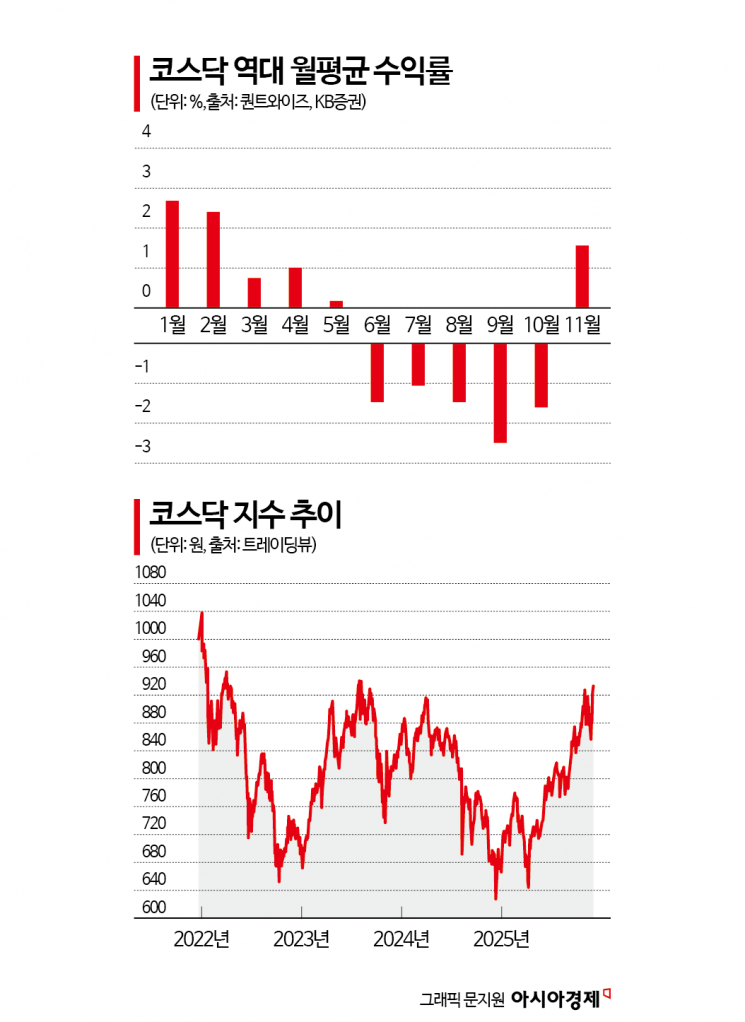

The fact that KOSDAQ has historically shown strong performance at the end and beginning of the year is also a point of interest. Reviewing the average monthly returns of the KOSDAQ market since 2000, January recorded the highest at 2.51%, followed by February at 2.2%.

The Samsung Securities Research Center stated, "Concerns over global liquidity and an artificial intelligence (AI) bubble are subsiding, while the KOSPI200 Volatility Index (V-KOSPI) is showing a downward stabilization trend, creating a favorable environment for a Santa Rally," adding, "There is a higher possibility that Santa’s gifts will arrive at KOSDAQ before KOSPI."

Reports that the government will announce policies to boost the KOSDAQ market by year-end have further heated up investor sentiment. The government is reportedly considering expanding the tax deduction limit for KOSDAQ venture funds and increasing the share of KOSDAQ investments by pension funds. On December 10, the National Growth Fund, with a planned size of 150 trillion won, will also be launched.

Kim Jiwoo, a researcher at KB Securities, said, "The National Growth Fund’s proposed direct equity investments of about 15 trillion won will mainly target small and mid-sized companies, and the comprehensive investment account (IMA) introduced last month also mandates the provision of venture capital, so similar effects to the National Growth Fund can be expected." Kim also recommended paying attention to the bio and robotics sectors, which led the rally during the 2017 KOSDAQ revitalization policy.

As a stock selection idea, free cash flow was highlighted. As it becomes more difficult for companies to raise investment capital through rights issues, which could dilute share prices, or by utilizing surplus capital for shareholder returns, companies with strong free cash flow are expected to attract market attention.

Jung Dawoon, a researcher at LS Securities, said, "By selecting stocks that have shown stable growth in free cash flow, one can identify market leaders." Jung cited Cafe24, PharmaResearch, Hanamicron, Hugel, Classys, Wonik IPS, Hanamaterials, TCK, and DongKook Pharmaceutical as examples of stocks within the KOSDAQ150 that have demonstrated stable free cash flow growth over the past nine quarters (based on the sum of the most recent four quarters).

However, there are also cautions against excessive optimism. Choi Jaewon, a researcher at Kiwoom Securities, noted, "Although similar KOSDAQ market revitalization policies were implemented in the second half of 2017 and led to a rally, the momentum was short-lived." Choi added, "Unless improvements in corporate governance, enhanced shareholder returns, and earnings growth accompany KOSDAQ companies, the sustainability of the KOSDAQ rally will be limited."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)