Losing Ground to Major Online Bookstores

Cafes Take the Place Where Books Were Once Read

Gwangjang Books, which opened in Chuncheon, Gangwon Province in 1999, closed its doors in 2023 after 24 years due to worsening business conditions. This bookstore, spanning the first and second floors and covering a total area of 430 square meters, was once a leading local bookstore, accounting for 60% of offline book distribution in the Chuncheon area. However, it was powerless in the face of changing times. Kyomun Books, which closed around the same time, was no exception. Having opened near Ajou University in Suwon in 1986, it served the local community for 37 years before closing on December 30 last year, fading into history.

This trend continues today. In September last year, Gyeryong Bookstore, a local bookstore that began in Jung-gu, Daejeon in 1966, entered the process of closing down. Since 2022, business difficulties intensified to the point where it could no longer afford rent. The building housing the bookstore was owned by Daejeon Technopark, an organization under the Daejeon Metropolitan Government. Lee Dongseon, CEO of Gyeryong Bookstore, requested a meeting with the mayor of Daejeon to ask for a deferral of overdue rent, but was refused on the grounds that “support cannot be provided to a specific business.”

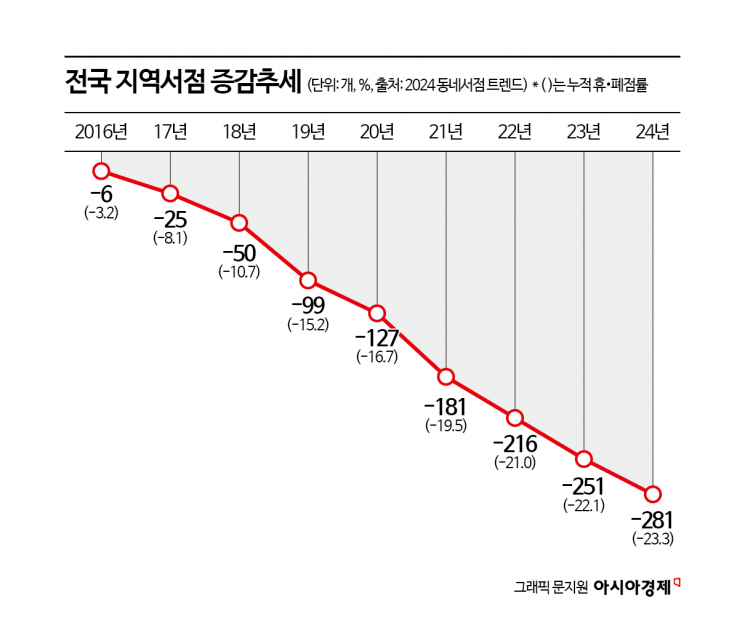

According to the report “Trend 2024” by Dongnae Bookstore, an independent bookstore service company, the cumulative number of independent bookstores that have temporarily or permanently closed jumped from just two in 2016 to 281 in 2024. Thirty bookstores have closed this year alone, and the number of new independent bookstores, which once reached 100 annually, plummeted to 42 last year.

According to the “2024 Local Bookstore Status Survey” released by the Publication Industry Promotion Agency of Korea, as of 2023, 31.6% of local bookstores had annual sales of less than 50 million won, the largest proportion. Another 17.9% had sales between 50 million and 100 million won. The proportion of bookstores with sales below 100 million won was 42.9% in 2021 and 47.2% in 2022, accounting for nearly half every year.

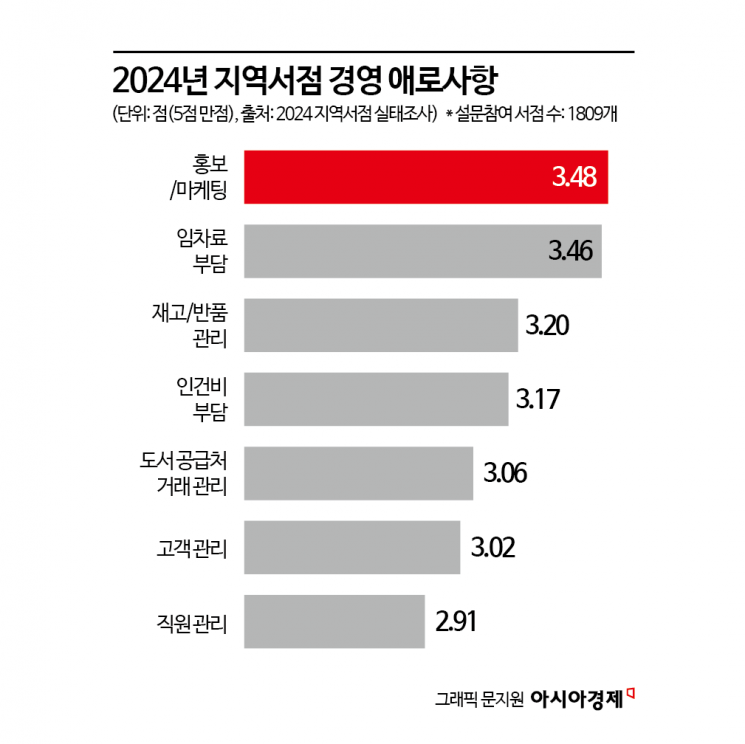

In a survey of difficulties (on a 5-point scale), the top issues were promotion and marketing (3.48 points), rent burden (3.46 points), inventory and returns management (3.20 points), labor costs (3.17 points), transaction management with book suppliers (3.06 points), customer management (3.02 points), and employee management (2.91 points), in that order.

The wave of local bookstore closures is mainly attributed to the expansion of online purchases and the price competition from large bookstores. Major online bookstores with nationwide distribution networks, such as Kyobo Bookstore, Yes24, and Aladin, have capital strength that small and medium-sized bookstores cannot match. In particular, convenient services such as free shipping have drawn consumers to online platforms. In a survey on local bookstore usage conducted among 1,000 people aged 10 and older between July 2023 and June 2024, the top channel for purchasing print books was online bookstores (41.2%), followed by chain bookstores (28.0%) and local bookstores (11.7%).

Cho Minji, team leader at the Korea Federation of Bookstore Associations, said, “A bookstore is not just a place to sell books, but a space that connects with the local community and runs cultural programs. It is disappointing that the cultural budget cut last year has not been restored, and there are no support plans for next year.” She added, “Local bookstores have small volumes and receive books by courier rather than through distributors, resulting in higher logistics costs and more time. Expanding digital infrastructure, such as providing logistics support and distributing POS systems, is urgently needed.”

Regarding President Lee Jaemyung’s instructions at a senior aides’ meeting to devise measures to address declining local bookstore sales, an official from the Ministry of Culture, Sports and Tourism said, “Although it is difficult to share specifics at this stage, we are discussing increasing the budget and exploring various support measures, including tax credits.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.