Seoul Home Prices Rise 1.19% Last Month

Highest Growth Rate in Seven Years and One Month

Monthly Rents Outpace Sales and Jeonse Increases

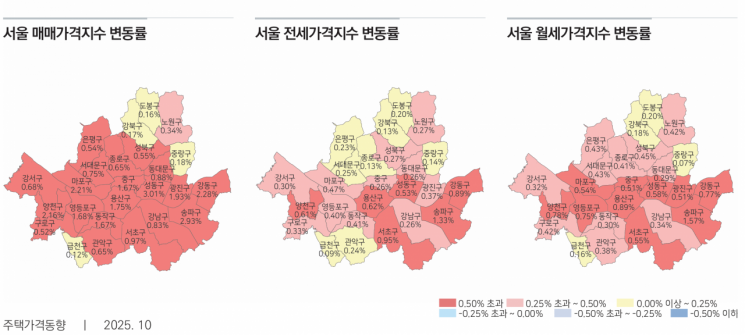

Following the government’s October 15 policy measures, housing prices in Seoul, including apartments, have surged at the fastest pace in seven years and one month, and this spike is now spreading to the rental market. As barriers to home purchases rise and the impact of jeonse fraud continues, some areas in Seoul have seen monthly rent prices jump by as much as 1.57% in just one month, intensifying the housing cost burden for ordinary residents.

According to the “October National Housing Price Trend Survey” released by the Korea Real Estate Agency on the 17th, the comprehensive sale price index for Seoul housing (apartments, row houses, and detached houses) rose by 1.19% from the previous month. This is the highest growth rate since September 2018 (1.25%), marking a seven-year and one-month high.

Market concerns are now shifting beyond sales prices to an overheating rental market. The comprehensive monthly rent price index for Seoul housing climbed 0.53% compared to the previous month (0.30%), nearly doubling the rate of increase.

In particular, the surge in monthly rents at major complexes in the Gangnam area is notable. In Songpa District, Seoul, monthly rents in October soared by 1.57% compared to the previous month. This figure is three times higher than the Seoul average increase (0.53%). In Songpa District, demand has been concentrated in key complexes such as Jamsil and Bangi-dong, but a persistent shortage of available properties has pushed prices higher. Yongsan District also led the rise in monthly rents in northern Seoul, with a 0.89% increase centered on complexes near Ichon and Munbae subway stations.

Jeonse prices in Seoul also continued their upward trend, with a 0.44% increase-higher than the previous month’s 0.30% rise-reflecting ongoing instability.

The Korea Real Estate Agency explained, “In Seoul, inquiries from buyers have increased, especially for preferred complexes with good residential conditions and areas with development potential, driving prices up. Both jeonse and monthly rents are rising, particularly in complexes located in areas with good residential environments, such as those near subway stations and in school districts, as rental demand remains strong.”

Across the greater Seoul metropolitan area, the growing burden of housing costs is evident. In Gyeonggi Province, sale prices rose by 0.34%, led by redevelopment and development hotspots such as Bundang District in Seongnam (4.04%) and Gwacheon (3.04%). Jeonse (0.24%) and monthly rent (0.20%) prices also increased, especially in areas with good access to Seoul, such as Hanam and Gwacheon.

In contrast, the housing market in provincial areas remains sluggish. Housing sale prices in the provinces were flat (0.00%), deepening the polarization with the capital region. Cities such as Daegu (-0.13%), Daejeon (-0.10%), and Jeju (-0.14%) continued to decline due to a backlog of unsold homes and accumulated listings.

However, jeonse (0.07%) and monthly rent (0.09%) prices in provincial areas posted slight increases. This indicates that the upward trend in the rental market is now a nationwide phenomenon.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)