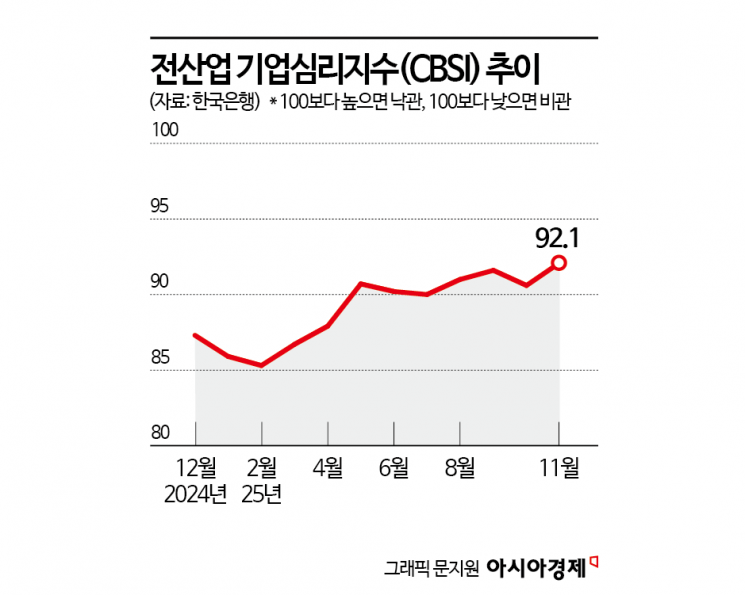

Bank of Korea Releases November Business Survey and Economic Sentiment Index (ESI)

However, Index Remains Below Baseline of 100... Improvement Is Limited

Rising Exchange Rate Negatively Affects Manufacturing Sector Funding Conditions

In November, business sentiment rebounded after one month, returning to levels seen before the December 12·3 Martial Law crisis last year. As the number of business days, which had decreased due to the Chuseok holiday in the previous month, was restored this month, the continued semiconductor boom and improved consumer sentiment contributed to the turnaround. However, the index still remains well below the baseline of 100, indicating that the improvement is limited.

According to the "November Business Survey Index Results and Economic Sentiment Index (ESI)" released by the Bank of Korea on the 26th, the Composite Business Survey Index (CBSI) for all industries this month stood at 92.1, up 1.5 points from the previous month. This is the highest level since October last year (92.5). The CBSI is a business sentiment indicator calculated using key indices from the Business Survey Index (BSI). A reading above 100 means that companies are more optimistic about the economic situation compared to the past, while a reading below 100 indicates pessimism. Lee Hyeyoung, head of the Economic Sentiment Survey Team at the Bank of Korea's Economic Statistics Department 1, assessed, "Although this month's figure is the highest since October last year, it is still below the long-term average, so it is difficult to say that the situation is good yet."

This month, the manufacturing CBSI rose by 0.3 points from the previous month to 92.7. In manufacturing, product inventory (up 1.1 points) and business conditions (up 0.4 points) were the main factors driving the increase. Manufacturing performance improved, particularly in electronics, visual and communication equipment, metal processing, and petroleum refining and coke. The electronics, visual, and communication equipment sector benefited from rising memory prices and strong exports driven by the activation of the artificial intelligence (AI) industry. Metal processing improved due to increased orders related to shipbuilders and offshore wind power plants. Petroleum refining and coke were influenced by higher refining margins and falling oil prices.

The non-manufacturing CBSI rose by 2.3 points to 91.8. In non-manufacturing, financial conditions (up 1.0 point) and profitability (up 1.0 point) were the main factors for the increase. This month, non-manufacturing performance improved mainly in wholesale and retail, information and communications, and transportation and warehousing. In wholesale and retail, improvements were led by pharmaceuticals, energy sources, and agricultural products. Lee explained, "Seasonal factors played a role, such as increased demand due to the flu outbreak (pharmaceuticals), higher demand for coal and electricity with the arrival of winter (energy sources), and improved sales due to events like the Korea Grand Festival (agricultural product wholesale and retail)." In information and communications, game companies that released new titles performed well. The transportation and warehousing sector benefited from a rebound in international freight rates and reduced fuel costs due to falling oil prices.

Meanwhile, there were not many companies that gave positive responses regarding the conclusion of the Korea-US tariff negotiations. Lee noted, "Even in the automobile sector, which could be considered the biggest beneficiary, there are so many domestic parts suppliers that there were not many strongly positive responses." She added, "However, the proportion of responses citing uncertain economic conditions as a management difficulty decreased slightly." The rise in the won-dollar exchange rate this month negatively affected responses related to financial conditions in manufacturing.

The business sentiment index outlook for next month was surveyed at 91.1, the same as the previous month. In manufacturing, the outlook fell by 0.9 points to 91.7 compared to the previous month, while in non-manufacturing, it rose by 0.5 points to 90.7. The December manufacturing outlook worsened, particularly in rubber and plastics, other machinery and equipment, and automobiles. The non-manufacturing outlook for next month improved, mainly in wholesale and retail, professional, scientific and technical services, and electricity, gas, and steam supply.

The Economic Sentiment Index (ESI), which combines the BSI and the Consumer Survey Index (CSI), recorded 94.1, down 0.3 points from the previous month. The cyclical component, which removes seasonal factors, rose by 0.8 points from the previous month to 94.6.

This survey was conducted from the 11th to the 18th of this month, targeting 3,524 corporate entities nationwide. A total of 3,269 companies (92.8%) responded: 1,824 in manufacturing and 1,445 in non-manufacturing.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)