Added to List of Exception Industries Eligible for Venture Investment

Some Say the Market Must Mature First

As concerns over an "investment gap" grow within the unlisted stock and fractional investment distribution platform industry, which has recently been incorporated into the formal financial system, the government has decided to revise regulations to allow venture capital investment. The aim is to prevent a funding bottleneck by making an exception to the current regulation that prohibits venture capital (VC) and accelerators (AC) from investing in platform companies classified as financial firms.

On November 20, the Ministry of SMEs and Startups announced that it will issue an administrative notice until December 10 regarding a revision to the notification that will allow investments in unlisted stock and fractional investment distribution platforms. The revision covers four areas: ▲ Regulations on registration of individual investment associations and issuance of investment confirmation ▲ Regulations on registration and management of startup planners ▲ Regulations on registration and management of venture investment companies ▲ Regulations on registration and management of venture investment associations.

Unlisted stock and fractional investment distribution platforms have so far operated as designated innovative financial services under regulatory exemptions. However, on September 30, following an amendment to the Enforcement Decree of the Capital Markets Act, these platforms were incorporated into the formal financial system, which strengthened investor protection measures and improved transaction convenience. The problem is that, under current law, VC and AC investments in financial companies are fundamentally prohibited. As a result, there has been a surge of concern within the industry that the incorporation into the formal system could block new investment opportunities.

To address these concerns, the Ministry of SMEs and Startups has decided to add unlisted stock and fractional investment distribution platforms to the list of "exception industries" eligible for venture investment under the notification. According to current law, even within the financial sector, industries based on ICT that demonstrate innovation and growth potential may exceptionally receive venture investment. Representative examples include simple payment services, simple remittance platforms, and crowdfunding platforms. Kim Bongdeok, Director of Venture Policy at the Ministry, stated, "We have rationally revised the regulations so that innovative financial startups can continue to attract investment and grow," adding, "We will gather various opinions during the administrative notice period, finalize the revision, and implement it as soon as possible."

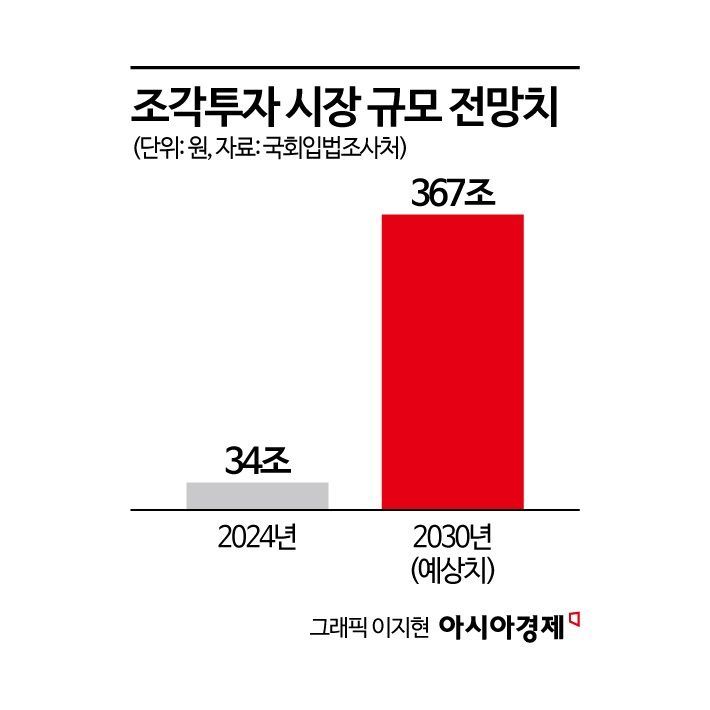

The venture capital industry has evaluated this measure positively, but also noted that the relevant market must first mature for substantial investment effects to be realized. A representative of the Korea Venture Capital Association said, "We see it as a positive development, as it creates opportunities to invest in competitive companies. However, since the unlisted stock and fractional investment platform market is still very small and lacks diversity, there are questions about how many worthwhile investment targets there will be and whether good companies can be discovered." The representative added, "If obligations such as information disclosure under the formal system are properly fulfilled and the market matures first, only then will substantial investment effects be achieved."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.