Daiso's Basic Cosmetics Purchases Double

Highest Growth Rate in Estimated Purchases Among Consumers in Their 60s

Consumers Test Performance at Low Cost Before Buying High-Priced Products

Demand Expected to Rise Amid Value-for-Money Trend

Daiso, a fixed-price household goods retailer, is rapidly expanding its presence in the beauty market by offering value-for-money products priced at 5,000 won or less. Notably, demand is also rising among seniors aged 60 and above who can afford high-end cosmetics. This trend is attributed to the growing popularity of "litmus consumption," where consumers try and compare products that suit them at a low cost before purchasing more expensive cosmetics. As a result, Daiso is attracting customers across all age groups.

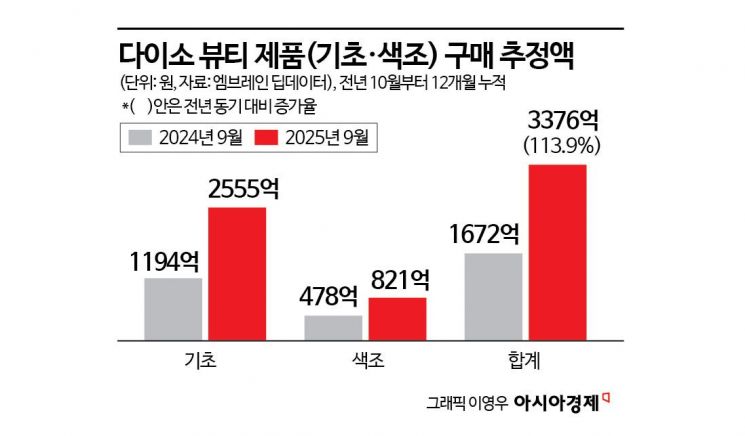

According to DeepData, which analyzes big data such as panel receipt purchase records from market research firm Embrain, the estimated purchase amount for skincare and makeup products sold at Daiso over the past year (from October last year to September this year) reached approximately 337.6 billion won, marking a 101.9% increase from the previous year. Of this, skincare products accounted for 255.5 billion won, up 113.9% year-on-year.

An Embrain representative stated, "Consumers tend to prefer branded skincare products because they are applied directly to the skin. However, many beauty brands are launching various second brands exclusively for Daiso, and as these products are relatively affordable yet competitive, more consumers are engaging in litmus consumption-testing the efficacy of products in small quantities before purchasing high-priced items."

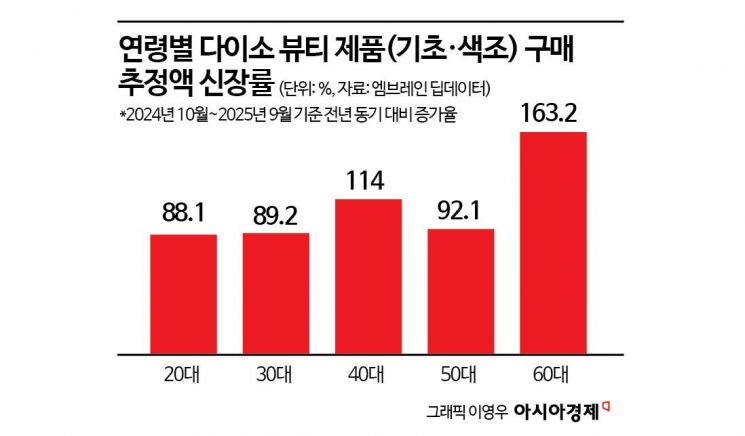

One notable finding is the significant increase in Daiso cosmetics purchases among the senior generation, classified as the silver generation. An analysis of estimated Daiso beauty product purchases by age group during the same period showed that those in their 60s recorded the highest growth rate at 163.2%. This is attributed to Daiso's diverse lineup of practical entry-level skincare products, which has piqued the curiosity of seniors who prefer to verify efficacy firsthand rather than rely on brands. Among other age groups, those in their 40s saw a 114% increase, those in their 50s 92.1%, compared to 89.2% for those in their 30s and 88.1% for those in their 20s, indicating that the growth rate was relatively higher among middle-aged and older consumers than among younger generations.

With the rapid growth of its beauty segment, Daiso is gaining momentum toward achieving annual sales of 4 trillion won. Last year, Asung Daiso, which operates Daiso in Korea, posted sales of 3.968 trillion won, up 14.7% year-on-year, and operating profit of 371.1 billion won, up 41.8%. Notably, sales in Daiso's cosmetics (skincare and makeup) category surged 144% from the previous year, far outpacing overall revenue growth.

An Embrain official commented, "In the past, products known as 'Daiso items' were perceived as cheap but of low quality, but this perception is rapidly changing. As consumers increasingly prioritize ingredients and efficacy relative to price, demand for Daiso beauty products-especially skincare-is likely to remain strong for the foreseeable future."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)