Bank of Korea: "The Impact of Real Estate-Driven Household Debt Accumulation on Consumption"

Private Consumption Structurally Slowed by 1.6% Points Over 10 Years... 25% Attributed to Real Estate Loans

Due to Burden of Principal and Interest Repayments and Low Wealth Effect

"Active Household Debt Management Needed, Consistent Response Required Going Forward"

An analysis has found that excessively high household debt in South Korea has been dragging down private consumption by approximately 0.4% each year. Over the past decade, private consumption has structurally slowed by 1.6 percentage points, with 25% of this slowdown attributed to factors such as real estate loans. The burden of principal and interest repayments, as well as the limited liquidity of housing assets, have constrained household spending. Experts point out that the current approach to managing household debt, in cooperation with financial authorities, must be maintained consistently over the long term.

On November 30, the Bank of Korea released a report titled "Key Issues - The Impact of Real Estate-Driven Accumulation of Household Debt on Consumption," stating, "Over the past 10 years (2013-2024), the ratio of household debt to gross domestic product (GDP) in South Korea has increased by 13.8 percentage points, mainly due to real estate-related loans." The report further analyzed, "This excessive accumulation of household debt has slowed private consumption by 0.4-0.44% annually since 2013." The report was authored by Kim Chanwoo, Deputy Director of the Structural Analysis Team in the Research Department, and others.

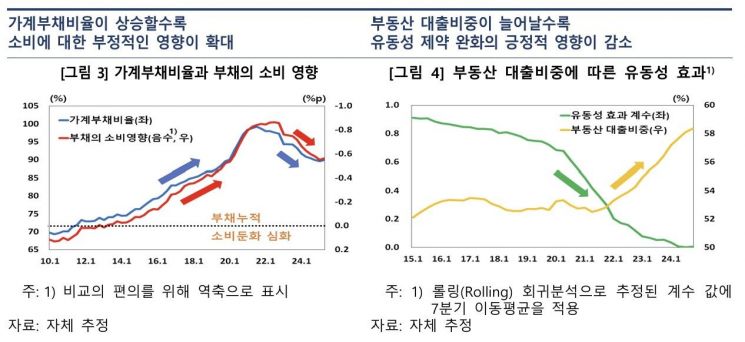

First, using macroeconomic variables for estimation, the findings showed that increased household debt has restricted annual average private consumption by 0.44% since 2013. Among the opposing effects of household debt-namely, the 'effect of easing liquidity constraints' and the 'burden of principal and interest repayments'-the negative impact was found to be more pronounced. Kim stated, "In particular, as the household debt-to-GDP ratio rises, the burden of principal and interest repayments increases, amplifying the negative impact on consumption."

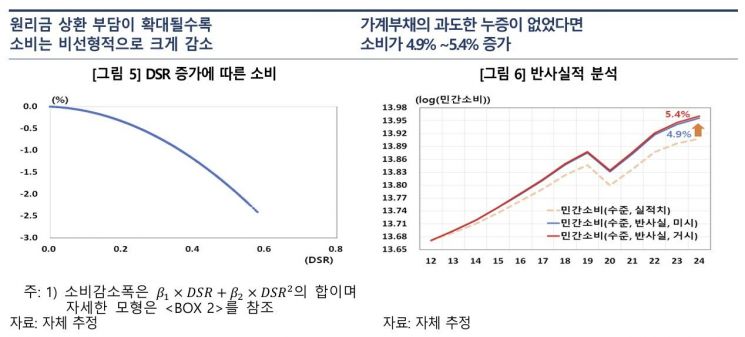

For a more precise estimation, the analysis used household-level data and found that a 1% increase in loans linked to housing results in an average 0.21% decrease in that household's consumption. When this is converted to reflect the increase in household debt over the past decade (excluding the nominal GDP growth rate), it amounts to 0.4%. South Korea’s private consumption growth rate structurally slowed by 1.6 percentage points during the same period, with 0.4-0.44% of this slowdown attributed to household debt. The report pointed out that if the household debt-to-GDP ratio had been managed at the 2012 level (80.2%), the level of private consumption last year would have been 4.9-5.4% higher than it actually was.

The report emphasized that the main reason household debt has structurally slowed consumption is the increased burden of principal and interest repayments. South Korea's debt service ratio (DSR) has risen by 1.6 percentage points over the past decade, the second-fastest increase after Norway. An analysis of the DSR’s determinants showed that the rise in the scale of household debt, rather than interest rates, has contributed to the increased repayment burden. Considering that the maturity of mortgage loans is long-term, the report pointed out that the burden of principal and interest repayments is likely to persist for a considerable period. Kim added, "Recently, as loan limits have been tightened, the burden of principal repayment has intensified, further constraining household consumption."

The "low wealth effect" resulting from the illiquidity of housing assets is also a factor restricting consumption. The analysis found that, in South Korea, the wealth effect of housing prices on consumption is only 0.02%, which is lower than in major countries (0.03-0.23%). The report explained that this is due to structural limitations, such as a lack of financial products to liquidate housing assets, and the tendency not to increase consumption despite rising housing prices, as households often purchase higher-tier homes or save for their children's future housing costs.

Other reasons cited include the low correlation between household debt and consumption in the real sector, and the fact that loans invested in non-residential properties such as commercial spaces or officetels have actually worsened household cash flows due to increased vacancy rates and deteriorating profitability. Ultimately, this suggests that funds remain within the financial system, potentially further dampening consumption.

Kim noted, "The household debt problem is not causing a sudden crisis like a heart attack, but rather is gradually constricting consumption like arteriosclerosis." However, he added, "Through policy coordination and proactive measures, the household debt-to-GDP ratio has recently begun to decline. If consistent, long-term responses continue, the structural constraints on consumption could gradually be alleviated."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)