Japan’s Inflation and China’s Deflation Reverse Government Bond Yields

US-China Tensions Also Affect the Bond Market

Yet the Yen Remains Weak and the Yuan Strong

Due to Sensitivity to the US Economy and the Dollar

For the first time since related statistics began to be compiled in 2000, the 10-year government bond yields of Japan and China have reversed. Following the earlier reversal of 30-year bond yields, the inversion of 10-year yields has prompted the market to describe the situation as a "sea change." In contrast, the foreign exchange market is moving in the opposite direction: the Japanese yen remains weak amid ongoing economic recovery and inflation, while the Chinese yuan is strengthening as China wages an all-out battle against deflation. How should we interpret these financial market movements, which differ from those of the past?

On November 26, iM Securities released a report titled "Diminished Chinese Influence, Heightened Japanese Influence in the Korean Financial Market," which explained that the bond market inversion is due to differences in economic growth and inflation outlooks between the two countries. However, when it comes to currencies, the difference in sensitivity to the US dollar has been the decisive factor.

Japan’s Growth vs. China’s Sluggishness → Impact on Government Bond Yields

Japan has emerged from a prolonged period of deflation and shifted toward inflation, with its growth rate gradually improving. In contrast, China faces mounting concerns over deflation due to sluggish consumption and a depressed real estate sector. In fact, recent consumer price data shows Japan maintaining positive growth, while China has slipped into negative territory.

Divergent economic policies are also widening the interest rate gap. Since Prime Minister Takaichi took office, Japan has rolled out large-scale stimulus measures and expanded fiscal spending. The Bank of Japan is also monitoring inflation and considering the timing of a rate hike. Both fiscal and monetary policies are pushing up government bond yields.

On the other hand, while China is injecting fiscal resources to boost domestic demand, it remains cautious about large-scale stimulus. There is still a possibility that the People’s Bank of China will further cut its benchmark interest rate. As a result, upward pressure on government bond yields is assessed to be lower in China than in Japan.

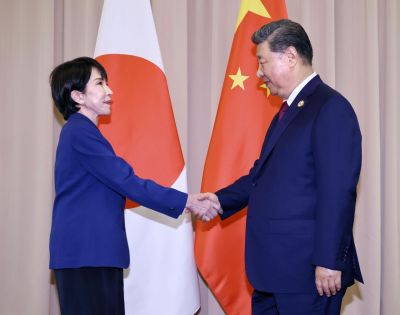

External conditions also play a significant role. Ongoing US-China tensions are increasing uncertainty in the Chinese economy, while Japan, through its close economic and diplomatic ties with the United States, is more closely linked to US economic trends.

Exchange Rate Trends Diverge from Economic and Interest Rate Conditions

The exchange rate trend is particularly noteworthy. Despite ongoing inflation and economic recovery, the Japanese yen remains weak, while the Chinese yuan, weighed down by deflationary concerns, has actually strengthened. This demonstrates that the value of both currencies is moving contrary to their respective domestic economic trends.

The diverging paths of the yen and yuan are rooted in their differing sensitivities to the US economy and the US dollar. Although the Japanese economy has improved compared to the past, it still lags behind the momentum of the US economy, making the yen highly susceptible to movements in the dollar. Meanwhile, China is reinforcing its "domestic-first" policy amid US-China tensions and appears to be intentionally maintaining the yuan’s relative strength to some extent.

Ultimately, the trends in interest rates and exchange rates for Japan and China are determined not only by each country’s economic conditions but also by how sensitively they react to the direction of the US economy and the US dollar.

The Strong Synchronization Between Korean and Japanese Financial Markets Likely to Continue

Since the beginning of this year, the synchronization between the Korean won and the Japanese yen, as well as between the KOSPI and the Nikkei 225, has become even more pronounced. Like Japan, Korea’s dependence on China has declined significantly compared to the past, making it more sensitive to US economic trends and policy than to those of China.

The fact that Korea, Japan, and Taiwan are the primary beneficiaries of the spillover effects from the US artificial intelligence (AI) investment cycle, and that Korea is always grouped with Japan in the context of US tariff policy, are among the factors strengthening the synchronization between the Korean and Japanese financial markets.

Park Sanghyun, an analyst at iM Securities, stated, "The synchronization between the Korean and Japanese financial markets is likely to continue for the time being," adding, "In particular, the trend of the dollar-won exchange rate moving in tandem with the dollar-yen exchange rate is expected to persist." While domestic foreign exchange supply and demand remains an important variable, the direction of the yen will also be a key factor in stabilizing the won-dollar exchange rate.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)