Cumulative Interest Expenses for Eight Major Card Companies Reach 3.5952 Trillion Won in Q3, Up 2.61% Year-on-Year

Specialized Financial Bond Rates Climb Above 3% This Month

Profitability Declines as Funding Costs Continue to Rise

With the benchmark interest rate frozen for the fourth consecutive time, credit card companies are facing increased interest expenses. As their core business performance continues to deteriorate due to the economic downturn and lower merchant fee rates, the rise in financial costs is expected to further reduce consumer benefits.

According to the financial sector on the 28th, the Bank of Korea maintained the benchmark interest rate at 2.5% per annum the previous day. The benchmark rate has remained at 2.5% since it was lowered in May, marking four consecutive freezes in July, August, October, and now this month. Since the regular Monetary Policy Board meeting held the previous day was the last policy direction meeting of the year, the benchmark rate will be maintained for two more months until the next meeting in January of the following year.

As the timing for further benchmark rate cuts is delayed, credit card companies are becoming increasingly concerned. Unlike banks, card companies do not have deposit functions and procure about 60% of their funds by issuing specialized financial bonds. When the interest rates on these bonds rise, card companies' funding costs also increase. Recently, as the likelihood of a rate cut has diminished, bond rates have rebounded.

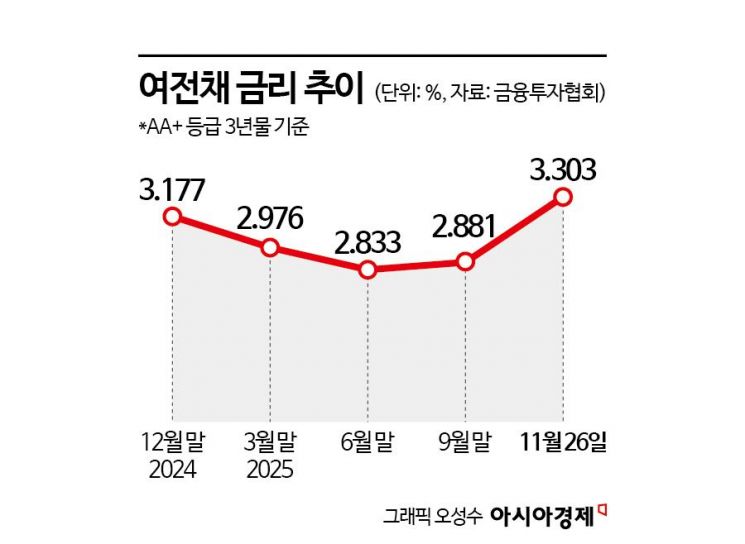

According to the Korea Financial Investment Association, as of the 26th, the interest rate for three-year A++ specialized financial bonds stood at 3.303%. The rate dropped steadily from 3.177% at the end of last year and remained in the 2% range until last month. However, since entering the 3% range this month, it has not fallen below 3% even once.

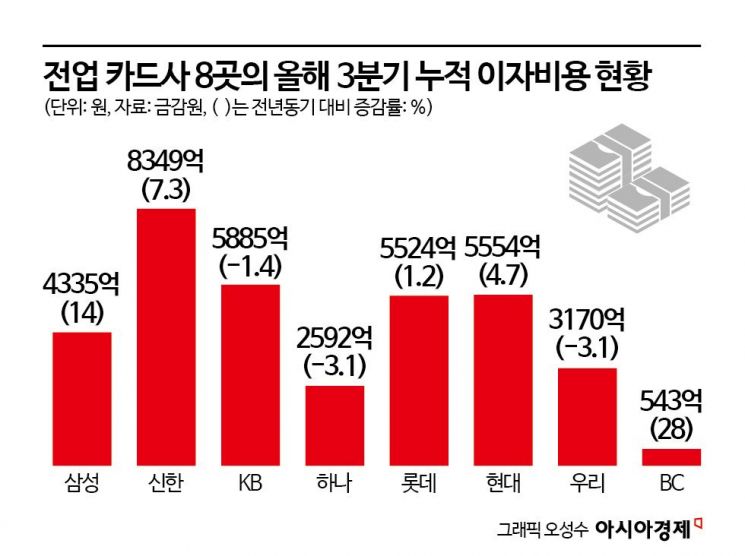

Interest expenses for card companies have also continued to rise. The cumulative interest expenses for the eight major credit card companies (Shinhan, Samsung, Hyundai, KB Kookmin, Lotte, Hana, Woori, and BC Card) in the third quarter of this year reached 359.52 billion won, up 2.61% from 346.86 billion won in the same period last year. Shinhan Card had the highest interest expenses at 83.49 billion won, followed by KB Kookmin Card (58.85 billion won), Hyundai Card (55.54 billion won), and Lotte Card (55.24 billion won).

Their profits have also shrunk. The cumulative net profit of the eight major credit card companies in the third quarter of this year was 193.32 billion won, down 14.1% from 225.08 billion won in the same period last year. After 15 consecutive merchant fee reductions over 18 years since 2007, structural profitability has weakened, and the recent inclusion of card loans in household loan regulations has further impacted performance.

As profitability worsens and interest expenses increase, the burden is inevitably passed on to consumers. As of the end of last month, the average interest rate on card loans at the eight major card companies was 14.01%. For low-credit borrowers with credit scores below 700, the average card loan rate was 17.41%, up 0.05 percentage points from the previous month. The increased cost burden on card companies is expected to have a greater negative impact on vulnerable groups with lower credit ratings. An industry insider said, "The worse the funding environment, the more conservatively card companies will operate, lowering rates for high-credit customers and raising them for low-credit customers," adding, "Consumer benefits, such as card perks, will also be further reduced."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)