Fair Trade Commission Releases "2025 Status of Corporate Governance in Publicly Disclosed Business Groups"

It has been revealed that shadow management, where the heads of large conglomerates avoid direct participation in the board of directors and operate from behind the scenes, remains prevalent. Even when board meetings are held, the practice of outside directors simply approving agenda items as originally proposed-so-called "rubber-stamp management"-has not changed.

On November 19, the Fair Trade Commission released the "2025 Status of Corporate Governance in Publicly Disclosed Business Groups." The report analyzes the management participation of owner families, board operations, and minority shareholder rights at 2,994 companies affiliated with 86 large conglomerates, covering the period from May last year to May this year.

Gap Between Authority and Responsibility... Owner Families Still Serving as Unregistered Executives

According to the Fair Trade Commission's analysis, only 18.2% of companies (518 out of 2,844) with controlling shareholders appointed members of the owner family as directors. Groups with the highest proportion of owner family members among registered directors included Booyoung (42.5%), Youngone (40.4%), KCC (40.0%), Nongshim (38.7%), and Bando Holdings (36.4%). In contrast, groups such as DL, Mirae Asset, E-Land, Samchully, and Taekwang did not appoint any owner family members to their boards.

The percentage of companies appointing the controlling shareholder as a director also increased from 5.2% to 5.7% during the same period. Over the past five years, the proportion of companies with owner family members as directors, those with the controlling shareholder as a director, and the overall share of owner family members among all directors have all steadily increased since 2022.

The practice of owner family members participating in management as honorary chairpersons or CEOs without being registered as directors remains unchanged. The share of companies where owner family members serve as unregistered executives rose to 7.0%, up 1.1 percentage points from 5.9% the previous year. Notably, the proportion of listed companies with owner family members as unregistered executives jumped from 23.1% to 29.4%.

Where Are the Owners... Focused on 343 Companies Subject to Private Interest Abuse Regulations

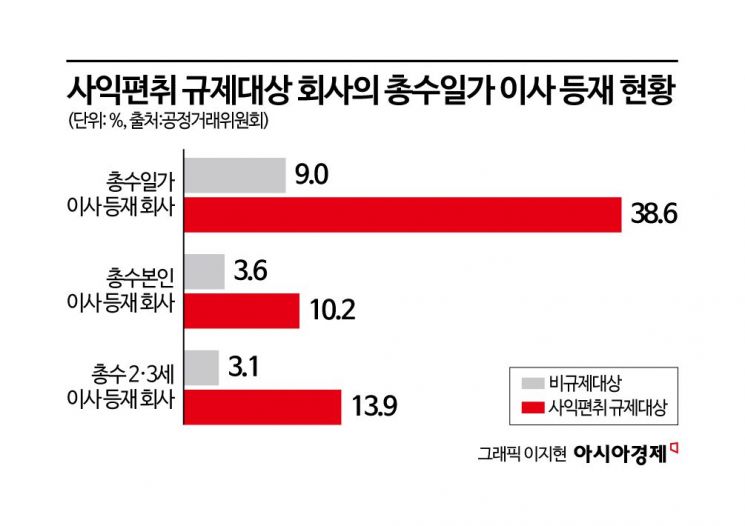

Companies where owner family members serve as directors were concentrated among those subject to regulations on private interest abuse. Among these regulated companies, 38.6% (343 out of 889) had owner family members as directors, a much higher rate than non-regulated companies (9.0%) and the overall average (18.2%). Of the 518 companies with owner family members as directors, 343 (66.2%) were subject to private interest abuse regulations.

Of the 259 unregistered executive positions held by owner family members, 141 (54.4%) were at companies subject to private interest abuse regulations. The average number of unregistered executive positions held per person was highest at Jungheung Construction (7.3), followed by Hanwha and Taekwang (4.0 each), Eugene (3.8), and Hanjin, Hyosung, and KG (3.5 each).

The number of outside directors, introduced to provide external oversight, has increased in appearance. Forty-nine business groups appointed more outside directors than legally required. Groups with the largest number of additional outside directors included Hyundai Department Store (14), SK, Hanjin, and KT (9 each), and Kakao and Hansol (8 each).

Over the past five years, the attendance rate of outside directors at board meetings has remained between 96% and 98%. Of the 9,618 agenda items submitted to boards, 99.62% (9,581 items) were approved as originally proposed. The proportion of agenda items not passed as originally proposed was the lowest in the past five years.

Only One Case of Cumulative Voting

To strengthen the voting rights of minority shareholders, 88.4% of companies adopted at least one of the following at their general meetings: cumulative voting, written voting, or electronic voting-unchanged from the previous year. Fourteen business groups, including Coupang, Booyoung, Dunamu, Netmarble, GM Korea, Kumho Petrochemical, Daebang Construction, BS, Korea HC, Bando Holdings, OK Financial Group, DN, Shinyoung, and Sampyo, did not implement any of these measures.

The proportion of companies adopting cumulative voting decreased from 3.8% to 3.6% year-on-year, with only one case-Korea Zinc, an affiliate of Youngpoong-actually implementing it to appoint a director.

The exercise of minority shareholder rights, such as shareholder proposals, reached a record high with 93 cases.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.