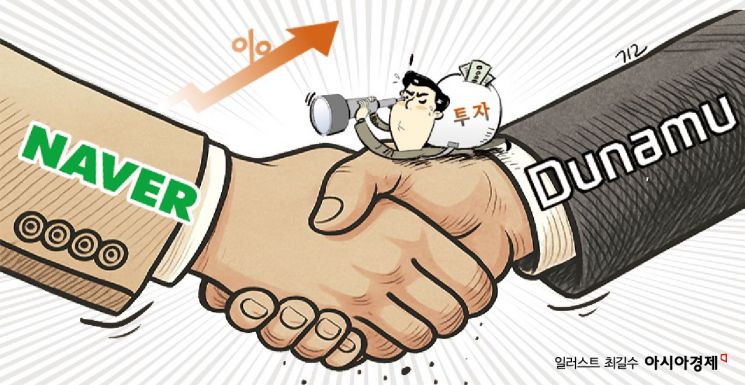

Naver is expected to finalize the merger process to incorporate Dunamu, the operator of Upbit, as an affiliate, with both companies' boards of directors set to approve the deal.

According to the information and communications technology (ICT) industry on November 19, Naver and Dunamu are reportedly planning to convene their respective board meetings on November 26 to present a comprehensive stock swap proposal.

Industry sources predict that the stock exchange ratio between Naver and Dunamu will be between 1:3 and 1:4.

However, the exact ratio is expected to become clear in detail ahead of the board meetings.

For the merger to proceed, a special resolution at the shareholders' meeting is required following board approval. This necessitates the consent of at least two-thirds of attending shareholders and more than one-third of the total issued shares.

Once the stock swap is completed, Naver Financial, Naver's financial affiliate, and Dunamu will exchange shares. Dunamu will become a subsidiary of Naver Financial, effectively making Dunamu a second-tier subsidiary of Naver.

After the merger is finalized, Song Chi-hyung, Chairman of Dunamu, will become the largest shareholder of Naver Financial, which will then include Dunamu. Naver is expected to become the second-largest shareholder.

Some in the industry have pointed out that the merger between the two companies could potentially conflict with the financial authorities' regulations requiring the separation of financial services and virtual assets.

However, as the authorities have reportedly determined that the merger does not violate these separation regulations, the merger process is said to be progressing rapidly.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)