Banks Raise Deposit Rates

Time Deposit Balances Increase for Second Consecutive Month

Demand Deposits Also Rise Amid Stock Market Volatility

Banks have significantly raised interest rates to prevent deposit outflows, resulting in a surge of over 6 trillion won in time deposit balances within just one month. As the stock market booms and capital continues to flow into the capital markets-a phenomenon known as 'money move'-banks have responded by increasing deposit rates, leading to the return of deposit products with interest rates in the 3% range at major commercial banks.

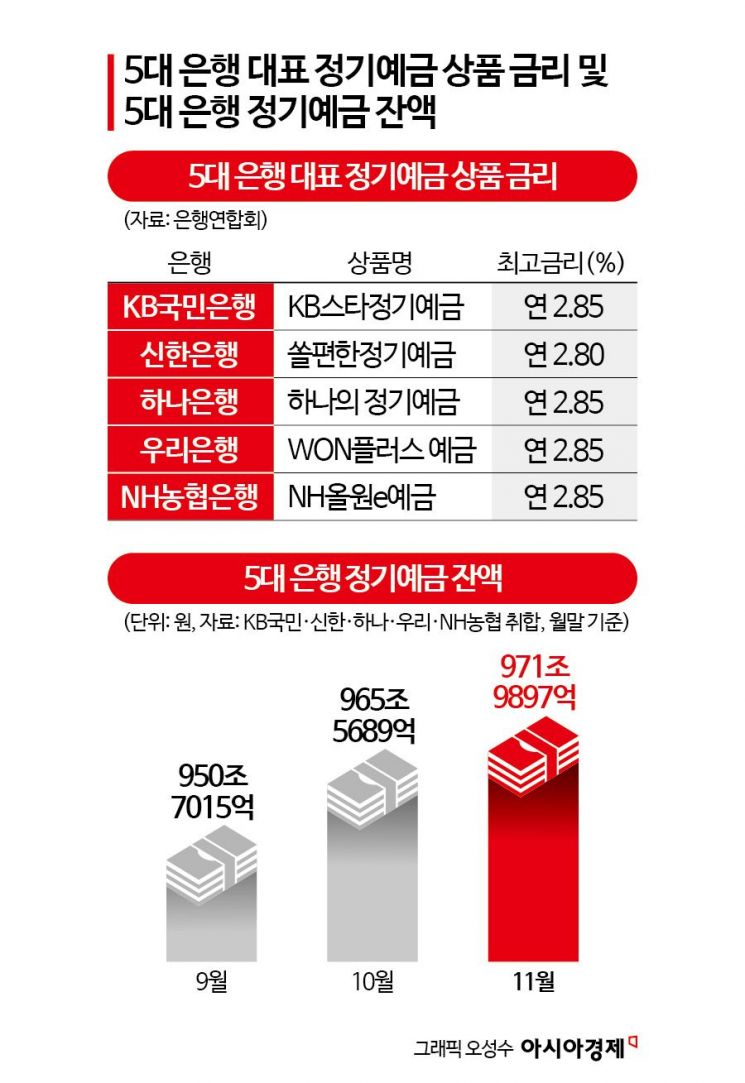

According to the financial sector on December 2, the balance of time deposits at the five major banks-KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup-stood at 971.9897 trillion won as of the end of November. This represents an increase of 6.4208 trillion won compared to the previous month (965.5689 trillion won). Time deposit balances have risen for two consecutive months, up by 21.2882 trillion won from the end of September (950.7015 trillion won). The total deposit balance at the five major banks reached 2,168.9095 trillion won at the end of last month, an increase of 17.7289 trillion won from the end of October (2,151.1806 trillion won).

The return of so-called 'deposit tech' savers to banks is largely due to rising interest rates. According to the Korea Federation of Banks, the highest interest rates for flagship 12-month time deposit products at the five major banks currently range from 2.80% to 2.85% per annum. Specifically, KB Kookmin Bank's 'KB Star Time Deposit' offers 2.85% per annum, Shinhan Bank's 'SOL Easy Time Deposit' offers 2.80% per annum, Hana Bank's 'Hana Time Deposit' offers 2.85% per annum, Woori Bank's 'WON Plus Deposit' offers 2.85% per annum, and NH Nonghyup Bank's 'NH All-One e-Deposit' also offers 2.85% per annum. Compared to early October, when time deposit rates hovered around 2.5%, rates have risen by approximately 0.3 to 0.35 percentage points.

It is now easy to find deposit products with rates in the 3% range at commercial banks. Recently, KB Kookmin Bank launched the '2025 1st Group Purchase Time Deposit,' which offers a tiered interest rate based on the amount deposited, with a maximum annual rate of 3.0%. Shinhan Bank also raised the maximum interest rate on its 'Shinhan My Plus Time Deposit' from 2.80% to 3.10%, an increase of 0.30 percentage points. In addition, Woori Bank's 'Woori First Transaction Preferential Time Deposit' offers a maximum annual rate of 3.0%.

The balance of installment savings at the five major banks also increased by 535.6 billion won from the previous month, reaching 46.2948 trillion won. The balance of demand deposits, including money market deposit accounts (MMDA), rose by 6.3968 trillion won to 654.2532 trillion won. Although demand deposits offer lower interest rates compared to regular deposits, they provide the advantage of allowing deposits and withdrawals at any time. This makes them convenient for moving funds into investment assets such as securities, so they are classified as 'funds waiting for investment.' While more than 21 trillion won flowed out in October, some of this has recovered as volatility in the domestic stock market increased. In fact, according to the Korea Financial Investment Association, as of November 28, investor deposits stood at approximately 77.912 trillion won, a decrease of more than 7 trillion won compared to the end of October.

However, some banks have seen a decline in demand deposits. An official at one commercial bank commented, "As deposit product interest rates have risen, deposit balances have started to recover. However, it seems that the money move toward the stock market is still ongoing."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.