Changing Drinking Culture Amid Domestic Downturn

Liquor Industry Faces a Test of Survival

Beer Companies Hand Over Management Control

Soju Producers Withdraw from Chinese Market

Alcohol companies rooted in local regions are facing turbulence. As domestic liquor consumption declines due to the economic downturn and changing drinking culture, large corporations are expanding their dominance in the market by leveraging their capital and distribution networks. In contrast, the business environment for local alcohol companies is deteriorating further.

According to the Financial Supervisory Service and industry sources on November 27, Hanul & Jeju (formerly Jeju Beer), based in Jeju Island, announced on November 25 that K Partners No.1 Investment Association, which participated in a third-party paid-in capital increase while Hanul Semiconductor, the previous largest shareholder, retained its stake, acquired 6,472,491 new shares (worth 12 billion KRW), securing a 29.24% stake. Effectively, an external investor injected new capital and took over management control.

This paid-in capital increase was structured so that 100% of the funds came from new capital, without rights offerings or existing stake sales. The purpose of the acquisition was explicitly stated as 'management participation,' indicating a strategic investment that involves entering the board of directors and exercising management rights, rather than a simple financial investment. It is also notable that Kang Yongho, the largest contributor to the association, invested the entire 12 billion KRW using only his own capital, without external borrowing.

Declining Consumption and Aggressive Moves by Major Corporations... Local Breweries Hand Over Management Control

Hanul & Jeju is a company that went public on the KOSDAQ under the Tesla listing conditions (special exception for companies without realized profits), riding the craft beer boom. Targeting Jeju's tourism demand and the trend favoring local brands, the company expanded its trendy lineup with beer and highball products and strengthened experiential consumption through brewery tours and brand collaborations. However, it revealed limitations in nationwide distribution and marketing competition. There have also been frequent changes in management control, with the company being sold to car repair firm Double HM in March last year, then returning to Hanul Semiconductor in November of the same year.

The financial situation also failed to improve. The company posted losses of 11.6 billion KRW in 2022, 10.4 billion KRW in 2023, and 4.8 billion KRW last year. In the third quarter of this year alone, it recorded a loss of 2.9 billion KRW.

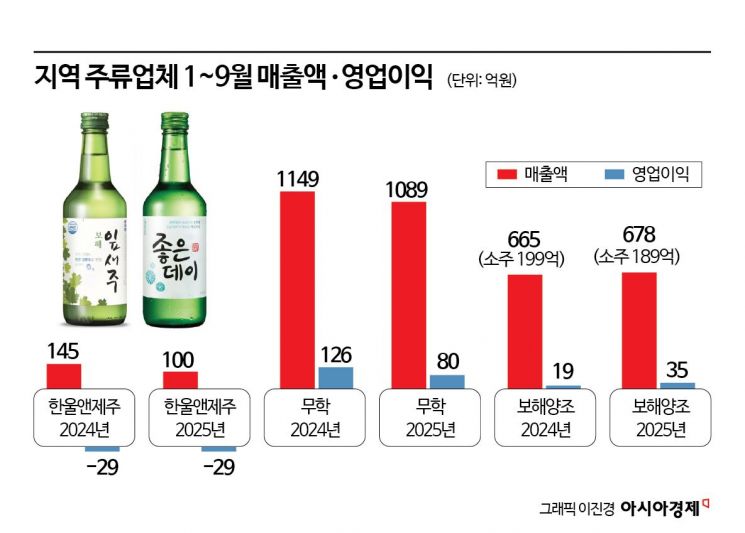

The situation is no different for Muhak, a leading liquor company in South Gyeongsang Province. From January to September this year, Muhak's consolidated sales reached 108.9 billion KRW, a 5.2% decrease from 114.9 billion KRW in the same period last year. Domestic liquor sales dropped by 3.1%, from 97.3 billion KRW to 94.3 billion KRW, while exports fell by 25.2%, from 14.3 billion KRW to 10.7 billion KRW. Operating profit also plunged by 36.5%, from 12.6 billion KRW to 8 billion KRW, significantly weakening profitability.

Muhak has long maintained a dominant position in the Busan, Ulsan, and South Gyeongsang regions with 'Good Day' and 'White Soju.' 'Good Day,' launched in 2006, lowered its alcohol content to 16.9% and strengthened regionally tailored marketing, establishing itself as a leading local brand. However, recent changes in consumption patterns are shaking Muhak's foundation. With increased convenience store purchases, growing preference for low-alcohol drinks and highballs, and a decline in company dinners, the company's traditional strategy, which relied heavily on the local nightlife market, is no longer effective.

Withdrawal from China and Falling Market Share: Local Brands Weaken in Succession

Bohae Brewery, based in South Jeolla Province, has begun winding down its business in China. In 2017, Bohae Brewery established a local subsidiary, Weihai Boga Farm Co., Ltd., in Shandong Province and entered the Chinese market with products like Ipsaeju, but failed to achieve results due to sluggish sales and worsening market conditions. Ultimately, the company liquidated the subsidiary in April this year, effectively withdrawing from the Chinese market. Bohae Brewery's sales for January to September reached 67.8 billion KRW, a slight increase from 66.5 billion KRW in the same period last year, but its main soju product, Ipsaeju, saw a 5% decline in sales.

The decline in market share for local companies is evident nationwide. Leading regional companies such as Daesun Distilling (Busan), Geumbokju (Daegu and North Gyeongsang), Seonyang (Daejeon and South Chungcheong), and Hallasan (Jeju) are all losing ground to national brands. This is because consumer preferences are shifting toward national brands, and the share of convenience store and online distribution is rapidly increasing, weakening the distribution networks centered on local regions.

In particular, Daesun Distilling, which had maintained the No. 1 soju market share in Busan since 2017, fell to second place in the first half of this year with a 30% share, overtaken by HiteJinro at 38%. Its market share, which was 69% in 2019, has dropped to less than half in just six years. Hallasan in Jeju, Muhak in South Gyeongsang, Bohae Brewery in South Jeolla, Geumbokju in Daegu and North Gyeongsang, and Seonyang in Daejeon and South Chungcheong have all lost their top positions to HiteJinro.

The gap in advertising and marketing expenditures between major corporations and local companies is widening further. From January to September this year, HiteJinro spent 692.9 billion KRW on selling and administrative expenses and 134.2 billion KRW on advertising and promotional expenses. Lotte Chilsung Beverage spent 868.4 billion KRW on selling and administrative expenses and 104.7 billion KRW on advertising and promotional expenses. During the same period, Muhak's selling and administrative expenses and advertising and promotional expenses were only 41 billion KRW and 3.8 billion KRW, respectively. Daesun Distilling's selling and administrative expenses and advertising and promotional expenses last year were 21.6 billion KRW and 3.1 billion KRW, respectively-more than a 30-fold difference compared to major corporations.

An industry insider commented, "The era when local alcohol companies could rely solely on the loyalty of local consumers is already over. If product and distribution innovation does not follow amid changes in drinking culture and the restructuring of the competitive landscape, further restructuring will be inevitable."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)