Foreign Investors' Net Selling in KOSPI Nears 15 Trillion Won in November

Surpasses Pandemic Record of 12.5 Trillion Won for All-Time High

Selective Buying of AI, Bio, and Chemical Stocks Draws Attention Amid Broad Sell-Off

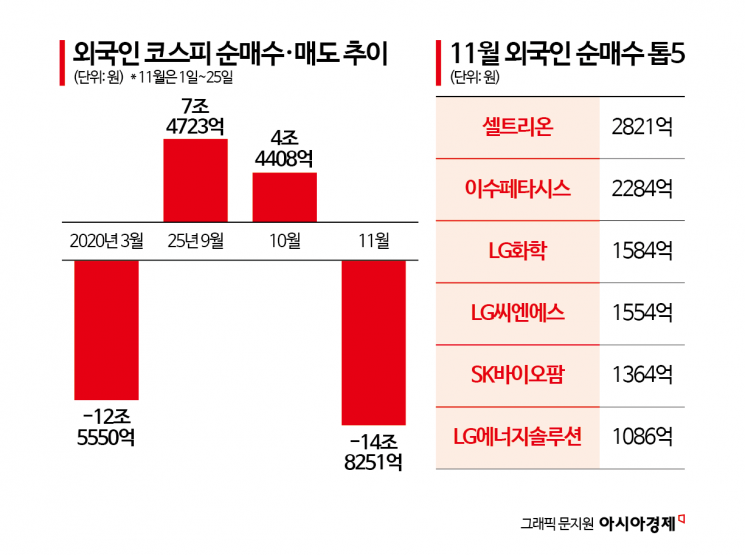

This month, the net selling amount of KOSPI stocks by foreign investors has approached 15 trillion won, setting a new all-time high. While they have been offloading a large number of semiconductor stocks that previously led the rally, they have selectively added stocks related to the so-called "ABC" sectors-Artificial Intelligence, Bio, and Chemical-to their portfolios.

According to the Korea Exchange on November 26, foreign investors sold a total of 12.9856 trillion won worth of stocks in the main stock market between November 1 and 25, 2025. This surpasses the previous record of 12.5 trillion won set in March 2020 during the COVID-19 pandemic. When including trading volumes from the alternative trading system (ATS) NextTrade, the total net selling by foreigners this month increases to approximately 14.825 trillion won.

The most notable change in foreign investment trends is that they are selling off both Samsung Electronics and SK Hynix, the two leading semiconductor stocks. Even last month, when the semiconductor rally was peaking, foreign investors had a net purchase of about 7 trillion won in Samsung Electronics and a net sale of 4.6 trillion won in SK Hynix, weighing their positions in the top semiconductor stocks. However, this month, they have sold more than 11 trillion won combined in these two stocks, signaling a full-fledged move to realize profits.

Heo Jaehwan, a researcher at Eugene Investment & Securities, commented, "Foreign buying in the semiconductor sector appears to be influenced more by changes in semiconductor earnings outlook than by exchange rates," adding, "The recent foreign sell-off may have been affected by the slowdown in upward revisions to semiconductor earnings."

Despite the large-scale disposal of semiconductor and other leading stocks by foreign investors, interest in the so-called "ABC" theme-Artificial Intelligence (AI), Bio, and Chemical-remains strong. This month, there have been six stocks that foreign investors bought more than 100 billion won worth, with two from each sector: AI (LG CNS, ISU Petasys), Bio (Celltrion, SK Biopharmaceuticals), and Chemical (LG Chem, LG Energy Solution).

In particular, Celltrion was the most heavily purchased stock by foreign investors this month, with a net buy of 273.1 billion won. The company drew attention after it was announced that the Export-Import Bank of Korea would provide 350 billion won in financing to support Celltrion’s acquisition of Eli Lilly’s manufacturing facility in the United States. The company’s new bio sales growth is reportedly leading to improved cost of sales ratios, and this year’s consolidated revenue is estimated at 4.162 trillion won (up 17.0% year-on-year), with operating profit estimated at 1.0779 trillion won (up 119.1%).

LG CNS and ISU Petasys are companies that were newly added to the KOSPI 200 index during the Korea Exchange’s recent regular index rebalancing. LG CNS is considered a beneficiary of Nvidia’s physical AI, while ISU Petasys is seen as a beneficiary of Google’s tensor processing unit (TPU) value chain. Yang Seungsoo, a researcher at Meritz Securities, stated, "As Google’s proprietary AI services enter a high-growth phase, ISU Petasys, which has a dominant market share in PCBs for TPUs, is expected to benefit from a supercycle," raising the target price from 140,000 won to 160,000 won.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.